We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Urgent help needed please

Comments

-

Are these 2 separate cases?skylined_gtr wrote: »Ah there you are! Was wondering where you went.......

Just to clarify, the information below relates to the CCJ that is trying to be put through against me by Cabot Financial at the moment not the CO that has already been granted.

No court attendance yet, I noticed a directive on the Allocation Questionnaire stating I should do all I can to try and settle the matter out of court first, so I requested a stay and have contacted the solicitors and explained the situation to them, they have acknowledged receipt of the information I have sent them and are going to contact me. Meanwhile I am sending them emails every week to ask them where they are up to as I am anxious to have this resolved.

So whilst I am waiting on that I have just got to get rid of the previous CCJ and CO by HFO Services Ltd! Any hints/tips/suggestions?

PS I started another thread a little while back on the CCJ and CO alone as it was getting a little confusing!! Here's the link:

http://forums.moneysavingexpert.com/showthread.html?t=1971723&highlight=skylined_gtr

Re the CCJ / CO, as you've requested a stay, if the solicitors have exceeded the time-scale issued by the court without reaching a satisfactorily outcome, you must contact the court and request the Judges direction.Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

Hi 10past6

Yes they are indeed 2 seperate cases:

1 is a Claim from County Court received May 2009 pursuing recovery of a debt (Cabot Financial). - This is the one I have requested the stay for and am communicating with the solicitors. Will check when the stay expires and request direction from the judge as you have recommended.

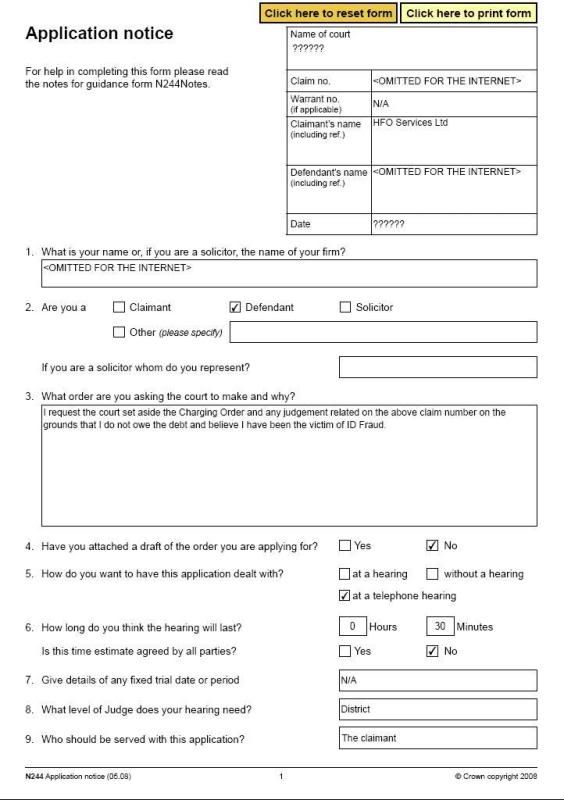

1 is a CCJ resulting in a CO on the property I own issued in February 2009 (claimant HFO Services) - This is what I want to get overturned/removed. Can you help me progress with this? As far as I can see the last piece of advice you gave me was to fill out a form N244 and request the judgement be overturned and the CO removed. I'll draft the N244 then post it on here for your review if that's ok?0 -

Thanks, of and when you update this thread, can you inform me via PM to draw my attention.skylined_gtr wrote: »I'll draft the N244 then post it on here for your review if that's ok?Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

I will be sure to send you a PM, It will be this weekend so please look out for a PM around then... Once again - can't thank you enough for your help.

Incidentally, whilst raising alerts against all the disputed entries on my credit report, I was told by Equifax to contact Turnbull Rutherford directly regarding a credit account. Turns out that Turnbull Rutherford are the solicitors who placed the CO against my property on behalf of Barclaycard.

So I figured I would start a dialogue with them on the whole situation and my intention to have the CCJ and CO overturned. The lady on the phone advised me to contact the Barclaycard Fraud department and explain the situation to them as if we can gain mutual agreement from Barclaycard that I am the wrong person to have this issued to Turbull Rutherford can have it removed for me thereby saving me money, time, etc.

I am a little suspicious of this advice and think I should continue to fill out the N244 and have the order removed if a Judge sees it fit to do so. In the letters from Turnbull Rutherford it states clearly that the outstanding debt is accumulating interest.

On the other hand I'm thinking that a Judge may look at my N244 and say "...well he hasn't contacted the fraud department at Barclaycard to investigate so he should do that first..." and then throw my case out - or does it not work like that?

What do you all think?0 -

If fraudulent activity has taken place, you MUST go through Barclaycard's fraud department, once you have the outcome to there findings, providing it's in your favour, include that documentation within your N244 application.skylined_gtr wrote: »On the other hand I'm thinking that a Judge may look at my N244 and say "...well he hasn't contacted the fraud department at Barclaycard to investigate so he should do that first..." and then throw my case out - or does it not work like that?Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

Thanks. I'd still like to progress with the N244 in the hope the Judge removes the CO and CCJ under the 'innocent until proven guilty' clause - I'll take a chance on the Judge throwing the case out. Will get it drafted and let you know when it's on here.

Thanks again.0 -

Hi again, sorry it's taken so long to do this but here goes....

The Evidence I will send in:

Your Honour

I do not acknowledge any debt with the claimant - I believe I have been the victim of mistaken identity or an Identity Fraud which requires further investigation by the Police and/or the creditors.

Approximately 2 and a half years ago, I moved out of my mortgaged dwelling (Omitted for the Internet) due to a family disagreement between my mother and I pertaining to the newly mortgaged property. I continued to pay the monthly mortgage payment, in full, in order to honour my agreement with the mortgage company despite no longer living at the address. For that particular period of time my mother and I had no contact. Just recently we have sought a resolve and I have moved in to assist her (she is disabled) at which time she informed me there was a charging order placed on the property by a Debt Collection Agency in February 2009 which she had assumed was due to an unpaid debt generated by me. This was my first and only realisation of this Charging Order. My mother sent in a defence but sadly it was not acknowledged. I do not acknowledge the debt relating to the Charging Order and strongly refute any allegation that I have anything to do with it. All of my personal finances are in order, I have one bank account, one credit card and one mortgage which have been managed impeccably from the start.

Upon requesting an updated credit report recently, I noted multiple accounts, aliases, public records information and linked addresses that are nothing to do with me. I have since joined CIFAS, the UK fraud prevention service, to block further attempts to gain credit in my name. As a result of the information on my credit report I have sent Subject Access Requests under the Data Protection Act to the originators of all the loans including the loan this Charging Order relates to (copy attached). The claimant has responded but is in default of the Consumer Credit Act as they have been unable to provide me with a signed consumer credit agreement.

I have contacted the Police who will not acknowledge the Identity Fraud as a crime but as a civil matter due to the looser ultimately being the financial institution (claimant), not me. They inform me that until such time as the financial institutions report the matter to the Police they are unable to investigate the matter further. For reference, I spoke to PC 296 ‘Stephen’ of xxxxxxxxxx Police Station.

This is causing me significant difficulty with a cost attached, I work Monday to Friday and am desperately trying to stay dedicated to my work given the current economic climate for fear of redundancy but unfortunately this is a difficult situation to resolve. I have had to take time from work to visit the Police station, speak to people on the phone to obtain legal advice, write letters asking for information held about me and visit the Post Office to send letters registered delivery and obtain Postal Orders to pay for the information requests. To further complicate matters I have now emigrated to Canada!

Therefore I kindly request the Charging Order be set aside and if your honour sees fit, to remove the order from the property.

Really having problems with the N244 as you can see:

1. Name of court - an interim charging order was granted at guilford county court however the Final Charging Order was granted at my local court, I'm guessing the local court goes here?

2. Where it asks for the date - is that the date the CO was made or todays date?!

3. I have made a guess at the time required for the hearing.

Please point out anything else you feel needs changing. Can't thank you enough again!!0 -

Insert the name of the court you're submitting this application to.skylined_gtr wrote: »I'm guessing the local court goes here?

Todays date.skylined_gtr wrote: »Where it asks for the date - is that the date the CO was made or todays date?!

1/2 hour will be sufficientskylined_gtr wrote: »I have made a guess at the time required for the hearing

Evidence that you've informed any financial instituation you've been the vicitm of fraud.skylined_gtr wrote: »Please point out anything else you feel needs changing

Should your set aside application be granted and the CO removed, you have the right to claim your costs, once you obtain a date for the hearing, contact me and I'll advise you how to apply for your costs.Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

Hi thanks again for the brilliant advice and hand-holding through this.

So the question I have is which court am I submitting this to? My local court because logistically I'm closer I'm guessing? Or does it have to go to a specific court like Guilford who initially granted the temporary CO?

....once I've added that and the extra evidence showing all the institutions I have contacted, send it in to the court in the 1st box on the form right?0 -

Your local court, if possible, hand delivery it.skylined_gtr wrote: »My local court

Correct, keep all documents as one bundle.skylined_gtr wrote: »....once I've added that and the extra evidence showing all the institutions I have contacted, send it in to the court in the 1st box on the form right?

Be sure to keep a copy of every document you hand in to the court.Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards