We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Peer to Peer lending

Comments

-

Broken_Biscuits wrote: »Thanks for the responses regarding P2P. As I pointed out in the opening post, I have a few months to research and then make the right decision. The information about the current accounts is quite readily available to anyone with a spare 5 minutes and an internet connection and so it wasn’t an issue finding that myself... I found researching P2P quite difficult.. the expected returns are there to be seen, but the actual use and mechanics of the system are not so transparent. I feel that I’m in a much better position to make a decision now though so cheers again for the responses. My mortgage rate is 3.5% so it seems to me the wrong decision to hold anything long term in any of the 4 and 3 percent savings accounts (unless I come into considerably more money again of course and it needs a guaranteed safe home) when overpayments would be more of a benefit. I only bought my home in January but have already managed to throw in an overpayment of £3000 before we hit April and plan to get the max 10% off this year. I guess another option would be to overpay another big chunk straight into the new tax year in April if I decide the risk of P2P or any of the other investments on my consideration list are , in my mind, too risky.

I did do a search for peer to peer bad new stories / nightmare/ horror etc. Brings up nothing obvious on google. Can it be true that no one has used peer to peer and come away with a negative result? If you diversify, it seems a fairly safe level of risk. Obviously there is risk, but you have to weigh it up against the around double rates of returns (to say a 3% current account). If I was going to dip my toe in early to get a feel for it, what is the minimum amount you would need to invest to get at least 100 loans covered. Ie, what is the minimum chunk you can loan out. Assuming £10 x100 = £1000. Also Ive read that the best way to stay covered is to have your money split by 200 loans. Is there no auto box to tick that says only lend out 0.5 of total capital to any one loan?

There's some good statistics here

https://www.fundingcircle.com/statistics

I think the risk would be if certain market conditions meant more small businesses started defaulting on their debts (but I imagine the pain would be felt over most asset classes if that were case)

Minimum amount you'd need there would be £2k, with £20 the minimum investment you'd need to cover 100 companies

I heard a quote the other day along the lines of "No one ever got rich investing in savings accounts"0 -

There are shortcomings/risks with any investment of course. My long explanation on that other thread of what risks you might face was really just to point some of them out in context of you perhaps putting 80-90% of your inheritance into 3 providers and wondering if it should be considered "risky". IMHO, yes it is, but that doesn't mean you shouldn't do it with a portion of your wealth if you don't mind some risk.Thanks RF...

There are some shortfalls - pointed out by bowlhead99 in the '200k inheritance. What to do?' thread that I have just responded to.

I think that I will have a dabble in the P2P markets, however, I shall perhaps moderate any investment, and not risk being caught with my pants down.......... in the financial sense.

Unsecured lending to a bunch of individuals via a privately-owned middleman is inherently risky, even if the individuals are a diverse bunch of people and the middleman has been established for decades. Given Fundingcircle and Ratesetter only launched in 2010, other things to note would include:

a) they and their borrowers have only been carrying on these activities in the "coming out of recession" era, where it is cheap and easy to refinance, rather than the "going into a credit crunch and recession" era where it isn't;

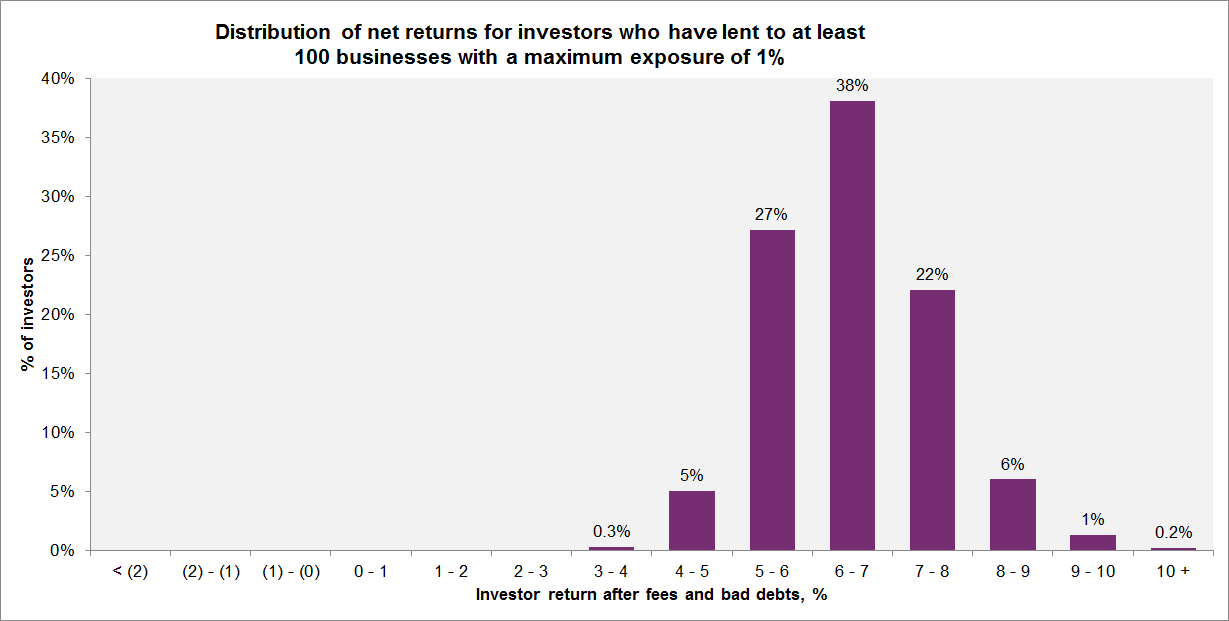

b) the average rates for their historic loans achieved via their website going back to 2010 are likely higher than current levels achieved by a new lender for the same level of risk today. So, the graph of average returns for people with 100 borrowers, shown in the graph above, does not mean most people would get 6-8% today. Also it doesn't tell you what risk bands they selected to get those returns or what returns they originally hoped to get before winding up with the 6.01% that nicely gets called "6-8%".

c) if they launched in 2010, then nobody has yet paid back a five year loan in full, except for those who deliberately gave back the money a bit early, causing the lender to need to redeploy the money at lower rates for a longer remaining term. So, while FCA regulation of the sector is good news, you don't have a great track record to rely on.

So, to me it's a bit different to a standard "bond ladder" (using listed bonds that could be sold in an emergency when you wanted to, even if that wasn't your plan). And it's certainly a tick up the risk scale from depositing with a bank, where the bank or FSCS take all the risk. You just need to decide if the reward is enough for the extra risk.

I'm currently not invested in p2p but I'm not against the whole idea of it.0 -

bowlhead99 wrote: »There are shortcomings/risks with any investment of course. My long explanation on that other thread of what risks you might face was really just to point some of them out in context of you perhaps putting 80-90% of your inheritance into 3 providers and wondering if it should be considered "risky". IMHO, yes it is, but that doesn't mean you shouldn't do it with a portion of your wealth if you don't mind some risk.

Unsecured lending to a bunch of individuals via a privately-owned middleman is inherently risky, even if the individuals are a diverse bunch of people and the middleman has been established for decades. Given Fundingcircle and Ratesetter only launched in 2010, other things to note would include:

a) they and their borrowers have only been carrying on these activities in the "coming out of recession" era, where it is cheap and easy to refinance, rather than the "going into a credit crunch and recession" era where it isn't;

b) the average rates for their historic loans achieved via their website going back to 2010 are likely higher than current levels achieved by a new lender for the same level of risk today. So, the graph of average returns for people with 100 borrowers, shown in the graph above, does not mean most people would get 6-8% today. Also it doesn't tell you what risk bands they selected to get those returns or what returns they originally hoped to get before winding up with the 6.01% that nicely gets called "6-8%".

c) if they launched in 2010, then nobody has yet paid back a five year loan in full, except for those who deliberately gave back the money a bit early, causing the lender to need to redeploy the money at lower rates for a longer remaining term. So, while FCA regulation of the sector is good news, you don't have a great track record to rely on.

So, to me it's a bit different to a standard "bond ladder" (using listed bonds that could be sold in an emergency when you wanted to, even if that wasn't your plan). And it's certainly a tick up the risk scale from depositing with a bank, where the bank or FSCS take all the risk. You just need to decide if the reward is enough for the extra risk.

I'm currently not invested in p2p but I'm not against the whole idea of it.

Thanks bowlhead99 - more wise words, that I will pay due heed to.

Our very own advocate and guardian (Martin) has himself had a dabble in the various markets and, to date at least, seems to have a favourable (if cautious) opinion – which gives me some confidence.

I did remember looking at P2P about a year/18 months ago, but dismissed it as a rather new and relatively untested scheme. However it would appear that there are some safety nets (protection funds) incorporated within the various schemes and I thought I read that they were seeking FSC recognition also – which may indicate that they are trying to establish the format.

I’ll need to perhaps have a small (short term) investment and watch the outcomes, before gaining the confidence to dip my toe deeper.

So, with my remaining inheritance – any good guidance as to where/which investment bonds I should look at …? I should say that I am fortunate enough not to need this money in the next 5 years.0 -

bowlhead99 wrote: »So, to me it's a bit different to a standard "bond ladder" (using listed bonds that could be sold in an emergency when you wanted to, even if that wasn't your plan). And it's certainly a tick up the risk scale from depositing with a bank, where the bank or FSCS take all the risk. You just need to decide if the reward is enough for the extra risk.

I'm currently not invested in p2p but I'm not against the whole idea of it.

Well you can sell loans back on the marketplace - other investors simply pick up loans which are already into their repayments

The only real difference I'm noticing with a bond ladder is that it would only take one default on a £15k bond ladder to wipe out a few year's earnings

Good point on how they may function in recessions, but I believe P2P lending's been around since 2005, with Zopa, so presumably the model's somewhat battle-tested ... My biggest cause for pessimism is simply that supply and demand brings loans down to savings account levels0 -

You'd expect it to fall, other things being equal, if gov't let you put it in ISAs. Not only greater admin cost for the provider but also demand by lenders which will spill over to people running non ISA versions of the account - all competing for same pool of loans, they accept lower yield. Same if high interest bank accounts dry up as market rates increase generally - more people seeking yield would fund into the p2p market.Ryan_Futuristics wrote: »My biggest cause for pessimism is simply that supply and demand brings loans down to savings account levels

You would assume the p2p guys can't lend out massively more efficiently than the biggest traditional banks so while they may still have an edge in terms of their lower cut, the increasing consumer demand (and perhaps overseas consumer demand, or private fund investor demand) to place money into this market will reduce returns so that they simply reflect a risk premium over a bank deposit rather than something really special and innovative as they perhaps once were.0 -

That's pretty much how I'd see it going (although maybe with business-specific P2P lending it may be more comparable to the high-yield bond market ... in which case you could envisage both sitting side-by-side and favouring different markets - the rates rise will presumably dampen enthusiasm for P2P lenders as it will bonds)

The way I'm seeing it, if you can get 5 years out of P2P lending, bonds should be on the way to looking good value again0 -

I've been in p2p for about a year, with thin cats, and I'm very happy with it. My return so far has been 9.3% after one default in that time. You have to put at least 1000 into each loan you go for, so you need a fair sum in there to get the risk sufficiently spread.0

-

Ryan_Futuristics wrote: »It's the 7% from Funding Circle that makes me think it's worth the effort

Very simply rate correlates to risk.

Short dated Gilts currently yield less than 1% to maturity.

That puts into perspective the potential downside.0 -

Thrugelmir wrote: »Very simply rate correlates to risk.

Short dated Gilts currently yield less than 1% to maturity.

That puts into perspective the potential downside.

Hmm, I think that's a step too much simplification. The return also reflects the relatively small market, so that it's effectively not available to the big pension fund investors who use short dated bonds extensively in lifestyling. Also, they're less liquid, not well understood, quite new and for all these reasons, as well as a risk element, they have higher returns.0 -

quotememiserable wrote: »not well understood,

What is there to understand in terms of the product? I simplified my comments. As that reflects the nature of many investors. Chasing yield (jam today) and risking capital. What investors need to understand is the nature of the borrowers that are forced to use P2P. For any sound business there's cheaper sources of finance available.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards