We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Let's go fly a kite..

Comments

-

Mortgage amount: £43,850

A bit frustrated today that the mortgage payment hasn't gone out and we are being charged ~£7 a day interest (5.89%). Had a look on the MSE mortgage calculator and it said approximate monthly payment will be £643 a month so, we've paid £300 overpayment today and will tidy it up on Monday when the DD goes out.

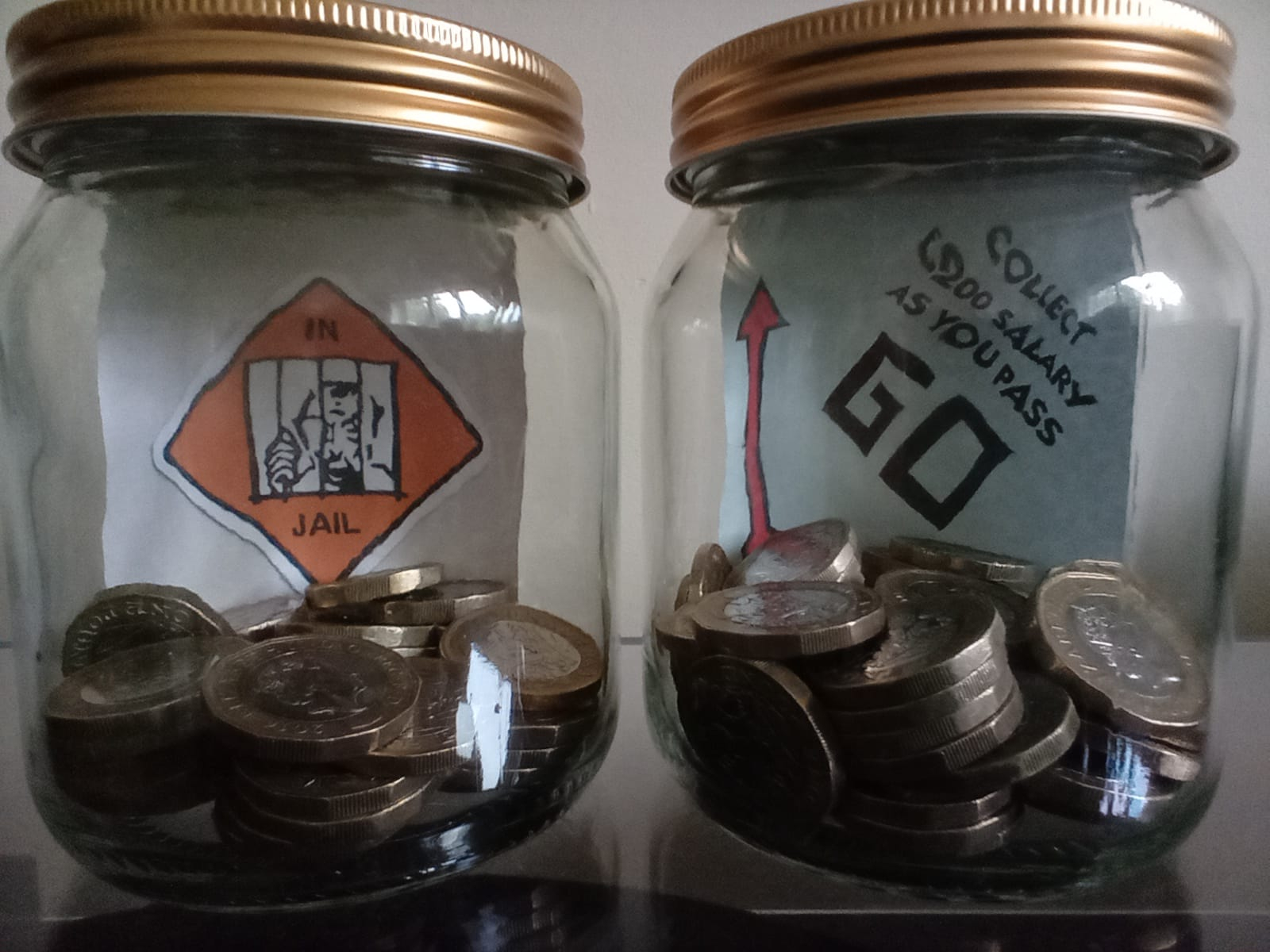

On the plus side, it's another sticker and another coin in the jar @savingholmes, it is our take on the marbles jar (great idea). I really need visual tools to motivate me so, I used the £100 from Nationwide Fair Share. Just when I'm about to make ends meet, somebody moves the ends4

@savingholmes, it is our take on the marbles jar (great idea). I really need visual tools to motivate me so, I used the £100 from Nationwide Fair Share. Just when I'm about to make ends meet, somebody moves the ends4 -

Well doneAchieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/261 -

Mortgage amount: £43,340

Interest amount: £207.65

Mortgage payment went out today for £714.93 which was higher than expected . Did a small tilly tidy of £2.72.

. Did a small tilly tidy of £2.72.

We have received two letters from HSBC with differing amounts quoted for the mortgage payment, neither of which were the amount actually taken. I suppose it is hard to get an accurate figure with interest rates fluctuating and overpayments being made. Going forward, I think the plan will be to pay £1k on the 20th (payday) and wait until the DD goes out before tidying up. This month, we have paid £2,017.65 in total which is £17.65 more than planned.

In the past, we have always had either a 5 year fix or 2 year fix so, the volatility of a tracker will take some getting used to!Just when I'm about to make ends meet, somebody moves the ends3 -

That's a lovely amount to have paid off in a month.Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/261 -

Mortgage amount: £42,340

Made an OP of £1,000 on payday, we'll wait and see what the monthly payment is before we OP anymore.

Thinking about budgets and savings at the moment. On the budget front, food is the main spanner in the works. Over the last couple of months, I've been monitoring how much I've overspent and I think I need to allocate an additional £18 per week to groceries . Looking at my till receipts, it seems to be meat/fish/dairy which are the main culprits. I only buy one meat and one fish item a week but they are definitely rocketing up in price (I shop at Aldi). I did a stocktake yesterday so hopefully, I'll be a bit more organised for this week's shop.

. Looking at my till receipts, it seems to be meat/fish/dairy which are the main culprits. I only buy one meat and one fish item a week but they are definitely rocketing up in price (I shop at Aldi). I did a stocktake yesterday so hopefully, I'll be a bit more organised for this week's shop.

On the up side, we are using less petrol so I have reduced that category by £40 per month...swings and roundabouts.

We have been looking at making our other savings work harder and after the BoE rate decision on 3rd August, we will move our long term savings (not a huge amount) into a higher interest paying account. We also have savings pots for various things which we put about 10% of our income in monthly. Looking for marginal gains.Just when I'm about to make ends meet, somebody moves the ends3 -

Marginal gains add up. Well done.Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/262 -

Mortgage amount: £41,555

Interest £215.04

The mortgage payment went out today of £590.85. Made an OP of £409.19, only a 4p tilly tidy. We allocate £2,000 per month to the mortgage in total, £1,000 OP on payday and then top up after the payment is made on the 1st. Another sticker on the chart and a coin in the jar.

We have been fiddling around with the budget to try and get the food budget to work. We decided to seperate food and alcohol and then halve the alcohol amount. We now have a budget of £60 per week for food which seems doable. I went to Tesco and bought a month's worth of alcohol in one go as they had their 25% off offer on and also wanted to get it before today's tax increase. Hopefully, this will work better. The money freed up will go into cash savings for early retirement.Just when I'm about to make ends meet, somebody moves the ends4 -

Love the jarsAchieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/261 -

Mortgage amount: £40,200

Got paid two days early due to pay day falling on a weekend Sometimes it does work in your favour. Paid £1,355 off the mortgage this morning before I even got out of bed. It still amazes me that you can transfer money so quickly now. Remember when you had to write a cheque, post it off and wait 3 days for it to be processed. Try telling kids that these days and they just won't believe you

Sometimes it does work in your favour. Paid £1,355 off the mortgage this morning before I even got out of bed. It still amazes me that you can transfer money so quickly now. Remember when you had to write a cheque, post it off and wait 3 days for it to be processed. Try telling kids that these days and they just won't believe you  Just when I'm about to make ends meet, somebody moves the ends4

Just when I'm about to make ends meet, somebody moves the ends4 -

Apparently America is still cheque based.

Well done on the OP.Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/261

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards