We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help me with my Defence PLZ!!

crxvt

Posts: 28 Forumite

Hey MSE appreciate some guidance and help on my issues! I have not received a claim form. I have just completed the AOS and now I need help building a defence.

How I have got here:

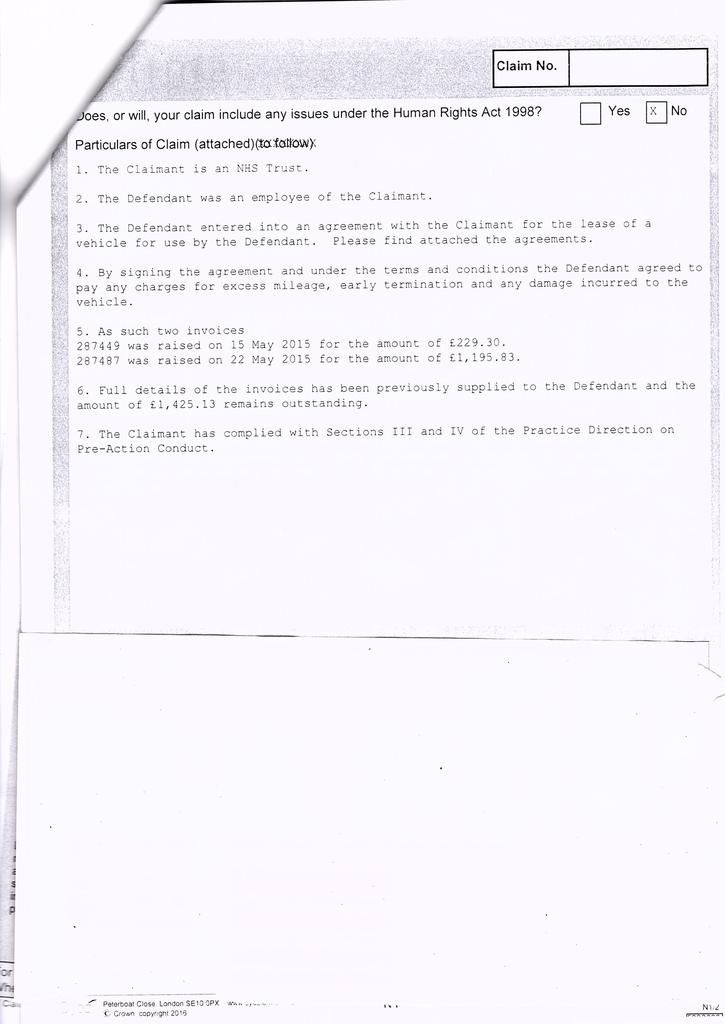

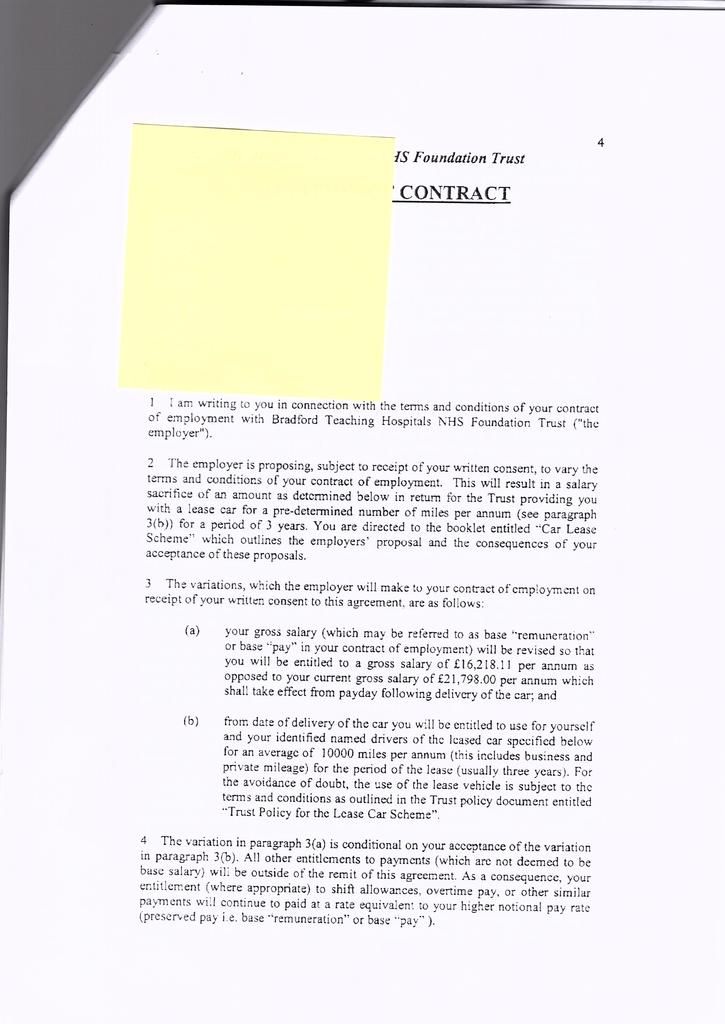

I am currently being chasedfor outstanding moneys for a vehicle i had on lease from a Hospital Trust. I was an employee of the trust and had a car on a Salary Sacrifice Scheme. There are two outstanding invoices that i am being chased for - early termination and mileage.

Now i though i had dealt with this issues years ago when i was in conversation with a NHS finance department worker and after i had sent him everything i never heard back. and now some years later I am in the same position I was in. unfortunately i do not have any evidence of this.

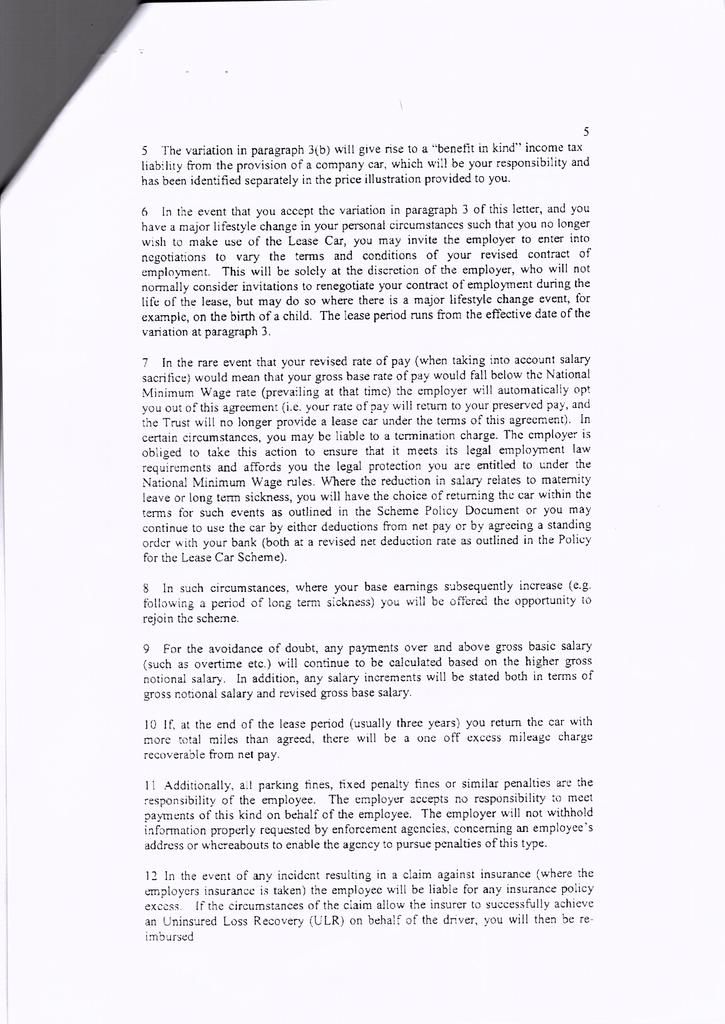

I disputed the charges because part of the charges being sanctioned on me was when i did not have the vehicle and it had already gone back to the supplier. The other part of the charges i disputed as I was off sick from work and then my contract was terminated without me present as they would not re-arrange. therefore I put the onus on the hospital for the reason i could not complete the term of the car lease making any charges void.

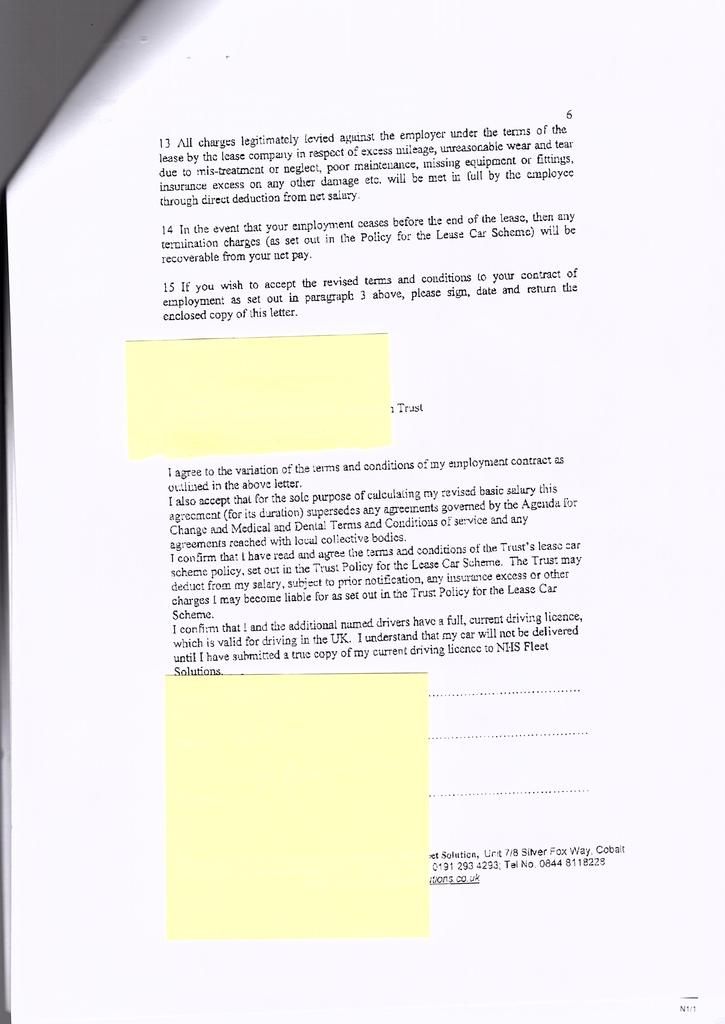

I have had a look at the agreement form I signed back in 02/2011 and under the declaration it says

'I understand that the car will be ordered on my behalf and I shall be bound to the scheme until the contract formally expires or my employment with the employing organisation ceases'

The information provided by the claimant shows an invoice from 2015 that they have been chasing the debt from, however the car was returned and my contract terminated in June 2012. If that's the case and as the amount of debt is under 2K would I still be potentially able to get the debt Statute barred?

Would appreciate some guidance on this please!

Thank you!

How I have got here:

I am currently being chasedfor outstanding moneys for a vehicle i had on lease from a Hospital Trust. I was an employee of the trust and had a car on a Salary Sacrifice Scheme. There are two outstanding invoices that i am being chased for - early termination and mileage.

Now i though i had dealt with this issues years ago when i was in conversation with a NHS finance department worker and after i had sent him everything i never heard back. and now some years later I am in the same position I was in. unfortunately i do not have any evidence of this.

I disputed the charges because part of the charges being sanctioned on me was when i did not have the vehicle and it had already gone back to the supplier. The other part of the charges i disputed as I was off sick from work and then my contract was terminated without me present as they would not re-arrange. therefore I put the onus on the hospital for the reason i could not complete the term of the car lease making any charges void.

I have had a look at the agreement form I signed back in 02/2011 and under the declaration it says

'I understand that the car will be ordered on my behalf and I shall be bound to the scheme until the contract formally expires or my employment with the employing organisation ceases'

The information provided by the claimant shows an invoice from 2015 that they have been chasing the debt from, however the car was returned and my contract terminated in June 2012. If that's the case and as the amount of debt is under 2K would I still be potentially able to get the debt Statute barred?

Would appreciate some guidance on this please!

Thank you!

0

Comments

-

If you haven't made a payment since June 2012 or acknowledged the debt in writing, then the claim would be statute barred if started after June 2018, as it sounds it was.

In that case you can just state the exact date the contract was terminated and say that the claim is statute barred under the Limitation Act 1980, section 5.0 -

If you haven't made a payment since June 2012 or acknowledged the debt in writing, then the claim would be statute barred if started after June 2018, as it sounds it was.

In that case you can just state the exact date the contract was terminated and say that the claim is statute barred under the Limitation Act 1980, section 5.

Agree with the big man here.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

i though i had dealt with this issues years ago when i was in conversation with a NHS finance department worker and after i had sent him everything i never heard back.

How many years ago did your conversation with the NHS finance department about this debt take place?

How long ago did you “send them everything” in relation to this debt?

Would this have been after your last payment in June 2012?

What is the claim Issue Date?

Di0 -

How many years ago did your conversation with the NHS finance department about this debt take place?

How long ago did you “send them everything” in relation to this debt?

Would this have been after your last payment in June 2012?

Di

What is the claim Issue Date?

Hi, yes the last conversation took place after June 2012, where I refused to pay for the above reasons. However I have no evidence of this!

The claim issue date is: 01/10/2018

Thank you.0 -

What is the claim Issue Date?

Hi, yes the last conversation took place after June 2012, where I refused to pay for the above reasons. However I have no evidence of this!

The claim issue date is: 01/10/2018

Thank you.

Refer to post #2# for your defense.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

yes the last conversation took place after June 2012, where I refused to pay for the above reasons.

The claim issue date is: 01/10/2018

I asked the question to see whether you may have acknowledged the debt in writing after June 2012 which may impact on the Statute Barred argument.

You posted earlier that you had a conversation with the finance department in June 2012 and then sent them some documents afterwards. If that written acknowledgment (if it was an acknowledgment) was sent before 1st October 2012 then you should be okay.

However, I always think you need to plead more than one argument in a Defence in case the DJ isn't persuaded by just the one you present them with. I don't know when or whether the contract was defaulted.

You've referred to the claim being in relation to an invoice for excess milage so the Claimant would have to prove that. Can you remember what was in the contract about potential excess milage charges such as xx pence per mile?

Under CPR 31.14 you can ask the Claimant to produce documents mentioned in the Particulars of Claim. I don't know what they've pleaed but you could ask them for the contract and documentary evidence of the excess mileage amount and how it was calculated etc.

That might give you two arguments to go into battle with

Di0 -

There are two outstanding invoices that i am being chased for - early termination and mileage.

. . . . conversation with a NHS finance department worker and after i had sent him everything i never heard back.

I disputed the charges . . .

. . . . . the claimant shows an invoice from 2015 that they have been chasing the debt from

One more quick question (sorry ) if you can't remember exactly when you last corresponded with the finance department, might it have been in response to the invoice sent in 2015?

) if you can't remember exactly when you last corresponded with the finance department, might it have been in response to the invoice sent in 2015?

Di0 -

I asked the question to see whether you may have acknowledged the debt in writing after June 2012 which may impact on the Statute Barred argument.

You posted earlier that you had a conversation with the finance department in June 2012 and then sent them some documents afterwards. If that written acknowledgment (if it was an acknowledgment) was sent before 1st October 2012 then you should be okay.

However, I always think you need to plead more than one argument in a Defence in case the DJ isn't persuaded by just the one you present them with. I don't know when or whether the contract was defaulted.

You've referred to the claim being in relation to an invoice for excess milage so the Claimant would have to prove that. Can you remember what was in the contract about potential excess milage charges such as xx pence per mile?

Under CPR 31.14 you can ask the Claimant to produce documents mentioned in the Particulars of Claim. I don't know what they've pleaed but you could ask them for the contract and documentary evidence of the excess mileage amount and how it was calculated etc.

That might give you two arguments to go into battle with

Di

Apologizes for the late reply, So many things going on right now my head is all over the place.

Massive thank you for you help so far.

Yes that is correct had been in contact with the Finance department back then however i have No proof of this. but it is realistic they would have chased me for it as its part of their process.

Please see the contract attached, i guess possibly we could have one more argument.

The last response was certainly not in 2015. The Trust randomly sent me invoices and they have picked one up that was sent in 2015 i guess.

Please see the original contract and the allegations out forward by Optima legal

0

0 -

If there was a contractual term requiring some action before they could start a court claim, then time would start running from that point.

In the famous case of BMW v Hart this was referred to as a 'second condition precedent'. If there was no such contractural term then the earlier case of Reeves v Butcher applied, where time starts running from the default of payment.14.The judge's decision was founded on the case of Reeves v Butcher [1891] 2 QB 509, a decision in this court. The judge considered that the decision in that case was that where a contract provides for two condition precedents, as in this case there was first of all a condition precedent of a default of payment, which set out a second condition precedent for the service of a termination notice, entitling a claimant to claim the termination payments, time began to run from the time that the first condition precedent was made, rather than from the time when the second condition precedent was fulfilled, on the theory that time started to run when the claimant was put in a position where he was entitled to avail himself of the fulfilment of the second condition precedent even if he had not yet done so. In this connection, the judge considered that one reason for that rule was that, otherwise, a claimant could postpone the running of limitation by failing to act on his entitlement. The judge said in terms that Reeves v Butcher was an exact parallel to the present case, and that he was bound by that decision. Subsequently, in considering the question of permission to appeal, the judge in the final paragraph of his judgment said both that he would not grant permission to appeal, because it seemed to him that the decision he had made was absolutely correct, given the decision of this court in Reeves v Butcher, but on the other hand he felt a bit of concern about the decision, and wondered whether in due course it would be thought right by some senior court to give permission, so that the Court of Appeal could look at the matter for itself.

I can't see any such term that would allow them to wait 3 years before issuing an invoice, then claim time started running when they issued the invoice.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards