We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Bulls, watch this video and try and counter the argument...

mbga9pgf

Posts: 3,224 Forumite

Why should I as a long-term saver bail out those reckless, !!!!less idiots that are now struggling to pay their mortgages?

Where do I get to sign a bit of paper forgoing any protection from the government and not have to pay for this?

Those that bought homes had a choice. They entered a legal agreement with their mortgage companies. Why should I now have to bail them out for their reckless decision? I was warning people from 2005 that this would all end in tears, If only they had listened....

http://www.youtube.com/watch?v=ca_aOvZPh-g

Where do I get to sign a bit of paper forgoing any protection from the government and not have to pay for this?

Those that bought homes had a choice. They entered a legal agreement with their mortgage companies. Why should I now have to bail them out for their reckless decision? I was warning people from 2005 that this would all end in tears, If only they had listened....

http://www.youtube.com/watch?v=ca_aOvZPh-g

0

Comments

-

Why should I as a long-term saver bail out those reckless, !!!!less idiots that are now struggling to pay their mortgages?

Where do I get to sign a bit of paper forgoing any protection from the government and not have to pay for this?

Those that bought homes had a choice. They entered a legal agreement with their mortgage companies. Why should I now have to bail them out for their reckless decision? I was warning people from 2005 that this would all end in tears, If only they had listened....

http://www.youtube.com/watch?v=ca_aOvZPh-g

This video is about the states, completely different market to over here0 -

Why should I as a long-term saver bail out those reckless, !!!!less idiots that are now struggling to pay their mortgages?

Where do I get to sign a bit of paper forgoing any protection from the government and not have to pay for this?

Those that bought homes had a choice. They entered a legal agreement with their mortgage companies. Why should I now have to bail them out for their reckless decision? I was warning people from 2005 that this would all end in tears, If only they had listened....

http://www.youtube.com/watch?v=ca_aOvZPh-g

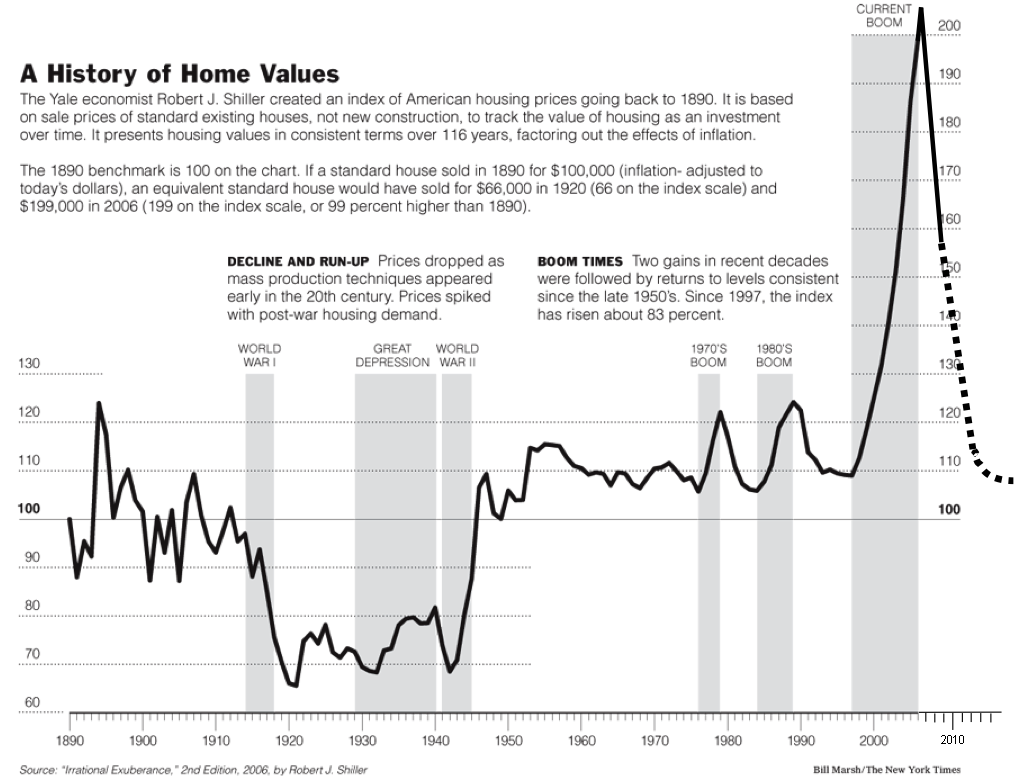

i had posted about this graph a few days ago on another thread. here is that graph again to keep the picture fresh in our minds as the uk govt seems to be trying to prop up the property prices as wellbubblesmoney wrote: »a picture can say it in an instant when sometimes a thousand words might not do enough justice.

here is a picture of past house price crashes in usa. probably the uk ones might not be much different. bubblesmoney :hello:0

bubblesmoney :hello:0 -

i guess just like the share market, bail outs, etc etc are different too. or did i not hear our wise leaders words that it is a global problem.This video is about the states, completely different market to over here

burys head in the sandbubblesmoney :hello:0 -

Basically it's the same old argument that house prices will follow the same patterns that they have in the past. The question I would ask is why should houses have cost an average of $100,000 in the past and is there any reason why they should continue to do so in the future?

The world in 2009 is very different to that of 100 years ago. Interest rates have been very low for the last ten years or so, and have just fallen to a historical low, thus making more expensive houses more affordable. People live longer, so get more value out of their houses because they get to use them for a longer number of years. Necessities such as food have become cheaper, leaving more disposable income to spend on buying a more desirable house. In the UK planning restrictions have led to fewer houses being built, so supply has not kept up with demand.

As to your question, "Why should I as a long-term saver bail out those reckless, !!!!less idiots that are now struggling to pay their mortgages?" I agree with your sentiments. However I would suggest that you get used to the idea that you WILL have to bail out those "reckless, !!!!less idiots" as there is going to be a General Election next year. Ironically the best way to do so may turn out to be to become a reckless, !!!!less idiot yourself by mortgaging yourself to the hilt and buying a great big house. It is quite possible that the bailout will cause high levels of inflation, this eroding your debt.

On the other hand, one can't rule out massive deflation, in which case you would be !!!!ed.0 -

Good point. But Glen Beck and fox news ! I love it when he says that you are paying your mortgage and the deadbeat down the street's. In the UK isn't that called council tax already ?0

-

Basically it's the same old argument that house prices will follow the same patterns that they have in the past. The question I would ask is why should houses have cost an average of $100,000 in the past and is there any reason why they should continue to do so in the future?

The world in 2009 is very different to that of 100 years ago. Interest rates have been very low for the last ten years or so, and have just fallen to a historical low, thus making more expensive houses more affordable. People live longer, so get more value out of their houses because they get to use them for a longer number of years. Necessities such as food have become cheaper, leaving more disposable income to spend on buying a more desirable house. In the UK planning restrictions have led to fewer houses being built, so supply has not kept up with demand.

As to your question, "Why should I as a long-term saver bail out those reckless, !!!!less idiots that are now struggling to pay their mortgages?" I agree with your sentiments. However I would suggest that you get used to the idea that you WILL have to bail out those "reckless, !!!!less idiots" as there is going to be a General Election next year. Ironically the best way to do so may turn out to be to become a reckless, !!!!less idiot yourself by mortgaging yourself to the hilt and buying a great big house. It is quite possible that the bailout will cause high levels of inflation, this eroding your debt.

On the other hand, one can't rule out massive deflation, in which case you would be !!!!ed.

the price quoted in the video and the chart i posted is 'an inflation adjusted price for 2006 dollars'. so a 100 years ago the price in actual terms would have been a lot lesser than now.

inflated adjusted house prices will have a relationship with price to earnings multiples. when the multiples go high then it puts a bigger debt burden and will be unsustainable in the long run.

remember we are not talking about individuals and individual homes, we are talking about the wider picture. there will always be exceptions but its the general trend as shown in the graph and video that stand the test of time which shows that it is valid theory.bubblesmoney :hello:0 -

I know it's adjusted for inflation. But it isn't adjusted for interest rates, increasing prosperity, introduction of planning constraints, deflation of other goods, etc... Just because trends have occured in the past does not mean that they will continue to occur in the future.0

-

inflation factors in all the things that you mention above. price to earnings ratio will always govern what we can afford.I know it's adjusted for inflation. But it isn't adjusted for interest rates, increasing prosperity, introduction of planning constraints, deflation of other goods, etc... Just because trends have occured in the past does not mean that they will continue to occur in the future.

yes technicals just sjhow the trend in the past and dont always accurately predict the future. but think of it as monopoly, then all of us have a pot of money(monopoly) we buy and sell whats available, if we in theory pushed in double the (monopoly) money into the game even though prices will rise in the game for land or any asset but if you see the inflation adjusted value for constant adjusted to monopoly money (standardised to a time period) then the affect would be the same. you can project the same onto life in general, printing money and pushing it into the system only notionally appreciates the prices but if you see inflation adjusted prices then the value of assets remains almost constant over the longer term. but there will always be booms and bust lead by market sentiment (plus short term market manipulation factors) and not change in intrinsic values. what ever the govt does reality kicks in sooner or later. you cant defy the inevitable boom-crash indefinitely and just expect boom-boom. by stoking unsustainable market price manipulation in the short term what in effect happens is boom-boooomm---bust--buuust. now this is what we are looking at. passing the parcel cant happen for ever, sooner or later one has to eat the cake.bubblesmoney :hello:0 -

This video is about the states, completely different market to over here

I agree with you Steve. House prices over here are a lot more over valued than the US. Our economy is also much more dependant on a strong banking and financial services sector. We have much higher taxes and the lowest manufacturing employment since the industrial revolution.0 -

it is precisely because of 'is' dependent that we will face the effects of the credit crunch and banking crises more and it will filter into after effects for others as well.I agree with you Steve. House prices over here are a lot more over valued than the US. Our economy is also much more dependant on a strong banking and financial services sector. We have much higher taxes and the lowest manufacturing employment since the industrial revolution.

the 'city' certainly got rocked. lets now see if their foundations were based on the ground or up in the clouds.

to see if it is viable for property price appreciation disproportionate to earnings to occur.

if average prices keep rising at 10-20% annually but average earning keep rising only at 4-5% annually in the short term there will be a boom but over a decade or so there will inevitably be a bust due to the power of compounding adding to the problems. much like when saving from a younger age with smaller amounts makes a bigger difference to ones savings after 40y than saving bigger amounts later in life without saving earlier.bubblesmoney :hello:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards