Predicting stock market returns

Options

IronWolf

Posts: 6,423 Forumite

I read a really good article on this and thought I would share it. Although it is based on US markets I wouldn't be surprised if the same held true here too.

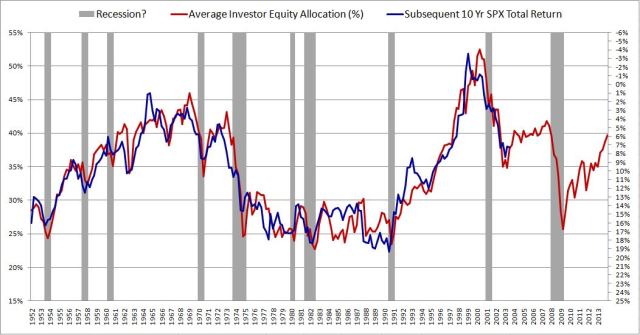

The author found a very strong correlation between stock market returns and the % of private investors assets held in the stock market. This relationship is inverse, i.e. the more investors have in the stock market, the lower future returns will be.

This makes intuitive sense since the less people have invested in stocks, the more money is available to buy stocks in the future and hence push prices higher. But just how closely they follow one another is surprising.

According to the chart, we should expect a 6% p.a. return over the next 10 years from investing in the US index today.

http://philosophicaleconomics.wordpress.com/2013/12/20/the-single-greatest-predictor-of-future-stock-market-returns/

The author found a very strong correlation between stock market returns and the % of private investors assets held in the stock market. This relationship is inverse, i.e. the more investors have in the stock market, the lower future returns will be.

This makes intuitive sense since the less people have invested in stocks, the more money is available to buy stocks in the future and hence push prices higher. But just how closely they follow one another is surprising.

According to the chart, we should expect a 6% p.a. return over the next 10 years from investing in the US index today.

http://philosophicaleconomics.wordpress.com/2013/12/20/the-single-greatest-predictor-of-future-stock-market-returns/

Faith, hope, charity, these three; but the greatest of these is charity.

0

Comments

-

Well the Fed plans to end QE in October, will be interesting what happens then.Faith, hope, charity, these three; but the greatest of these is charity.0

-

-

Glen_Clark wrote: »Errr No.

The Fed plans to stop increasing QE in October.

I thought they were ending it. Currently at about $35 billion per month but to be reduced in increments to zero at October?0 -

I assume Glen means that winding down the asset purchases to zero per month will stop the *increase* of "quantitatively eased" assets. The demand for those assets will then have to come from real people in the markets, rather than just the Fed/ the Government stimulating the demand themselves by buying stuff / bidding stuff up.

But in a sense that doesn't mean QE has "ended" because all the assets are still out there. To properly end the QE and go back to an un-intervened market you would have to reverse it, which is nowhere near being on the table.

You can define these things differently but I think it's pretty reasonable in layman's terms to say the "easing" has stopped when they stop applying artificial pressure to make things easier. If someone is selling an asset, it will have to be met by real demand not fake government demand, and markets will return to a sense of normalcy. However, applying the brakes to stop it running out of control, is different to then putting it in reverse gear and going back down the road in the other direction.0 -

Yes, talking mixed semantics there. Can't see any reversing any time soon.0

-

bowlhead99 wrote: »To properly end the QE and go back to an un-intervened market you would have to reverse it, which is nowhere near being on the table.

Which is absolutely correct of course but in practice the Fed (or the BoE for that matter) does not have to. They ('they' effectively being the countries respective governments) can continue to hold assets which 'they' value at the level required to justify their purchase.

This can be done indefinitely and I imagine probably will be. The overall theoretical effect is to devalue the currency in which they are valued although this will not be easy to measure in practice and in the case of mega-economies such as the US may have no real impact anyway.

For most practical purposes, stopping further purchases under the QE scheme does effectively end QE.0 -

Typical that you start a thread showing how to predict stock market returns and everyone just ends up talking about QE

Faith, hope, charity, these three; but the greatest of these is charity.0

Faith, hope, charity, these three; but the greatest of these is charity.0 -

Also central banks dont really need to 'undo' QE, they can just sit back and wait until the bonds mature. Once they get paid off they just 'unmake' the money.Faith, hope, charity, these three; but the greatest of these is charity.0

-

Very interesting Iron Wolf, thanks.

Anybody know where to find UK data on equity allocations?0

This discussion has been closed.

Categories

- All Categories

- 343.5K Banking & Borrowing

- 250.2K Reduce Debt & Boost Income

- 449.9K Spending & Discounts

- 235.7K Work, Benefits & Business

- 608.6K Mortgages, Homes & Bills

- 173.2K Life & Family

- 248.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards