We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Should I Balance Transfer??

Comments

-

Can go one better

You can download the file from

You can download the file from

http://www.yourfilehost.com/media.php?cat=other&file=calcs.xls

EDIT: Don't right-click and Save Target as the site suggests. Just click on the Download calcs.xls and save from there."A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

it's blocked at work

doh 0

doh 0 -

would someone be kind enough to paste the formula from the interest column

0

0 -

All it's doing is multiplying the OPENING amount by the RATE and rounding it

=ROUND(B19*C19,2)

Except for the 3rd part where it's working out the 5% fee on the opening balance

=I19*5%where the opening balance is the maximum you can BT=3000*95%

"A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

Sorted

Canny, do you know if the interest is charged per month, or per day? would it be better to work out 365th of the interest then multiply it by how many days are in that month? Just so its as correct as possible?0 -

Hmmm Canny, the sums dont add up according to your spreadsheet

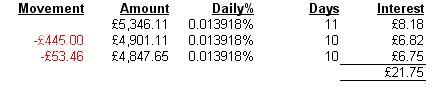

My Balance last month closed at £5346.11, with a minimum payment (not yet cleared) of £53.46

I paid an extra £445 which has cleared

I now have a balance of 4901.11

Once the DD has cleared of £53.46 I will have a balance of £4847.65

But according to your spreadsheet my APR would have to 0% to achieve this figure?

Is it possibly as the charged interest has not been added to my balance yet? (I'm not sure if it has been yet)0 -

geordie_ben wrote: »Sorted

Canny, do you know if the interest is charged per month, or per day? would it be better to work out 365th of the interest then multiply it by how many days are in that month? Just so its as correct as possible?

It is calculated daily and applied monthly - that's why it's best to pay as much as you can as early as you can. The interest calculation in the spreadsheet is based on the statement balance being £4901.11 - if you change it to £5346.11 and change the payment amount then it'll be closer. To get it exactly then you'd need to break the interest down to a daily level

For comparing the two scenarios you don't need that degree of accuracy so long as you keep your calculations consistent between them. But if you were wanting to check an interest calculation then you'd be taking it down to a daily level. Remember that APR is compounded interest, so 5.2% APR is equivalent to an annual rate of 5.08%. You could divide this by 365 and work it out that way."A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

I think I'll just stick with the your original figures, might have play when I find out what day the interest gets applied. They very sneakily take the DD out during a window of time, they say no earlier than the Xth and no later than the xth of the month but I'll see what I can come up with

Thanks for your help CannyJock!0 -

Bah humbug.

Had to kill the time waiting on my lasagne cooking

http://www.yourfilehost.com/media.php?cat=other&file=monthlyinterest.xls

Fill in the APR and the amount from your last statement. Start the first row of dates with the date from your last statement and list any other movements. It'll work out the uncompounded daily rate, the number of days and do it for you.

Try it with a previous statement to see if the interest agrees. PM me if it needs tweaked - can't check it against my own statements because I don't pay interest "A child of five could understand this. Fetch me a child of five." - Groucho Marx0

"A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

Canny, what should show in the Nominal cell? it's coming up with #NAME? at the moment, I've input the APR and the statement amount0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards