We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Student Loan - statute barred..?

NeObliviscaris

Posts: 11 Forumite

Greetings one & all, {hope I get this in the right forum}

Have read a few threads and think I see what the situation is and how to react, but figured I may as well make sure. Brevity is not generally my strong point, but I will attempt to be concise.

Just returned from vacation to find not one, but two letters from CSL (Credit Solutions Ltd, of Brighton)... on my doormat, concerning a Student Loan from around 1991/1992. The most recent one mentioned that they are going to send their agents to visit my address to collect any monies owed!

Obviously with such a huge amount of time ago the fact that they are statute barred is more than likely, but I will bore you with some 'background'.

Dealing with matters back in mists of time here but anyway;

- 1999 I moved over to the USA, took a few months to get sorted & out of limbo - but then contacted student loans to say was living overseas, no UK bank account... blah blah blah. Never heard anything further from them.

- 2004 Returned to UK - with events in interim (and having not heard from them) Student Loans never entered my mind.

- Opened new UK bank account and then, after year or so, credit cards.

- Now - 4 years after return to UK, and some 9 years after last communication with the S.Loans company..... these two letters from CSL turn up, the last one with a rather threatening tone regarding this "visit".

To say the letters took me by surprise is an understatement.... :eek:

As I see it they are more than likely on a hiding to nothing and it is statute barred due to time involved..... unless there was a CCJ.... I certainly heard nothing from them at my US address (although I moved after a while), but if they - for whatever mistaken reason - had gone the CCJ route on my last UK address then I wouldnt even know about it. {Hell, I cannot even remember what my previous/last UK address was back in 1999}.

Was planning on running an Experian "free" (sort of) credit report to see if there is any mention of CCJ anywhere (which I think unlikely)... and then just sending out a statute barred letter and tell them not to bother sending any goons round as I will consider it harassment.

But I may be overlooking something, or be on wrong track so thought it best to seek advice of the forum.... so feel free to chip in... but please no moral judgments or comments along those lines. If I wanted that I'd go to a church

thanks.

Have read a few threads and think I see what the situation is and how to react, but figured I may as well make sure. Brevity is not generally my strong point, but I will attempt to be concise.

Just returned from vacation to find not one, but two letters from CSL (Credit Solutions Ltd, of Brighton)... on my doormat, concerning a Student Loan from around 1991/1992. The most recent one mentioned that they are going to send their agents to visit my address to collect any monies owed!

Obviously with such a huge amount of time ago the fact that they are statute barred is more than likely, but I will bore you with some 'background'.

Dealing with matters back in mists of time here but anyway;

- 1999 I moved over to the USA, took a few months to get sorted & out of limbo - but then contacted student loans to say was living overseas, no UK bank account... blah blah blah. Never heard anything further from them.

- 2004 Returned to UK - with events in interim (and having not heard from them) Student Loans never entered my mind.

- Opened new UK bank account and then, after year or so, credit cards.

- Now - 4 years after return to UK, and some 9 years after last communication with the S.Loans company..... these two letters from CSL turn up, the last one with a rather threatening tone regarding this "visit".

To say the letters took me by surprise is an understatement.... :eek:

As I see it they are more than likely on a hiding to nothing and it is statute barred due to time involved..... unless there was a CCJ.... I certainly heard nothing from them at my US address (although I moved after a while), but if they - for whatever mistaken reason - had gone the CCJ route on my last UK address then I wouldnt even know about it. {Hell, I cannot even remember what my previous/last UK address was back in 1999}.

Was planning on running an Experian "free" (sort of) credit report to see if there is any mention of CCJ anywhere (which I think unlikely)... and then just sending out a statute barred letter and tell them not to bother sending any goons round as I will consider it harassment.

But I may be overlooking something, or be on wrong track so thought it best to seek advice of the forum.... so feel free to chip in... but please no moral judgments or comments along those lines. If I wanted that I'd go to a church

thanks.

0

Comments

-

NeObliviscaris wrote: »... but please no moral judgments or comments along those lines. If I wanted that I'd go to a church

Oh, OK then.loose does not rhyme with choose but lose does and is the word you meant to write.0 -

PMSL. sorry not at your situation, but at the comment about church, made me giggle. Hopefully someone will be able to help you when the boards wake up in the morning.

Boo x x xNight Owl Member No 1 :rotfl: :rotfl:

Night owl member of the threesome. Rules are for fools to follow and wise men to be guided by

No Man is worth your tears,

And the one who is wont make you cry !!!!!0 -

Actually that really has tickled me.Night Owl Member No 1 :rotfl: :rotfl:

Night owl member of the threesome. Rules are for fools to follow and wise men to be guided by

No Man is worth your tears,

And the one who is wont make you cry !!!!!0 -

smashedbooboo wrote: »PMSL. sorry not at your situation, but at the comment about church, made me giggle. Hopefully someone will be able to help you when the boards wake up in the morning.

Boo x x x

Well thanks for understanding where I was coming from :j

As you say, maybe someone 'in the know' - with morality circuits by-passed - will be along in the morning! 0

0 -

Depends to some degree what system of loans you were on.

Link: Factsheet | Liability for Debts and the Limitation Act (England/Wales)

May be worth giving National Debtline a call.Student loans

Student loan agreements are simple contracts and this gives the Student Loans Company (SLC) six years from the date you last paid or acknowledged the debt to go to court to enforce the agreement. There are two sorts of student loans and different rules apply depending upon when you took out the loan.

Old style student loans

Old style or 'mortgage' student loans are consumer credit agreements. Payments cannot automatically be deducted from your wages. The SLC has to go to court before they can enforce the debt against you. This means that the Limitation Act can apply if you have not paid or acknowledged the debt for over six years.

WARNING Asking for the loan to be deferred could count as acknowledging the debt and start time running again.

New style student loans

From September 1998 new style or 'income contingent' student loans include rules to say that repayments will be automatically deducted directly from your wages or through your tax return if you are self-employed. This means that the SLC are still allowed to take money from your wages for a loan over six years old as they do not have to go to court to do so

If there is a CCJ, then that will prevent it being time barred.If the creditor has been to court and there is a county court judgment outstanding, then you cannot use the Limitation Act to dispute you owe the debt. It does not matter how many years ago the creditor went to court; the county court judgment will still exist. However, the creditor may not be able to enforce the judgment without the court's permission if the judgment is over six years old.Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Depends to some degree what system of loans you were on.

Link: Factsheet | Liability for Debts and the Limitation Act (England/Wales)

May be worth giving National Debtline a call.

If there is a CCJ, then that will prevent it being time barred.

Thanks for taking the time to respond.

Well I already know it is the old loan - as mentioned, from 1991/92 - and thus treated the same as any other unsecured loan.

And am aware about the CCJ and time barring...... that's pretty much the point I am at.

I didn't receive any communication from them in the US. So no mention of taking to court, or anything else for that matter. But these organisations do tend to be incompetent at times and so if they did try to pursue the court route years ago - via my last UK address - I wouldnt even know about it.

Now I know there is a register of CCJ's and you can pay (£8 I think it is) to search, but I cannot remember the address or area, so that is not practical.... but surely a CCJ would be on my credit report. So my getting a new UK bank account, credit cards etc would not be likely?

I may take up the 'free' Experian credit report thing just to check but, logically, would expect that there is no CCJ relating to the loan and thus a simple statute barred letter should be next course of action.0 -

NeObliviscaris wrote: »Now I know there is a register of CCJ's and you can pay (£8 I think it is) to search, but I cannot remember the address or area, so that is not practical.... but surely a CCJ would be on my credit report. So my getting a new UK bank account, credit cards etc would not be likely?

I may take up the 'free' Experian credit report thing just to check but, logically, would expect that there is no CCJ relating to the loan and thus a simple statute barred letter should be next course of action.

That would apply if a judgment had been obtained in the last 6 years, but a CCJ is only recorded for 6 years after the actual judgment date.

So if a CCJ was obtained before that, then it might not show up.How long is judgment and decree information kept on the Registers?

Judgments and decrees are reported by credit reference agencies and by Registry Trust Ltd for a period of six years from their date of registration.

If you send the statute barred letter, then the onus is then on the creditor to prove the debt is not barred.Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

That would apply if a judgment had been obtained in the last 6 years, but a CCJ is only recorded for 6 years after the actual judgment date.

So if a CCJ was obtained before that, then it might not show up.

If you send the statute barred letter, then the onus is then on the creditor to prove the debt is not barred.

Cheers.... :beer:

I will wing one off in the next day or so... I have a template from another forum. (Although I am sure there is one in this forum somewhere too).

Chances are - given timescale and last communications etc - that the CCJ would have been within 6 years, if at all. And it can never hurt to have a peak at my credit report anyways.... so will still do that.

On a general point in regards to the 'standard' letter informing Debt Collectors of statute barred status... I know there is use of words like "alleged debt" etc.... but how can you send a letter, saying that as far as you are aware the last payment/communication was 6 years ago - without that being a de facto acknowledgement of the debt?

I mean I know, from reading the forum threads, that they do work.... am just curious as to the how.....0 -

Once a debt becomes statute barred it remains so. That means that acknowledgement after the 6 years have passed does not matter.

However, it is always best to word it somewhat like this:1 High Street,

Newtown,

Kent

R21 4RH

Date

The Loan Company

Company House,

Church Street,

Newtown,

Kent,

R1 7HG

I do not acknowledge any debt to you or any other company or organisation that you claim to be representing.

Dear Sir/Madam

Account No:

You have contacted me/us regarding the account with the above reference number, which you claim is owed by myself/ourselves.

I/we would point out that under the Limitation Act 1980 Section 5 "an action founded on simple contract shall not be brought after the expiration of six years from the date on which the cause of action accrued".

I/we would also point out that the OFT say under their Debt Collection Guidance on statute barred debt that "it is unfair to pursue the debt if the debtor has heard nothing from the creditor during the relevant limitation period".

The last correspondence/payment/acknowledgement or payment of this debt was made over six years ago and no further acknowledgement or payment has been made since that time. Unless you can provide evidence of payment or written contact from me/us in the relevant period under Section 5 of the Limitation Act, I/we suggest that you are no longer able to take any court action against me/us to recover the alleged amount claimed.

The OFT Debt Collection Guidance states further that "continuing to press for payment after a debtor has stated that they will not be paying a debt because it is statute barred could amount to harassment contrary to section 40 (1) of the Administration of Justice Act 1970".

I/we await your written confirmation that no further contact will be made concerning the above account and confirmation that this matter is now closed.

I/we look forward to your reply.

Yours faithfully

Mrs A N OtherFree/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Once a debt becomes statute barred it remains so. That means that acknowledgement after the 6 years have passed does not matter.

Havent been online as much - so belated thanks for the above info (and the other info above the above info).... :cheesy:

cheers.. :beer:

Anywhoooooo... by way of an update on proceedings...

I sent off a fairly standard non-acknowledging, "statute barred" letter to the lovely people at CSL on 9th September - letter based very heavily on the one supplied/exhibited above.

I had thought it had worked and the idea had penetrated the cranial mantle of someone at their office as I heard nothing back from them.... until today that is....

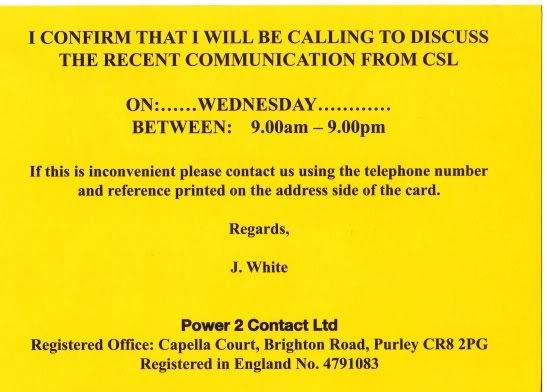

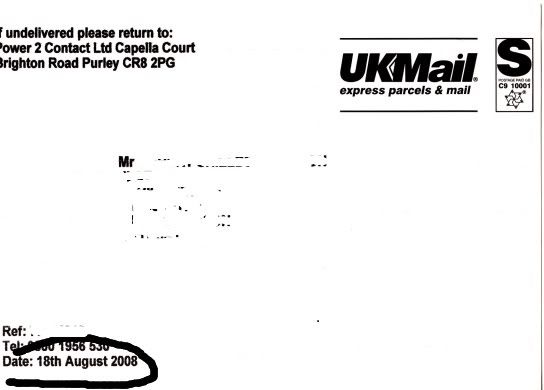

I got in shortly after lunchtime today (Wednesday) to find to find this shocking yellow card with a note saying they would be calling (in person?, by phone??) in order to discuss matters....

Initially I cursed the ignorant morons, but then noticed that the card was date 18th August 2008... so, giving the CSL cretins the benefit of the doubt, was possibly just an earlier part of their attempts that was delivered a tad late.

:rolleyes:

So am, currently, continuing on my assumption that the message may have been received by the CSL drones and that they are not contacting me further....

Time will tell.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards