We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

How goverments piled costs onto pensions during the good times

cepheus

Posts: 20,053 Forumite

It seems the pension crisis isn't all about low interest rates and us living longer as some media would have you believe! Governments, employers, investment managers, advisers, companies and actuaries are also at fault.

Unlike Ros Altmann I think the latest change in allowing easier access to pension pots could be problematic for the less financially savvy, the majority of people, which could be another impending disaster.

Unlike Ros Altmann I think the latest change in allowing easier access to pension pots could be problematic for the less financially savvy, the majority of people, which could be another impending disaster.

This post by our guest author, Dr. Ros Altmann CBE, explains how our pension funds have been raided since the 1980s by successive governments seeking taxes, and by employers taking "contribution holidays" and legally diverting money from the staff pension funds into their companies. Raids that were justified by the accountants and actuaries who declared our pensions were in surplus and could actually afford to shed money!

Dr. Altmann is an independent expert on consumer finance, pensions, retirement, care funding and economic policy. She is an advisor to governments, corporations and industry bodies. In July 2014 she was appointed as the UK Government's Older Workers Business Champion.

Summary of reasons why pension fund surpluses have disappeared and are no longer there now that we need them:

1. Nigel Lawson decision to tax pension fund surpluses

2. Successive extra mandatory costs - preservation, deferred pension revaluation

3. 1995 Pensions Act - MFR, priority order, limited price indexation

4. Removal of ACT relief

5. Employer contribution holidays

6. Employer use of surpluses for industrial restructuring

7. Trend to earlier retirement expectations

8. Increasing longevity

9. Actuaries investment and mortality assumptions too optimistic

10. Benefit enhancements which could not be removed

11. Maturing of schemes (i.e. more pensions needing to be paid as workers retire)

12. Over-reliance on equity investment

13. Trustees not questioning actuarial advice

14. Plunging stock markets

15. Sharply lower interest rates

0

Comments

-

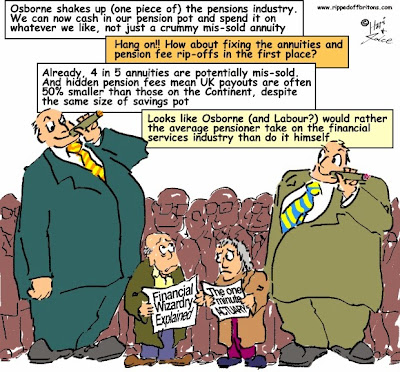

Just in case anyone is tempted to take that seriously, it's from the cartoon strip of the Guardian:

1. Back then companies could put money into a pension pool then take it out to use for company purposes, using the pension to evade corporate taxes. So an anti-evasion measure was needed.

2. Those "extra costs" are what give those who have left a job the inflation-linked increases until they retire instead of it reducing to a pittance by the time they get there or simply saying sorry, no pension at all for you, you left.

3. 1995 Pensions Act added more protection for pensioners, their pensions had to increase with inflation, at least up to 5% a year. It was one of the responses to the massive embezzlement of money from the Mirror Group newspaper pension fund. The Minimum Funding Requirement set a minimum amount that had to be in the pension scheme to cover its liabilities for those who hadn't retired yet, so a firm couldn't just under-fund and them go bust leaving members with no pensions. It no longer applies, it was replaced by the 2004 Pensions Act that improved the protection because it still wasn't good enough. Priority order in the blog is described as meaning that people can lose all their pension but that's not what happens today, the Pension protection Fund steps in instead.

4. Removal of Advance Corporation Tax Relief is mostly irrelevant because Advance Corporation Tax itself was abolished from 6 April 1999. There were just two years during which ACT relief for pensions ended before ACT itself ended.

5. Contribution holidays stopped a waste of money, paying money into the pension when it wasn't needed, so it could instead be used to grow the business or make it more attractive to its owners by paying them income. The author seems out of touch with investment reality, writing "to build up assets to cover for times like now, when markets and investments go wrong" when the years since 2008 have been one long boom market and possibly the best time in my life for my own investing.

6. Industrial restructuring? Presumably means paying pensions early while making people redundant. I doubt that those who were made redundant would think that this was a bad thing. For the pension fund it could be, though, if the company didn't fund it, but that was before the time when there were funding requirements and much regulation and all that happened was that the companies had to fund it later while paying the pensions.

7.People expecting to retire earlier doesn't matter, the pension schemes have fixed retirement dates and profitable penalties called actuarial reductions that make the scheme better off if people take out the money earlier than that.

8. Increasing longevity makes pensions more expensive today for those who retired in the past so it's a factor. It also increases the future cost for those who haven't retired yet.

9. This one seems to be based on a daft idea that average growth of investments would be taken literally as meaning that it never varied, or that it couldn't change from high to low or low to high and that business owners would believe that. Anyone with much clue about investments knows that they change over time and you have to monitor and adjust and that includes business owners. Mortality assumptions weren't too optimistic, they were too pessimistic. When health improved the extra costs of the lower mortality fell on current costs to cover that including for people no longer working in the firm or already retired, as well as those to retire in the future. Blame government for much of the health increase, though "blame" isn't really the right word for making people better off.

10. This one is a repeat of some of the earlier ones.

11. Of course people retire. That's why there are minimum funding requirements now.

12. Under-reliance on equity investment? Who's the author kidding? Equities are very well suited to long term liabilities because they have the high growth needed to keep the costs down. Some of the biggest disasters have been from foolish moves out of equities (massive cost increase for Boots when that was done by a major advocate of this, with lousy timing, similar requirements for insurers that caused them trouble). But equities go up and down and changes in accounting rules make equities unattractive because they cause wide swings in reported liabilities. So do small changes in interest rates. The accounting rules make defined benefit pensions very unattractive for CEOs because they threaten their bonuses for reasons that they cannot control.

13. A repeat of the earlier one about actuaries.

14. Stock markets go up and down, get a clue and maybe notice that some major markets are at record high values at the moment. The variation is an issue, though.

15. Lower interest rates are a massive problem because they set the funding requirement and things like QE then cause a requirement for massive increases due to government policy rather than investment returns. Avoiding equities makes this even worse because even more of the pension fund money is in the interest-paying investments that are most affected.

If you want to pick one big thing that put the nail in the coffin of pension schemes of this type, blame accounting standards that made pensions a random effect on CEO bonuses and gave them a strong incentive to get rid of the defined benefit pensions by selling them off to insurers, switching to defined contribution [STRIKE]benefit[/STRIKE] or both. And notice that the government, for its own employees, doesn't have to do these things, so politicians get to avoid this during their own terms in charge.

Accounting standards may seem boring but when your pay depends on what they say you're going to react based on the results that they produce. And that makes defined contribution [STRIKE]benefit[/STRIKE] pensions with their known and fixed current costs and no future liability increase potential the way to go. Which is exactly what has happened.

Not that this matters much, since it's all about pension schemes that are based on the largely obsolete one job for life idea.0 -

Yes, private sector DB schemes were fantastic if you stayed in the same job for 40 years, but if you left then your benefits could become practically worthless. We've seen loads of posts from people here complaining that the DB scheme they had with an employer in 80's is now worth practically nothing. They'd have probably been better off with a modern day DC scheme!

Companies did use it as a way of trapping people in a job, knowing that if they left the value of their pension would be far less. Changes made by the govt to address this, and scandals like Maxwell, plus regulatory/accounting changes, plus taxation changes eg abolishing ACT credits and ACT itself, obviously increased costs and made DB schemes very expensive for employers (typically a 1/60th final salary scheme now costs around 40% of salary!).0 -

You mean "defined contribution" surely.If you want to pick one big thing that put the nail in the coffin of pension schemes of this type, blame accounting standards that made pensions a random effect on CEO bonuses and gave them a strong incentive to get rid of the defined benefit pensions by selling them off to insurers, switching to defined benefit or both. And notice that the government, for its own employees, doesn't have to do these things, so politicians get to avoid this during their own terms in charge.

Accounting standards may seem boring but when your pay depends on what they say you're going to react based on the results that they produce. And that makes defined benefit pensions with their known and fixed current costs and no future liability increase potential the way to go. Which is exactly what has happened.

Not that this matters much, since it's all about pension schemes that are based on the largely obsolete one job for life idea.0 -

It's not so much the cost. An employer can deal with that by reducing it to 80ths or 100ths or 120ths or by getting current employees to handle current prediction costs for themselves. It's the uncertainty about future costs and the random ups and downs due to interest rate policy and stock markets that are the killers. DC by contrast is 100% predictable and manageable. It's by far the better deal for employers even if they keep today's money funding at exactly the same level as before.obviously increased costs and made DB schemes very expensive for employers (typically a 1/60th final salary scheme now costs around 40% of salary!).

It's probably too late to fix that today. Accounting standards and a regulator dealing with underfunding in ways that dealt thoroughly with ups and downs and didn't treat them as today's profit to be paid to the pension fund could have helped. The transient extra costs probably come during a downturn so it's extra losses that threaten the accounting terms solvency of the business when it's least able to afford them. Even better accounting rules and a regulator with built in delays would still leave longevity risk, though.0 -

There's no reference to Brown's raid of 1997................

How much has cost those that save for their own pensions?0 -

"Brown's raid" was removing ACT relief for pensions. ACT was abolished two years later.

As the wikipedia article points out "The Treasury contend that this tax change was crucial to long-term economic growth: the existing corporation tax system created biased incentives for corporations to pay out profits as dividends to shareholders (including pension funds, who could then reclaim the tax paid) rather than to reinvest them into company growth (which would result in corporation tax being paid). The old system of corporation tax was widely viewed by economists as a constraint on British economic growth"

To put that another way, what Brown did was close a tax dodge that companies had been exploiting.

Pension contributions are a business expense that can be deducted from profits so the business gets the relief anyway, and gets to use that to fund the pension, replacing what the pension would have got itself but with more flexibility for the company.0 -

Just in case anyone is tempted to take that seriously, it's from the cartoon strip of the Guardian:

Silly people, it's by Ros Altman, leading independent UK pensions expert.

About time you guys stopped reading rubbish. Less of the industry propaganda please we get enough vested interests on here.0 -

It's still a contribution from her to the Guardian's cartoon strip, not to a serious pension story. Handy for those with a glass half full view to cast all of the improvements in pension protection for employees as bad, I suppose.

I'm not in the pension industry. Nor in financial services at all.0 -

Thrugelmir wrote: »There's no reference to Brown's raid of 1997................

How much has cost those that save for their own pensions?

Suppose you could try and read it, but the Torygraph is more likely to wave your flag.The Press have been trying to blame Gordon Brown's removal of Advanced Corporation Tax (ACT) relief in 1997 for the problems, but this is simply not true.0 -

Silly people, it's by Ros Altman, leading independent UK pensions expert.

About time you guys stopped reading rubbish. Less of the industry propaganda please we get enough vested interests on here.

What a load of rubbish you read. No 'vested interests' here, those who are IFAs say so. and still give freely of their time to explain to newbies.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards