We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Planning ahead

Escapar2020

Posts: 136 Forumite

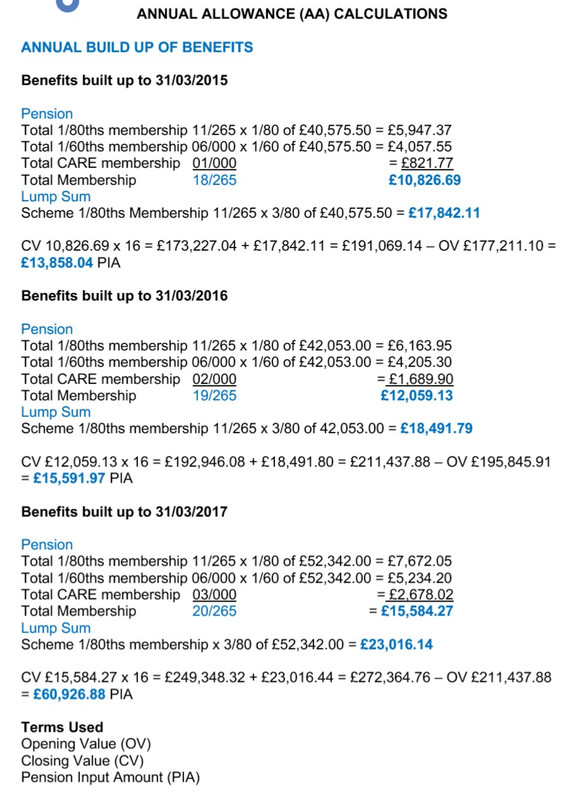

As part of trying to calculate, my net worth, I asked my scheme what my pension is worth, this is what they sent me. I find stuff like this like another language! I hope someone here can help me translate the key points into plain English? What would you highlight? And I'm still not sure which figure is my pension value!?

I’m 45 now and in the LGPS. I'm hoping to change career in the next couple of years for a better work life balance, which will probably mean a much smaller salary. Long-term, I’d like to be more financially independent and possibly retire early, I think I could start drawing this pension from 55, I certainly can't stay in this job to 67!

0

Comments

-

Basically, there is no pot of money to value, just a set of guaranteed pay outs at scheme age.

For the purposes of convenience, do 20X the pension amount.0 -

As part of trying to calculate, my net worth, I asked my scheme what my pension is worth, this is what they sent me.

Your type of pension is not money purchase. It does not have a pot. It is a defined benefit scheme. It pays you defined benefits at retirement.And I'm still not sure which figure is my pension value!?

Your pension value is nil as there is no pension value. Clearly it has value in respect of what it does and will provide but it does not have a capital value.

In which case, your net worth is not what you should be looking at. For example, your main residence is not going to provide you an income. But it is in your net wealth. If you are looking at income then you look at income provision and the assets that can provide that income.I!!!8217;d like to be more financially independent and possibly retire early, I think I could start drawing this pension from 55, I certainly can't stay in this job to 67!I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

http://www.nottspf.org.uk/media/124525/active-members-guide-2017.pdf

Does your own LA produce a similar leaflet?0 -

Basically, there is no pot of money to value, just a set of guaranteed pay outs at scheme age.

For the purposes of convenience, do 20X the pension amount.

20 x pension plus automatic lump sum (from pre 2008 service).

Note this is just a notional value. Actual CETVs for transfer out/divorce etc are calculated using different factors and take into account your age and service etc.

OP - if you take your pension at 55, you will take a considerable hit in respect of the early payment reduction - likely to be as high as 50%.0 -

The LGPS is a DB scheme so no pot of money just entitlement to pension linked to salary and number of years contributions. It looks confusing because the scheme has changed the way it calculates benefits a number of times in recent years.

I am drawing my pension on my LGPS and there is online access to calculators telling you what you would get at retirement and also if you deferred it so you can work out what to aim for. You can draw it from 55 but obviously it is reduced if taken before Normal retirement date.

From the 2017 statement it looks like if you carry on until your normal retirement date (NRD) you will get £15584 pension per annum based on contributions to date. The lump sum is £23016. Obviously if you continue to work for the LGPS this figure will go up each year. Even if you don't I think there is some index linking if you decide to defer. It looks like you have just over 20 years service within the scheme. The hit will be considerable though as I guess if you go at 55 your normal retirement age is probably 68 so 13 years early will mean considerable reductions.

My suggestion would be that you look at your overall savings position and maybe look into a few options. DH and I retired at 58 but I went part time about 8 years before retirement. You need to first of all decide what level of income you will need and don't forget for most of us there is no mortgage if repaid by then and you wont have NI to pay on a pension and tax will be reduced considerably.

We used a three way plan to reach our early retirement goals. First we overpaid our mortgage to get it repaid before retirement.

Second we overpaid our pensions, my DH was putting in 10% and his employer put in 20% for just over 8 years as a sweetener for them moving from DB pension to DC pension. The LGPS has an AVC scheme with prudential which you can overpay into or you could do as I did and up your contribution limit which is probably somewhere around 6% or 7% and that will get you added years so if you go early and take a hit it won't have as big an impact.

Thirdly and this is where you could probably have the most impact you can open a personal SIPP which you can access from 55 and leave your LGPS untouched for a few more years so it wont be as massively reduced by taking it early. A SIPP is an investment vehicle so you are effectively investing monthly or annual amounts and these are linked to investment growth.I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Save £12k in 2026 Challenge £12000/£2000

365 day 1p Challenge 2026 £667.95/£110

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php0 -

Escapar2020 wrote: »As part of trying to calculate, my net worth, I asked my scheme what my pension is worth, this is what they sent me. I find stuff like this like another language! I hope someone here can help me translate the key points into plain English? What would you highlight? And I'm still not sure which figure is my pension value!?

Your 'pension value' could mean lots of things. The administrator has taken one of them, viz., its value for 'Annual Allowance' (AA) purposes. The Annual Allowance is one of the mechanisms for limiting tax relief on pension contributions, and the statement shows that your big pay rise (promotion?) in presumably April 2016 meant you went well over the AA limit for 2016/17. However, simplifying slightly, AA rules mean you can go back three years and roll forward unused allowance from them, so it looks like you're fine.

Some other definitions of 'pension value':

- For 'Lifetime Allowance' purposes (another sort of tax relief limit) - on retirement, this will be your annual pension x20 + lump sum + value of any DC pension pots you have. Lifetime Allowance rules are very favourable to DB pension holders however, so while you need to be aware of it, the LA is not very interesting for considering the 'value' of your LGPS pension for anything else.

- For commutation purposes to get a bigger tax free lump sum on retirement: £1 of pension = £12 of lump sum. The 12/1 ratio intentionally 'undervalues' the pension however (it was introduced a decade ago as a small cost saving measure).

- For purposes of transferring out: a 'cash-equivalent transfer value' (CETV) is calculated according to a complicated formula. Will very likely only make sense to transfer out (if at all) once you've exited for a private sector employer (or self-employment), and have a special reason to forgo the guaranteed income of the LGPS pension.

- For income-in-retirement planning: trivially, the pension due in today's money at NRA, which at moment stands at over £15.5 per year + a tax free lump sum of £18.5. There is a slight complication in the fact different parts of your pension have slightly different NRAs, but I wouldn't get overly bothered about that.

- For looking-for-a-new-job planning: go back 25 years, and occupational pensions across a large part of the private sector were not so different to the LGPS of the time. In fact, someone not so far from your current level but in a large private sector company might be eligible for a special 'executives' section that would make senior council officers jealous. With the collapse of private sector DB that is no longer the case - as a finger in the air, you might consider your LGPS eligibility to be equivalent to (say) 30% DC pension contribution.I!!!8217;m 45 now and in the LGPS. I'm hoping to change career in the next couple of years for a better work life balance, which will probably mean a much smaller salary. Long-term, I!!!8217;d like to be more financially independent and possibly retire early, I think I could start drawing this pension from 55, I certainly can't stay in this job to 67!

Rather than looking to draw the LGPS pension at 55, it might be better to open a personal pension (sooner rather than later) and then draw from that at 55 to at least delay drawing the LGPS pension early.0 -

Rather than looking to draw the LGPS pension at 55, it might be better to open a personal pension (sooner rather than later) and then draw from that at 55 to at least delay drawing the LGPS pension early.

I completely agree with all the above posters who recommended this option. A DB pension is too valuable to reduce it so heavlily by taking it 10 years or more early. If you are of ill health, and have no spouse to inherit consider transferring out of the LGPS once you have stopped working for them.0 -

Thanks everyone. I should achieve mortgage neutrality next year all being well, so will have some spare income that I!!!8217;ll look at putting into a personal pension. I expect (and hope) to change job for a different way of living once the mortgage is clear, which will probably mean I'll have less spare income for the pension.

One response noted my large salary increase. I've been trying to understand this as it didn't feel that large, going from 44k to 53k, and paying more tax. I still don't understand the large variations in annual allowance /pension input amounts. Do I need to be able to understand them!?0 -

Did you make any other pension contributions in the last four tax years?

I'm asking because 60,926.88 PIA appears to show that last year you exceeded the 40,000 annual allowance. You can carry forward unused allowance from the previous three tax years so there's no problem now unless you made other pension contributions.

You should start to record these PIA numbers and if you can, get the one for 31/3/2014. If you continue to see numbers like that you'll need these numbers to work out how much annual allowance was available from past years and whether you have an annual allowance charge to pay.

If you want a more accurate net worth ask for a CETV.0 -

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards