We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Moneyweek: 0% interest rates are dangerous...

Comments

-

Cannon_Fodder wrote: »Think I saw a technical definition of "hyperinflation" as 50% per month. Sounds unlikely, hope we've got better finance experts to guide the Govt than Mugabe has got :- "agree with me or be burnt alive, doesn't create a dissenting environment".

"Hyper" in the tabloid sense? - very high compared to what we have been used to, very high compared to even the seventies...?

good chart at http://www.bankofengland.co.uk/education/inflation/timeline/chart.htm shows the recent peak of 25% in 1975...and 36% in 1800...

If Brown digs himself a hole by bailing out more and varied organisations then he could create a scenario whereby the unions demand that it is their "turn" to be bailed-out...workers get a big % to keep up with moderate inflation, go out and spend it like the good economy-helpers they are = high inflation.

Feasible. Hope the election beats him to it.

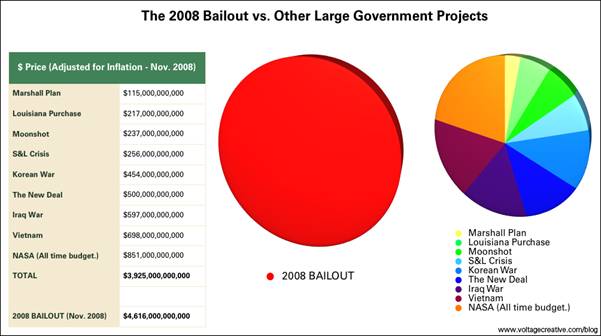

Another interesting chart - if the US have spent as per the below, then that money sloshing around is going to have what effect?

http://www.marketoracle.co.uk/Article7787.html

Scariest pie chart ever!0 -

Dithering_Dad wrote: »Then why did you mention him at all in a discussion that had nothing to do with the sad situation in Zimbabwe?

Purch said that he didn't think Hyperinflation was likely in our lifetime.

Neither did Robert Mugabe I'm sure.--

Every pound less borrowed (to buy a house) is more than two pounds less to repay and more than three pounds less to earn, over the course of a typical mortgage.0 -

Dithering_Dad wrote: »lol, if you really believed that Brown is as bad as Mugabe, you'd be looking to leave the UK and take your wealth with you. An even better way to escape the hyper inflation that you believe is coming.

Why are you not doing this?

He would need Brinks Matt to transport his amassed gold wealth.Official MR B fan club,dont go............................0 -

Purch said that he didn't think Hyperinflation was likely in our lifetime.

Neither did Robert Mugabe I'm sure.

Exactly, so if you can't see how your statement about Mugabe linked the current problems we're facing in the UK to the problems being faced in Zimbabwe (where Rob Mug is from) then there's no hope.

However, as you seem to be retracting your comment, we'll say no more about it.

It does still beg the question, do you think the UK will have a period of hyper inflation or not?

Surely if you even think there is a 10% chance, then you'd be well advised to move your money out of Sterling and into a bank outside this country?Mortgage Free in 3 Years (Apr 2007 / Currently / Δ Difference)

[strike]● Interest Only Pt: £36,924.12 / £ - - - - 1.00 / Δ £36,923.12[/strike] - Paid off! Yay!!

● Home Extension: £48,468.07 / £44,435.42 / Δ £4032.65

● Repayment Part: £64,331.11 / £59,877.15 / Δ £4453.96

Total Mortgage Debt: £149,723.30 / £104,313.57 / Δ £45,409.730 -

Dithering_Dad wrote: »Exactly, so if you can't see how your statement about Mugabe linked the current problems we're facing in the UK to the problems being faced in Zimbabwe (where Rob Mug is from) then there's no hope.

However, as you seem to be retracting your comment, we'll say no more about it.

The comment you seem to think I'm retracting was never made by me. You interpreted it to mean something, I've cleared it up for you in my last post. You still apparently don't (or won't) get it.

I quite clearly stated back in my reply to you in post #30 what my thoughts were about the likelihood of hyperinflation, not half an hour ago. Maybe you might try reading my replies?It does still beg the question, do you think the UK will have a period of hyper inflation or not?

Over half my cash savings are not in Sterling. And I foresee remaining in the UK for personal reasons.]

Surely if you even think there is a 10% chance, then you'd be well advised to move your money out of Sterling and into a bank outside this country?--

Every pound less borrowed (to buy a house) is more than two pounds less to repay and more than three pounds less to earn, over the course of a typical mortgage.0 -

I don't think we'll see hyperinflation (many % per month) but I do think there is a risk of high inflation, say 15 - 20% p.a....much enquiry having been made concerning a gentleman, who had quitted a company where Johnson was, and no information being obtained; at last Johnson observed, that 'he did not care to speak ill of any man behind his back, but he believed the gentleman was an attorney'.0

-

neverdespairgirl wrote: »I don't think we'll see hyperinflation (many % per month) but I do think there is a risk of high inflation, say 15 - 20% p.a.

The problem is that no-one will want to turn off the credit taps and get blamed for spoiling the party.

And as that Moneyweek article pointed out, could you really trust our current politicians not to print up money on demand for their pet projects once that money printing is established and somewhat accepted?

There's a very appreciable risk of hyperinflation in that scenario. That compares to the possibility being pretty much unthinkable a year or two back. But then again a lot of things and actions that would have been unthinkable not so long ago are now established matters of fact or government economic policy.--

Every pound less borrowed (to buy a house) is more than two pounds less to repay and more than three pounds less to earn, over the course of a typical mortgage.0 -

The problem is that no-one will want to turn off the credit taps and get blamed for spoiling the party.

And as that Moneyweek article pointed out, could you really trust our current politicians not to print up money on demand for their pet projects once that money printing is established and somewhat accepted?

There's a very appreciable risk of hyperinflation in that scenario. That compares to the possibility being pretty much unthinkable a year or two back. But then again a lot of things and actions that would have been unthinkable not so long ago are now established matters of fact or government economic policy.

unemployment will be used as a tool to control inflation - it's not something Mr Brown or Mr Darling would be able to say though0 -

The only inflation which would reduce debt would be wage inflation - price inflation may pay off debts, but (as in Zimbabwe) you wouldn't be cheering about paying the mortgage if you had to leave work every 15 mins to do the shopping.Dithering_Dad wrote: »If I believed that we were in for a period of hyper inflation, then I'd buy a house now and arrange a fixed rate mortgage. Hyper inflation would take off and reduce down my motgage debt significantly (i.e. if you bought a farm in Zimbabwe with a mortgage for £1M pre-inflation, you could now pay that debt off with less than a week's wage!) and the fixed rate mortgage would protect me from the BoE raising its interest rates to 15%+ in order to fight inflation.

I doubt we'll "go hyper", but even a relatively moderate increase in "essentials" costs over the last couple of years seems to have caused a fair bit of havoc. Dunno what happens in a couple of years time if anyone is suckered into more "now even cheaper" debt...0 -

Sir_Humphrey wrote: »Even the crudest quantity theory of money has to take into account velocity.

Velocity of circulation has clearly been falling as the banks hoard cash, presumably that's why central bankers are starting to print money.

It's a very dangerous game they're playing IMO. What happens when velocity returns to normal?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards