We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Marshall Hoares/Northern Debt Recovery - FOS on unfair charges & breach of OFT rules

fermi

Posts: 40,542 Forumite

FOS decision that may be useful to some: http://www.ombudsman-decisions.org.uk/viewPDF.aspx?FileID=12684

complaint

Ms D complains that Marshall Hoares Bailiffs Limited (MHBL) added unfair charges to her account

and harassed her in pursuit of a debt.

our initial conclusions

Our adjudicator recommended that the complaint be upheld. She found that MHBL added charges

to this account after Ms D told it of her financial difficulties; she did not consider this to be

reasonable. Our adjudicator also found that MHBL’s communications with Ms D did not meet Office

of Fair Trading (OFT) requirements. She recommended that it reduce Ms D’s outstanding debt to

£359 and pay Ms D £200 to reflect the distress and inconvenience this matter has caused her.

my final decision

I have considered all the available evidence and arguments to decide what is fair and reasonable

in the circumstances of this complaint. Having done so, I uphold this complaint.

Ms D was lent £200 by a company affiliated to MHBL in April 2012. Ms D suffered financial

difficulties and was unable to repay the debt as planned, incurring late payment charges. She

informed the lender of her situation in June 2012 and tried to negotiate an affordable repayment

plan. Her lender rejected this and referred the debt to MHBL, adding further charges to the

account. Both companies sent aggressive emails and texts to Ms D demanding repayment.

I find that MHBL added unreasonable charges to Ms D’s account after she said she was in financial

difficulties. I am also satisfied that MHBL’s communications did not meet the requirements of the

OFT’s debt collection guidance by “putting undue pressure” on Ms D. It follows that MHBL should

compensate Ms D for this.

My final decision is that I uphold this complaint and I order Marshall Hoares Bailiffs Limited to pay

redress as set out in full overleaf.

ombudsman notes

My final decision is that I uphold this complaint and order Marshall Hoares Bailiffs Limited to:

reduce Ms D’s outstanding debt to £359;

agree an appropriate and affordable repayment plan with Ms D for this debt; and

pay Ms D £200 for the distress and inconvenience this matter has caused her.

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed

0

Comments

-

I have an almost identicle case with the adjudicator now with MHBL and expect the same or similar decision shortly.0

-

Each case is done on it's own merits with the FOS, but hopefully you will get a result.

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

The decision made by the clerk was the same compensation level as your quoted result above. MHBL refused this and offered a counter offer of a 20% discount on my "outstanding" balance of £2804, I only ever had a loan of £350 and I have refused to deal with them since they wouldn't stop calling my work and divuldging my loan details to colleagues and obiously because of their illegal charges they are pursuing, so know they don't know where I work or live, so stuff them.

Anyway because it was not settled at that stage it has been refered to the ombudsman. The clerk said off their record that it was extremely unlikely to not be upheld, given the strength of my evidence against them and the level of harassment. I may even be awarded more.

Obviously when I do get compensation, it is going to be difficult for me to take it without giving my details away to the thugs at MHBL so I will have to cross that bridge when I come to it.0 -

Around £2.5K in charges? :eek:Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Bunch of crooks that should be shut down. Report them to the OFT as well.Still rolling rolling rolling......

<

<

SIGNATURE - Not part of post0 -

FOS complaints ---> http://www.financial-ombudsman.org.uk/consumer/complaints.htm

OFT complaint form --> https://docs.google.com/file/d/0B6i5-2tePE-TSXpaM0otTEFua2M/edit?usp=sharingFree/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Maybe trading standarsd as well.Still rolling rolling rolling......

<

<

SIGNATURE - Not part of post0 -

Ouch ---> My SpeedCredit horror storyFree/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

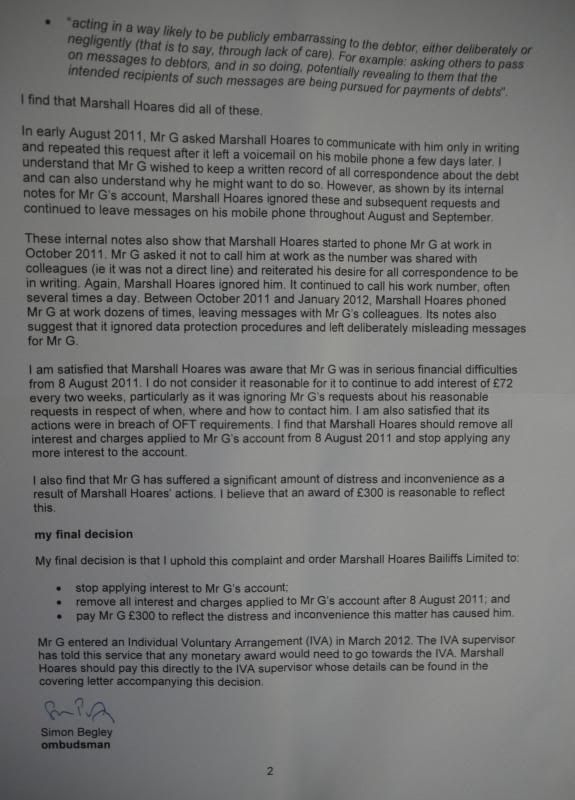

Another result.

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Thanks Fermi. I hope to see their license revoked soon as they are clearly operation outside the confines of the regulations. The oft wanted a copy of this decision for their case, I have sent it to them today. Hopefully this will be the straw that breaks the camels back. Question is, why does it take so long to shut them down?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards