We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Corus Sharesave/ Loan Notes - Anyone help me please !!

stylus360

Posts: 448 Forumite

in Cutting tax

Hi

Need help in filling in the the Sharesave Maturity Form basically to avoid paying tax. I am single cannot pass any to spouse/partner.

Have been saving for 3 years at £250 month = £9000

Basically had £9350 (£350 tax free bonus) and got option to buy shares at £1.95

= 4794 shares.

They are now offering £6.08 a share so 4794 x £6.08 = £29147

£29147 - £9000 = £20147 profit.

I am allowed £9600 before i pay CGT so £20147 - £9600 = £10547 which would be taxed at 18% i beleive.

There is an option for loan notes but i do not know how to fill form in. Does that mean i ask for £10547 in loan notes ?

Anyone Help ?

Cheers

Need help in filling in the the Sharesave Maturity Form basically to avoid paying tax. I am single cannot pass any to spouse/partner.

Have been saving for 3 years at £250 month = £9000

Basically had £9350 (£350 tax free bonus) and got option to buy shares at £1.95

= 4794 shares.

They are now offering £6.08 a share so 4794 x £6.08 = £29147

£29147 - £9000 = £20147 profit.

I am allowed £9600 before i pay CGT so £20147 - £9600 = £10547 which would be taxed at 18% i beleive.

There is an option for loan notes but i do not know how to fill form in. Does that mean i ask for £10547 in loan notes ?

Anyone Help ?

Cheers

0

Comments

-

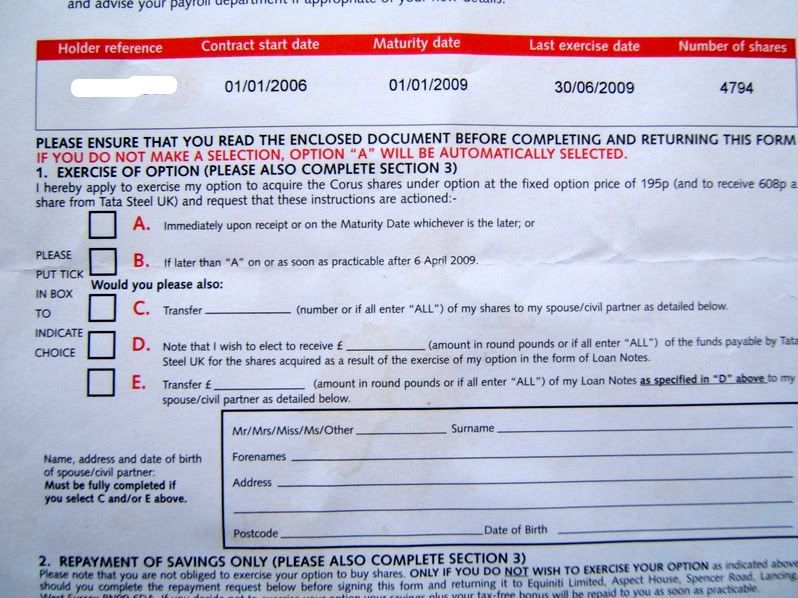

Cheers Jimmo. Did come across that thread but my Sharesave maturity form has no options for me to

a - Transfer 'x' of shares to my spouse/partner

b - Note that i wish to Recievw '£xx' of funds payable by Tata/corus for the shares aquuired as a result of the exercise of option in the form of loan notes.

c - as b above but to spouse or partner

I take it then i should exercise my option and put in box b to recieve £10547 in loan notes.

??0 -

I was going to tick box 'A' to exercise my option. Then Tick box 'D' and enter a value of £10547. See form below.

Cheers0 -

Cheers Jimmo but i do not have a partner that's why i have to go down the loan notes route.

I have to exercise my option as that entitles Tata to buy my shares at the higher price. What confuses me is what to do with the loan notes part ?

Do i work it out at for capital gains reasons at the Corus price of £1.95 or at the Tata price of £6.08 ?

In a seperate leaflet i have it states -

ELECTING FOR LOAN NOTES - If you elect for loan notes, you should not be treated as making a disposal of your Corus shares for CGT purposes and so no CGT will be payable. Instead, CGT will be payable when loan notes are sold or redeemed. You may be able to reduce the amount of CGT by taking advantage of your annual allowannce and/or by transferring some or all loan notes to spouse/partner.

This now reads to me as i have to work out how many loan notes in £ at the corus price of £1.95

Which makes everything above wrong.....

So basicall y i have to work the loan note value as if i was giving my wife shares at the £1.95 price ?

How do i do that ?

Cheers0 -

Here’s what happens, assuming you have no spouse/partner option;

On 1st Feb 2009 Tata take the money you’ve saved plus the bonus (£9,350) and use it to buy Corus 4794 shares at £1.95. They then immediately buy them back at £6.08, thus leaving you with £29,147.52. So far so good J

The question now is how do you take this money. You can take all of it as cash (Option A only) some as cash and some as Loan Notes (option A + option D).

Anything you take as cash will be assessed for CGT at the time you take the cash. Anything you take as Loan Notes will be considered for CGT when you sell the Loan Notes back. In either case, the gain is based on return-cost.

Hope this helps.

0 -

Also worth bearing in mind that there is a risk with Loan Notes; you would want to be confident that 'Tata Steel UK Ltd' is still good for them by the time you want to redeem them, and the earliest opportunity is Nov 09...0

-

Also worth bearing in mind that there is a risk with Loan Notes; you would want to be confident that 'Tata Steel UK Ltd' is still good for them by the time you want to redeem them, and the earliest opportunity is Nov 09...

Where does it state the earliest opportunity is Nov 09, thought i could redeem the rest in June or July (not sure which it was) when the interest is paid on them also ?

Cheers0 -

Where does it state the earliest opportunity is Nov 09, thought i could redeem the rest in June or July (not sure which it was) when the interest is paid on them also ?

Cheers

There is also a stipulation that the loan notes must be held for at least 6 months, so the first date (June/July'09) is not an option (excuse the pun).

Hope this helps.0 -

There is also a stipulation that the loan notes must be held for at least 6 months, so the first date (June/July'09) is not an option (excuse the pun).

Hope this helps.

Just found the exact quote regarding Loan Note redemption;

"This can be done on 30th June and 31st December in any year after the first date on which the Loan Ntes have been in issue for 6 months..."

So I make 31st December 2009 the earliest ate for redemption.

Hope this helps.0 -

Cheers for advice mate.0

-

17/05/09

Has anybody been given an update? I notice that my Equiniti portfolio is showing zero yet I have only taken half the money also does anyone have the nessasary forms to cash in the June 30th 2009 available funds?

18/05/09

Today I spoke to a colleague and he had the same issue, he gave me a Corus sharesave helpline to phone, they are sending out an ESOP redemption form for me to complete and they also advised to fill the details in on the rear of the Loan note and sendto Equinity.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards