We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Marriage Transfer Allowance flip-flopping

HugoFS

Posts: 12 Forumite

in Cutting tax

In 23-24, circumstances were such that Mrs F-S was able to transfer 10% of her income tax allowance to me. I understand that in HMRC parlance, she was the claimant.

For 24-25, the situation was reversed and I have just sent off form MATCF to HMRC to ask retrospectively for me to transfer 10% to Mrs F-S. But I note from elsewhere on the forum that this may not be all that's required. Does Mrs F-S also need to revoke her claim? What happens if she doesn't? Do we each transfer 10% to the other and it all cancels out? Is my claim for 24-25 ignored?

For 25-26, both of us will have income above the basic tax threshold, so who needs to request to cancel, and when?

For 24-25, the situation was reversed and I have just sent off form MATCF to HMRC to ask retrospectively for me to transfer 10% to Mrs F-S. But I note from elsewhere on the forum that this may not be all that's required. Does Mrs F-S also need to revoke her claim? What happens if she doesn't? Do we each transfer 10% to the other and it all cancels out? Is my claim for 24-25 ignored?

For 25-26, both of us will have income above the basic tax threshold, so who needs to request to cancel, and when?

0

Comments

-

The person making the claim has to cancel it BUT cancellation will only apply after the end of the current year. Your wife can cancel now for it to take effect from 6 April 2026.

Your request will transfer the share of your allowance to your wife for 25/26 but your wife’s transfer will still apply.You cannot change 24/25 now.0 -

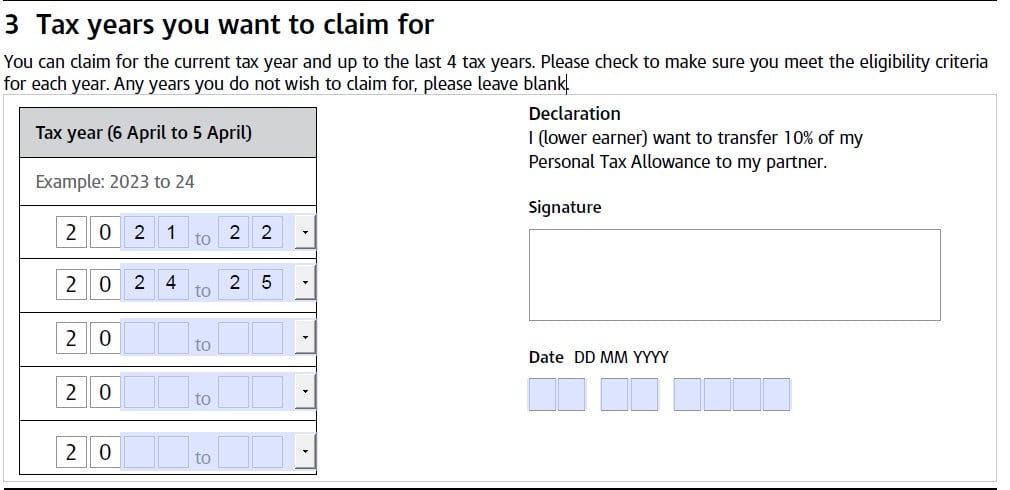

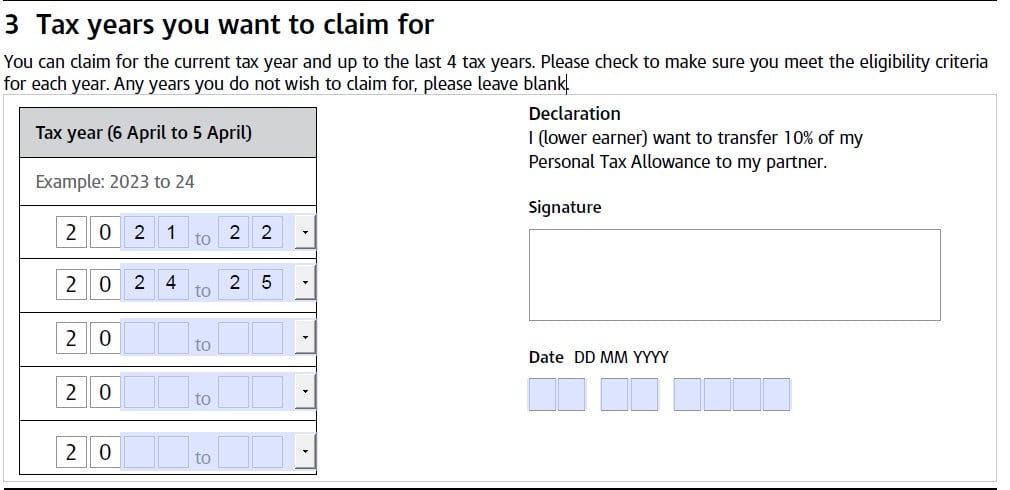

But that's not what I understand from this page and the MATCF form, which explicitly allows you to request backdated transfers for selected years "for the current tax year and up to the last 4 tax years". The form itself is designed for entering any or all years between 21-22 and 25-26 inclusive.sheramber said:You cannot change 24/25 now.0 -

It allows back dated claims for the transfer but not cancellation of the transfer.

https://www.gov.uk/marriage-allowance/if-your-circumstances-change

1 -

Then why create a form that permits you to select individual years to transfer? If I sent a form that only had one past year selected, why would that be taken as every year from then on, if it explicitly says "Any years you do not wish to claim for, please leave blank".

0

0 -

That is for claiming the allowance not for cancelling.HugoFS said:Then why create a form that permits you to select individual years to transfer? If I sent a form that only had one past year selected, why would that be taken as every year from then on, if it explicitly says "Any years you do not wish to claim for, please leave blank". A claim for previous years will not cancel any original transfer your wife has made to you.That form does not include a section to cancel a transfer.that has already been made.0

A claim for previous years will not cancel any original transfer your wife has made to you.That form does not include a section to cancel a transfer.that has already been made.0 -

So what you're saying is that unless Mrs F-S cancels her transfer, we can end up with each of us transferring allowance, annulling any benefits?sheramber said:

A claim for previous years will not cancel any original transfer your wife has made to you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards