We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

HP expect the rate of decline to accelerate, Economist.

Comments

-

It's great to see that Dan; has been transmogrified into a big bad bear by the sheer wealth of evidence available. He won't be the last convert, that's for sure.

Don't panic just yet fatpig - I aint converted to nothing. Most of the evidence is unreliable and as i stated above it's all guess work. My current guess is another 10% average drop by the end of year and a very very slow recovery over 7 years.0 -

I actually think they will fall for a long time, staggering downward, blips upwards. It's not JUST guesswork...you can look at historical bubbles, graphs, economics, etc. etc. But us plebs are not privy to all the information.

At the moment people are desperately trying to crystalise their gains, and who can blame them ?, sometimes it works, (I see houses selling and think 'who the bloody hell has been daft enough to buy that'). It's these people who are holding up asking prices.

When people realise houses aren't worth what they used to be and they want to move and realise the house they want to buy is cheaper anyway, they will become more realistic with their asking prices.

Calling the bottom is only possible with hindsight, 2010 it may be (I think 2011) but then perhaps a few years of stagnation. As long as wages don't rise dramatically then house prices shouldn't either. Surely the way to control housing bubbles is to keep house prices in line with wages ?. I will gladly pay £3 million for a house when I am on 1 million a year*.

* Average wage.....I am not average, I am underaverage so will not buy an average house at £3 million, I will buy and underaverage house for less, or if I become overaverage reverse this. A xDon't believe everything you think.

Blessed are the cracked...for they are the ones who let in the light. A x0 -

I agree. Alot of people are in denial. We're just at the very beginning of the biggest housing bear market ever.

I agree. It's clear that the decline in house prices has further to go. I think at the very least we are likely to see a further fall of around 10% but it could be a lot more than that.

Whilst this would obviously come as welcome news for potential first-time buyers, I can see such falls posing a serious risk to the wider economy and the length and depth of the recession.

Many financial commentators view house prices bottoming out as a necessary precursor to any upturn in the economy, both here and in the US. Further falls in house prices and growing mortgage defaults would presumably cause further write downs in the value of the mortgage-backed securities held by banks, thus further undermining the banks balance sheets and hence their ability to lend. It's a kind of economic self-perpetuating nightmare.0 -

We've yet to see inflation really start rising, as it will do after Q4 2009. Then people will regard leverage and hard assets in a different light.0

-

chrisandanne wrote: »I actually think they will fall for a long time, staggering downward, blips upwards. It's not JUST guesswork...you can look at historical bubbles, graphs, economics, etc. etc. But us plebs are not privy to all the information.

At the moment people are desperately trying to crystalise their gains, and who can blame them ?, sometimes it works, (I see houses selling and think 'who the bloody hell has been daft enough to buy that'). It's these people who are holding up asking prices.

When people realise houses aren't worth what they used to be and they want to move and realise the house they want to buy is cheaper anyway, they will become more realistic with their asking prices.

Calling the bottom is only possible with hindsight, 2010 it may be (I think 2011) but then perhaps a few years of stagnation. As long as wages don't rise dramatically then house prices shouldn't either. Surely the way to control housing bubbles is to keep house prices in line with wages ?. I will gladly pay £3 million for a house when I am on 1 million a year*.

* Average wage.....I am not average, I am underaverage so will not buy an average house at £3 million, I will buy and underaverage house for less, or if I become overaverage reverse this. A x

I agree with your post, however I don't know how you can suggest that predicting 2011 is not guesswork. Sure you can analyse available data and look at historic movements, but its still guesswork, even for the experts who get it wrong constantly (even in the HPI years)0 -

I am no sure why house prices have to be a certain amount of income though. It is possible that people might prefer to spend a greater proportion of their income on housing, especially if other prices fall.0

-

Radiantsoul wrote: »I am no sure why house prices have to be a certain amount of income though. It is possible that people might prefer to spend a greater proportion of their income on housing, especially if other prices fall.

It depends on various other factors too, such as other expenses, debts, etc. It needs to be broadly linked in order to establish affordability. The lack of which, in recent years, is a big part of the reason for our current problems.0 -

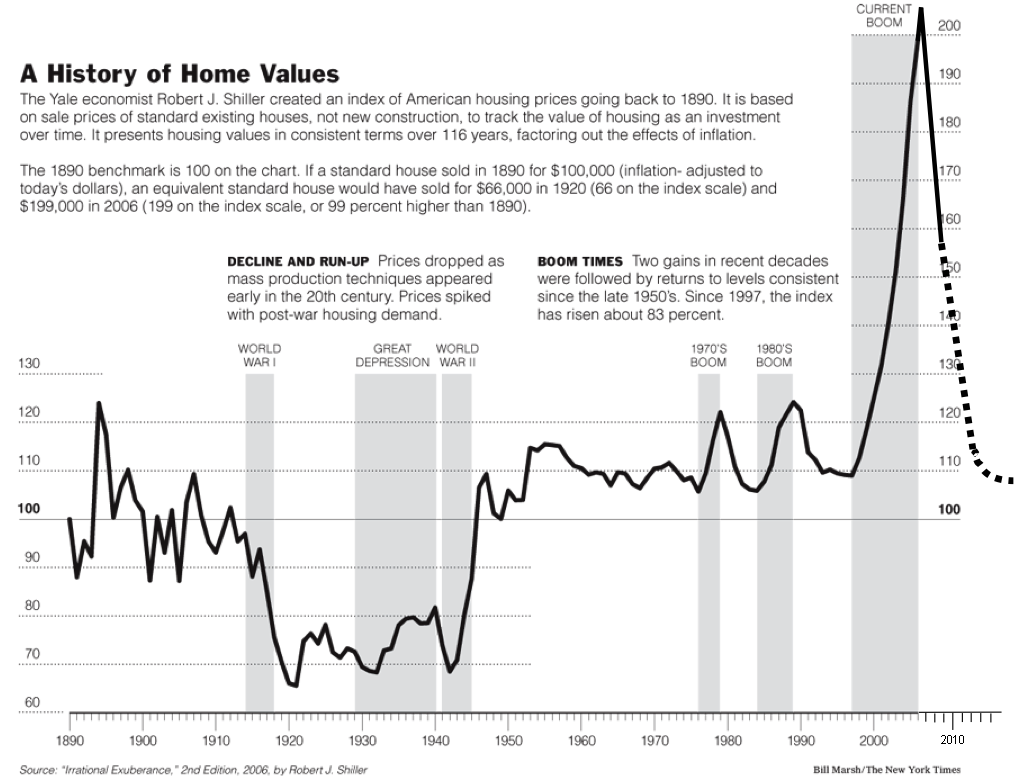

This graph says it all adjusted for inflation back to 1890.

It is the US market so we are about a yr ahead of them. http://www.youtube.com/watch?v=ca_aOvZPh-g

http://www.youtube.com/watch?v=ca_aOvZPh-g

Originally Posted by bubblesmoney

a picture can say it in an instant when sometimes a thousand words might not do enough justice.

here is a picture of past house price crashes in usa. probably the uk ones might not be much different. 0

0 -

What people on here are forgetting is this is the biggest drop in prices this last year since records began in 1952

http://209.85.229.132/search?q=cache:IS8ZhMhVvfkJ:www.nationwide.co.uk/hpi/historical.htm+this+is+the+worst+housing+market+since+1952&hl=en&ct=clnk&cd=1&gl=uk&client=firefox-aIt is nice to see the value of your house going up'' Why ?

Unless you are planning to sell up and not live anywhere, I can;t see the advantage.

If you are planning to upsize the new house will cost more.

If you are planning to downsize your new house will cost more than it should

If you are trying to buy your first house its almost impossible.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards