We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

printing money what does it mean

Comments

-

Thanks pssst i get what QE means in terms of what it is. Just dont get the effect it could have on my savings what i should be watching for etc, is it likely that it could all go wrong and they could be worthless. Hope that makes sense just trying to get my head round it all. I feel i AM BEING FROG MARCHED TO THE BANK TO SPEND SAVINGS when all i want is time to find a home at a fair price

Exactly. i know its not the answer but i shall be carrying out my own version of QE. I shall be increasing the money supply in my very big and secure safe,and decreasing it in my savings accounts.

They are NOT having use of my hard earned money free of charge.

Banks have become very hard and arrogant toward customers recently.

They are like cowardly males on the titanic. Pushing women and children to one side in order to steal a place in the lifeboats.

My own bank has suddenly become incredibly arrogant toward me.

I shall pay them back.0 -

What it means is:

The Government have officially run out of money (not that they didnt "unofficially" run out of it in December).Not Again0 -

1984ReturnsForReal wrote: »What it means is:

The Government have officially run out of money (not that they didnt "unofficially" run out of it in December).

Do you really think that's true given that the government has auctioned off all its debt so far? Unlike many other countries.“I could see that, if not actually disgruntled, he was far from being gruntled.” - P.G. Wodehouse0 -

people with money in the bank waiting for a house are still quids in look below

inflation needs to be higher than 17.7% a year to make buying a house better than having cash

in the bank at 0% interest.

£200,000 in the bank at 0% will give you £200,000 year.

£200,000 in property will give you £200,000 - 17.7% £164,600 at year end.It is nice to see the value of your house going up'' Why ?

Unless you are planning to sell up and not live anywhere, I can;t see the advantage.

If you are planning to upsize the new house will cost more.

If you are planning to downsize your new house will cost more than it should

If you are trying to buy your first house its almost impossible.0 -

Do you really think that's true given that the government has auctioned off all its debt so far? Unlike many other countries.

Yes I do.

The Government is copying the business model of the banking industry they critised & condemned.

IE Borrowing more because of "assets" (unpaid future debt & additional income).Not Again0 -

Again that's really not true when it comes to government debt.

Government debt will shoot up but is not currently on a trajectory too different from the 1990's. I suspect it will go higher, but it's unlikely to reach a different order of magnitude.

The debt problem in the UK is real, and there is a massive debt bubble. The government is not the body that's been borrowing though. It's us with the debt problem. Household and corporate debt is what's at historically abnormal levels, and it's that debt that's going to cause problems, not the government debt. The government's sin has been to create the conditions and regulatory system in which companies and individuals have borrowed absurdly. Giving people and businesses the opportunity to do something stupid is not the worst sin though. Doing something stupid -- taking out 125% mortgages, living off credit cards, takeovers with inflated quantities of borrowed money -- is.

(Which isn't quite true, the worst, the real bile at the heart of the financial crisis, is that of the tens of thousands of Americans who borrowed money from subprime lenders and haven't paid it back.)

The figures I saw were different, will try and dig them out although I think they were part of a PDF. However if you're confident your figures are correct then glad to be corrected

Also does current debt include or exclude the bank bailouts?

With regards this QE it seems the money is being used to buy Gilts - does this money then go to the HM Treasury? How will it filter down into the banking system?matched betting: £879.63

0 -

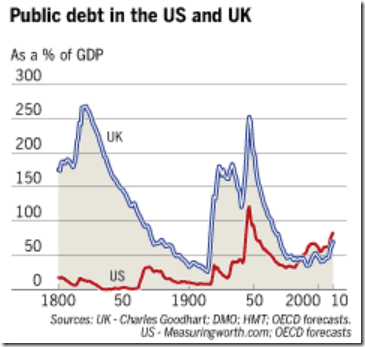

You will have seen an image like this:

This covers all debt, not just government debt. It indicates clearly how in the US there has been steady growth in private debt since the earlier eighties. I don't know how reliable this particular graph is, but it is does show the correct general trend. I can't find a good graph for the UK from this computer, but they show something very similar only with the debt boom starting around 1987.

The graphs I posted earlier do not include liabilities taken on as a result of the bank bailouts, which for these purposes is the correct way to do things.

Try The Economist for a (rightly) pessimistic but also sensible look at Britain's economy.The_Economist wrote:Ben Broadbent, an economist at Goldman Sachs, a bank, has estimated that the Treasury’s insurance plan for bank assets could cost up to 8% of GDP. If other measures (recapitalisations, support for the two nationalised lenders and the rescue of British depositors with failed Icelandic banks) are included, the bail-out could take around 14% of GDP. That would be a lot more than the cost to Sweden of sorting out its banking crisis in the early 1990s (around 4% of GDP) but in line with Japan’s 14%.

If Britain’s bill turns out to be more like Japan’s than Sweden’s, the Treasury would gulp but could swallow it, for Britain’s official debt has been relatively smaller than that of other G7 countries. In 2007 Britain’s gross government debt was 47% of GDP; in France, for example, it was 70%.

That is no cause for complacency. Even excluding financial bail-outs, public debt as a share of GDP may rise by 20-30 percentage points by 2011, as recession pushes up public borrowing (see chart 4). If it does, Britain would end up somewhere in the middle of the pack.0 -

I don't understand why making things more expensive (because the pounds are worth less) will make people spend money. How is this going to encourage me, an ordinary person, to go out for a meal or buy some more books?

Are there any examples where quantative easing has worked to stabilise an economy?0 -

people with money in the bank waiting for a house are still quids in look below

inflation needs to be higher than 17.7% a year to make buying a house better than having cash

in the bank at 0% interest.

£200,000 in the bank at 0% will give you £200,000 year.

£200,000 in property will give you £200,000 - 17.7% £164,600 at year end.

On the other hand, everyone needs somewhere to live (assuming one isn't prepared to live with parents for free or minimal rent!)

With stories of tenants being kicked out because their BTL landlord hasn't kept up the mortgage payments, I'm still reasonably happy I bought my home in late 2006, even if there's a prospect of it being worth less than I paid for it in the short- to mid-term.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards