We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Charging Order? The myth

Comments

-

@fatbelly OK, thanks for that information. Apologies.

It was only that I'd noticed blyth hadn't received much response from her earlier posts, so thought more people would see it on the other forum.

@blyth_2 If you do want to try the other forum, search for House Buying, Renting & Selling, then to start a new topic, click on the red button at the top right where it says + Create New.

0 -

I did reply when you first posted but I think you may need to add a bit more detail as to why you are now asking?That’s not a challenge but simply an effort to help others understand the reason(s) better.Are you thinking for example that following his sad death the debt is ‘wiped’? Are you trying to sell or mortgage the property or something else perhaps?You reference having contacted the creditor so what did you ask and why? Or was it because you think the creditor can force you to do something or you fear losing your home?It’s these kind of details that would help others to comment and offer advice“Official Company Representative

I am the official company representative of Land Registry. MSE has given permission for me to post in response to queries about the company, so that I can help solve issues. You can see my name on the companies with permission to post list. I am not allowed to tout for business at all. If you believe I am please report it to forumteam@moneysavingexpert.com This does NOT imply any form of approval of my company or its products by MSE"0 -

I am selling my property which is now in my name only. I have a buyer and the sale is proceeding.

Any other debt my late husband had was wiped except the charging order/restriction on our jointly owned property, which was a credit card debt in his name only.

My worry is Mortimer Clarke will make me pay the debt when the sale of my house goes through, or hinder the final sale until I pay them my husbands debt.

I asked Mortimer Clarke to remove the restriction on my property as I’m not responsible for his debt. They have said if will be removed when I pay the debt in full.The charging order/restriction was made in 2009, my husband died in 2013, and I transferred the property into my sole name in 20200 -

blyth_2 said:I am selling my property which is now in my name only. I have a buyer and the sale is proceeding.

Any other debt my late husband had was wiped except the charging order/restriction on our jointly owned property, which was a credit card debt in his name only.

My worry is Mortimer Clarke will make me pay the debt when the sale of my house goes through, or hinder the final sale until I pay them my husbands debt.

I asked Mortimer Clarke to remove the restriction on my property as I’m not responsible for his debt. They have said if will be removed when I pay the debt in full.The charging order/restriction was made in 2009, my husband died in 2013, and I transferred the property into my sole name in 2020

I'm not an expert, but found the below online, which might help clear up some of your questions. It does seem to suggest that while you are not responsible for your late husband's debt, your late husband's Estate was. So, presumably (someone may come along and disagree) as part of the probate process following your late husband's passing, the debt should have been settled before the estate was distributed to the beneficiaries, i.e. you. As the debt was not paid off at that time, the restriction was not removed from the title. Now you are selling, the restrictioner wants the debt settled.

The below information is from Shelter:Effect of a charging order on jointly owned propertyUp to four people can jointly own a freehold or leasehold property. All the joint owners own all the land. The legal title to the land passes to the surviving joint owners if one owner dies.The equity in the property is the money that is tied up in it. The equity is usually owned by the legal owners.Beneficial joint tenantsMost joint owners are beneficial joint tenants. Unless they opted to be tenants in common when they purchased the property together, they are all jointly and severally liable owners.Beneficial joint tenants each own all the equity. This is held on trust for themselves and for the benefit of the other joint owners. If something happens that requires the equity to be severed, for example a relationship breakdown or the bankruptcy of one owner, the presumption is that they each own equal shares.When one beneficial joint tenant dies, their share of the equity automatically passes to the surviving joint tenants. This is called survivorship.Tenants in commonTenants in common hold identifiable shares of the equity from the outset. The amount of these shares will usually have been decided when the property was purchased.There are situations when a property is owned by two or more people as joint tenants, but something happens which severs the joint tenancy. This results in the owners becoming tenants in common instead.Severance of beneficial joint ownershipSome events can sever a beneficial joint tenancy. These include:bankruptcy of an ownercharging order against an ownerdivorceA charging order made against one joint owner of a property severs a beneficial joint tenancy between owners. This means that from the date of the charging order, the property is held by them as tenants in common, with a presumption that their individual shares are equal unless there is evidence to the contrary.The owners are not notified that their beneficial joint ownership has been severed. The property does not revert back to beneficial joint ownership when the charging order debt is paid off.Impact of severance on survivorshipThe effect of the severance of a beneficial joint ownership means that if one joint owner dies, the deceased's share does not pass automatically to the surviving joint owners under the rule of survivorship. Instead, the deceased's interest in the property becomes part of their estate and must be administered according to the rules of probate.The surviving joint owners might have to sell the property if they cannot pay off the charging order debt.0 -

So PG 76 explains what happens re the form K restriction on a sale so they presumably can’t ‘hinder’ you - they just have to be notified of the sale/purchase as the restriction explainsblyth_2 said:I am selling my property which is now in my name only. I have a buyer and the sale is proceeding.

Any other debt my late husband had was wiped except the charging order/restriction on our jointly owned property, which was a credit card debt in his name only.

My worry is Mortimer Clarke will make me pay the debt when the sale of my house goes through, or hinder the final sale until I pay them my husbands debt.

I asked Mortimer Clarke to remove the restriction on my property as I’m not responsible for his debt. They have said if will be removed when I pay the debt in full.The charging order/restriction was made in 2009, my husband died in 2013, and I transferred the property into my sole name in 2020

@Tiglet2’s post helps re the severance so if there’s now a form A restriction on the title you need to appoint someone to act as a Co-trustee to then jointly transfer (sell) it.And after the sale you need to consider the debt and what responsibilities you have to pay it as it’s part of his estate/beneficial ownership“Official Company Representative

I am the official company representative of Land Registry. MSE has given permission for me to post in response to queries about the company, so that I can help solve issues. You can see my name on the companies with permission to post list. I am not allowed to tout for business at all. If you believe I am please report it to forumteam@moneysavingexpert.com This does NOT imply any form of approval of my company or its products by MSE"1 -

Thank you for your replies @Tiglet and @Land_Registry

It looks as though I’m going to have to pay my late husband’s debt.

If I try and pay it before the sale goes through it will save any hindrance in a few weeks. Mortimer Clarke doesn’t know I’m selling the property, I'm assuming they wouldn’t do a deal and accept a lower figure.

Has anyone one had experience of this?0 -

Do read PG 76 and speak to your conveyancer as suggested. You still refer to it being a hindrance re the sale/purchase when that may not be the case. Yes the debt still exists but as eggbox explains in this thread the form K doesn’t always prevent a sale/purchase providing the restriction wording is complied withblyth_2 said:Thank you for your replies @Tiglet and @Land_Registry

It looks as though I’m going to have to pay my late husband’s debt.

If I try and pay it before the sale goes through it will save any hindrance in a few weeks. Mortimer Clarke doesn’t know I’m selling the property, I'm assuming they wouldn’t do a deal and accept a lower figure.

Has anyone one had experience of this?“Official Company Representative

I am the official company representative of Land Registry. MSE has given permission for me to post in response to queries about the company, so that I can help solve issues. You can see my name on the companies with permission to post list. I am not allowed to tout for business at all. If you believe I am please report it to forumteam@moneysavingexpert.com This does NOT imply any form of approval of my company or its products by MSE"0 -

Your latest conclusion does not follow from our advice. When you posted in November you were pointed to a practice guide that you could pass to your solicitor that explains what happens with a Form K restriction - the most common restriction, as that is the default setting, and what this thread is all about.blyth_2 said:Hi, I wonder if anyone can help or advise me. In 2009 a charging order/restriction of an unsecured debit of my husband’s was placed on...

Another poster led you to think you may have a Form A restriction.

Actually we don't know because we haven't seen your restriction but you and your solicitor have.

The different sorts are explained here

https://www.gov.uk/government/publications/notices-restrictions-and-the-protection-of-third-party-interests-in-the-register/practice-guide-19-notices-restrictions-and-the-protection-of-third-party-interests-in-the-register#appendix-b

0 -

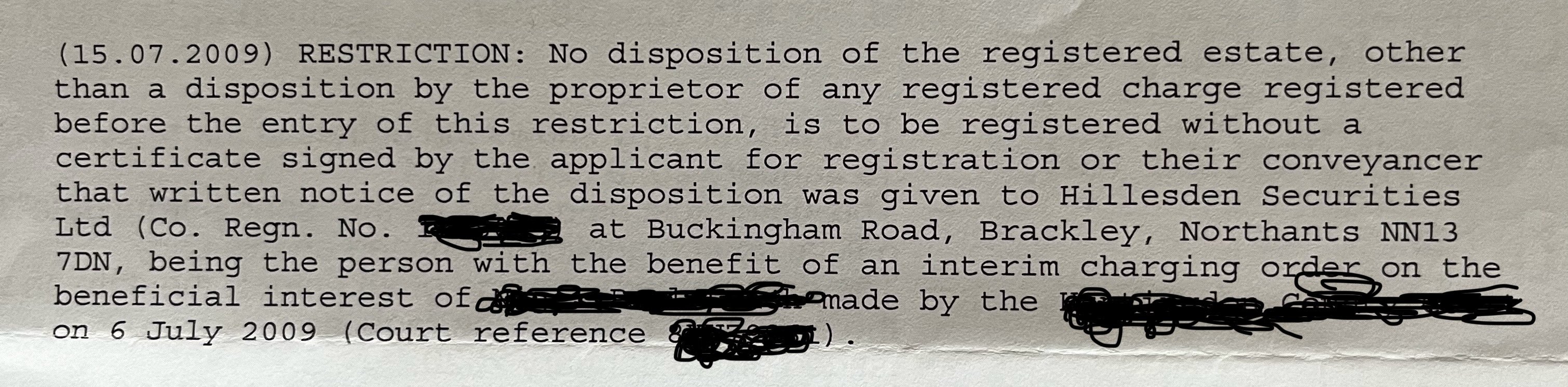

This is the wording on my deeds, I’m not sure if it’s a form k or a, and the difference it makes when the person with the charging order against them has died.Can anyone tell me which it is please?0

This is the wording on my deeds, I’m not sure if it’s a form k or a, and the difference it makes when the person with the charging order against them has died.Can anyone tell me which it is please?0 -

It’s a form K restriction. The restriction wording is very clear re how to comply with it.blyth_2 said: This is the wording on my deeds, I’m not sure if it’s a form k or a, and the difference it makes when the person with the charging order against them has died.Can anyone tell me which it is please?“Official Company Representative

This is the wording on my deeds, I’m not sure if it’s a form k or a, and the difference it makes when the person with the charging order against them has died.Can anyone tell me which it is please?“Official Company Representative

I am the official company representative of Land Registry. MSE has given permission for me to post in response to queries about the company, so that I can help solve issues. You can see my name on the companies with permission to post list. I am not allowed to tout for business at all. If you believe I am please report it to forumteam@moneysavingexpert.com This does NOT imply any form of approval of my company or its products by MSE"0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards