Smi/interest only mortgage

Options

whits_end_lass

Posts: 10 Forumite

20 years ago, when times were good, and both myself and my husband were working full time, we decided to buy a do upper 2 bedroom bungalow to live in . We had a regular repayment mortgage at the time. However a few years later, we took out a remortgage to carry our serious repairs that needed doing in the property. The broker at the time said that we should do an Interest only Mortgage and carry out an ISA alongside for when the term of the mortgage ended. As fate would have it, my husband fell ill with a Parkinson's related disease, and had to stop work as a result. I still worked full time whilst looking after him, to maintain the mortgage payments and bills. However his illness got worse, and a s a result I had to stop working to and become his carer.

The recent changes in the DWP house/mortgage payments, as a Loan, is fundamentally a major ticking time bomb

We have four years to run on our mortgage with no assistance from the Mortgage company who insist we cant 'remortgage', just to extend the timescale, because we are on benefits, and we wouldn't be able to have another interest only mortgage anyway.

Contact the DWP, and they have stated that its down to Serco, contact Serco and they say we should speak to the DWP, contact the original Mortgage firm , and they state that they cant advise, and contact shelter or Citizens advice.

Both of these state that as there is no Equity in the property that they would be unable to really help with a way forward. Even the ombudsman have no complaints process to bring this to any sort of end. Apart from handing over my keys to whomever gets my house first , I am at a loss. Any ideas anyone?????

The recent changes in the DWP house/mortgage payments, as a Loan, is fundamentally a major ticking time bomb

We have four years to run on our mortgage with no assistance from the Mortgage company who insist we cant 'remortgage', just to extend the timescale, because we are on benefits, and we wouldn't be able to have another interest only mortgage anyway.

Contact the DWP, and they have stated that its down to Serco, contact Serco and they say we should speak to the DWP, contact the original Mortgage firm , and they state that they cant advise, and contact shelter or Citizens advice.

Both of these state that as there is no Equity in the property that they would be unable to really help with a way forward. Even the ombudsman have no complaints process to bring this to any sort of end. Apart from handing over my keys to whomever gets my house first , I am at a loss. Any ideas anyone?????

0

Comments

-

Why is there no equity? Property values have been increasing in virtually all areas compared to 20 years ago. Even with an interest only mortgage, you should see some gain.

For mortgage options it would be helpful if you were willing to post the mortgage size and current value.I'm a Forum Ambassador on The Coronavirus Boards as well as the housing, mortgages and student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

It's a fair point from silvercar - 2 bed bungalows are very highly sought after in just about every area of the country, and you've put an entire remortgage into doing it up. It beggars belief your property isn't worth more than it was 20 years ago - where are you in the country?0

-

The bungalow/dormer was bought for 100000k, a remortgage to sort out dodgy gas and electrics, and a new roof. Bathroom updated, new windows. The existing mortgage is 140000k. The current value is 140000. Living in South Wales, this is a norm. House prices do not rise if there is no employment in the area.

I was even told to move to a smaller house ( than a 2 bedroomed bungalow). At 60 years of age I do not want to have to carry out another doer upper, because that would be all we could get for less than 140000.0 -

I also cannot believe that we are the 'only ones'. Thus the Ombudsman has no 'complain procedure'. Surely there are other people living in the UK with interest only mortgages, that are due to end and have the unfortunate and degrading experience on having to rely on benefits to survive, through no fault or choice of their own. Who do they contact?0

-

How much have you got in the ISA?0

-

Have you been putting money into an ISA? My guess is that you stopped doing that when your husband become ill. If you couldn't afford to pay the I/O mortgage and continue to pay into an ISA then you wouldn't have been able to afford the monthly payments for a repayment mortgage either.0

-

Note: I am responding with all emotion removed. This may seem cold to some but I am focusing on the issues rather than waste text on wrapping it up in cotton wool. It is not written with any intention of being cold. Text can just look that way sometimes when you remove the wishy washy.Even the ombudsman have no complaints process to bring this to any sort of end.

The complaints process exists and is defined and the ombudsman is part of it.

I suspect its more a case that there is no wrongdoing here and no case to be answered.The bungalow/dormer was bought for 100000k, a remortgage to sort out dodgy gas and electrics, and a new roof. Bathroom updated, new windows. The existing mortgage is 140000k. The current value is 140000.

So, you used the equity in the property as a cashpoint machine.I also cannot believe that we are the 'only ones'. Thus the Ombudsman has no 'complain procedure'.

You are not. There are a few million others on interest only mortgages. However, there is nothing wrong with having an interest only mortgage. If you went into it with your eyes wide open and the sale was compliant then there is no case to answer.

Its not as if you cant say you didnt know it was interest only. It has one of the most sensible product names you can get.that are due to end and have the unfortunate and degrading experience on having to rely on benefits to survive, through no fault or choice of their own. Who do they contact?

Broadly speaking, the mortgage balance minus the value in the ISA will be in the same sort of ballpark as what you would have had if you had a repayment mortgage. So, where is the ISA money?

In life you make choices. Sometimes with hindsight, the wrong choices. You then suffer negative events. However, the consequences of those are often linked to choices. For example, your husband fell ill. If you had chosen to take out insurance to cover illness then the money situation would not be a problem. if you chose to not pay the premiums each month and spend it instead then that is a choice. Most people will get away with that choice but the minority that suffer a claimable event will not.

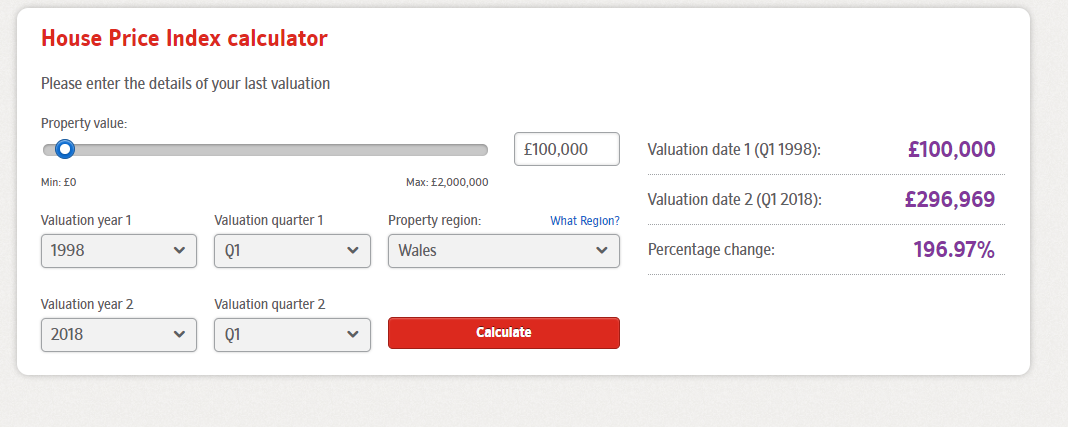

You bought a property that appears to have been substandard and borrowed again multiple times to spend on that property despite that. £100k in 1998 was twice the average house price in Wales. House prices in Wales have not been great over the last 10 years, only recently recovering to pre-credit crunch levels. However, a typical £100k house in Wales bought in 1998 would be worth £300,00 today. you say yours is worth less than half that.

You dont get compensation for making the wrong choices. However, you do get benefits to help.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

This is what beggars belief:

https://www.nationwide.co.uk/about/house-price-index/house-price-calculator

Put in all your numbers - Wales, 1998, 100,000

So your numbers don't make sense - especially if you bought in a town like Cardiff, Newport, Swansea etc. If you bought rural then £100,000 would have got you a palatial 3 bed bungalow not a 2 bed doer-upper.0 -

Thank you to everyone for your replies.

In particular Dunstonh.

As It seems you live in Norfork, I fail to see how you would have any knowledge of House prices in Wales whatsoever. Unless of course you are a property magnate , In which case, you really shouldn't be commenting on any post with your IFA 'wisdom', as it would only benefit other property magnates. Reading the other threads in this site it is clear that most people want to save money, and not advise people how they should have spent it . Whether it be now or 1999. Furthermore, you buy a house for lots of reasons; Near to work, near the motorway, near your children. In our case it was all three. Hindsight is a fantastic vehicle for some people to ride, however, the reality is I am not complaining about it, I was simply asking if anyone else was in the same predicament. Clearly; you are NOT0 -

So how much is in the ISA then?0

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608.1K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards