We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

2009 MF Wannabe's

Comments

-

Evening all

So the Bank of England does it again. My rates on my savings have been annihilated and I'm seriously considering just them to pay off even more of the mortgage than I was intending to.

What's to do guys?

SmileyGTarget acheived: _party_ Mortgage offset in June 2012!_party_Mortgage = -£98Endowment = £0Investments = £40,247[STRIKE]Deficit[/STRIKE] / Surplus = £40,149(at 22/09/2017)"Don't spend then save, save then spend!"0 -

Hi all.

I've been lurking on this board for about 6 months now and been very inspired by reading the amounts you all manage to clear from your mortgage. With some changes to finance commitments, I want to start regular overpayments on 1st Jan 09 and thought it'd be a great time to sign up to the new MFW board And like SmileyG, with the completely poor interest rates for savers and my good 2 year fixed savings rate ending next week, I figured the best return on my money is to whack it into overpayments (I do have to check how accessible the money is though should I need it).

And like SmileyG, with the completely poor interest rates for savers and my good 2 year fixed savings rate ending next week, I figured the best return on my money is to whack it into overpayments (I do have to check how accessible the money is though should I need it).

So...

On 1st Jan 09 outstanding mortgage will be: £138,802.08

I plan to make minimum £10 overpayments per month as I have a direct debit to a savings plan finishing this month so I won't miss that money. By my calculations, by the end of my current fixed rate at 5.75% in June 2011, that would save me nearly £700.00 in interest and pay an extra £230 off the capital.

My target for the year dependant on what else I can afford is to repay the equivalent of one year capital repayment - £1050.00

I've already pm'd with the details, so look forward to being added to the challenge and seeing if I can manage it! Though I anticipate a new (used) car being necessary in the year, which may dent my hopes somewhat!

Thanks for organising

JBMFW 2009 Overpayment Target: £1050.00Mortgage Balance 01 Jan: £138,802.08Overpayments Made: £200.00 / £1050.000 -

Hey folks, finally noticed there was a 2009 board...doh! So I signed up 2008 year and over paid nothing due to job issues. I want to sign up again for 2009 but am upping the mortgage by 20K (or so) because we are moving house.

So until we find out what we are upping the mortgage by, and what the repayments will be I can't really say what my overpayment plan is. But I shall be keeping up with everyones posts because it motivates me massively.

Thanks everyone.Reduction in daily mortgage interest since October 23 (new mortgage) - £2.36 July 25

% of house owned/% of mortgage paid off. July 25 - 38.82%/31.66%

MFiT-T7 #21

MFW 2025 #2

MF Date: Oct 37 Feb 370 -

Well I've finally decided to go for a realistic (touch wood!) £4000 overpayment for 2009. 2008 started off well but has tailed off recently, so will make a bit more effort next year.

Juli - num 142.0 -

Hi would love to join this challenge please.Am hoping to overpay the mortgage by £2600 in 2009.We currently have a mortgage of £1300000

-

Hi,

I've just posted something very similar to this on my own diary. As I've subscribed to this 2009 challenge, I was wondering if this would also be useful to someone in the 2009 challenge, so I've also posted here. Hope that's ok.

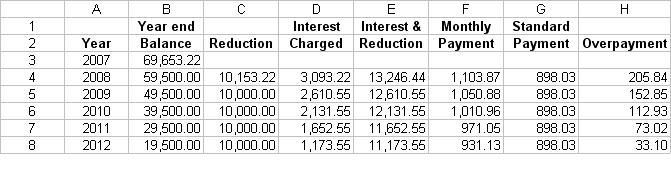

I’m presuming you’re starting a new sheet:

In cell A2, enter “Year”

In cells B1 and B2 enter “Ending” and “Balance”

In cells C1 and C2 enter “Reduction” and “Required”

In cells D1 and D2 enter “Interest” and “Charged”

In cells E1 and E2 enter “Interest +” and “Reduction”

In cells F1 and F2 enter “Monthly +” and “Payment”

In cell A3, enter 2008.

In cell B3, enter your year end balance for 2008.

Stilll with me? Now for some calculations…

In A4, enter: =A3+1

In B4, enter: =B3-C4

In C4 enter amount you want to reduce mortgage by in 2009

In D4, calculate interest for 2009: =AVERAGE(B3:B4)*0.0479

Note: Mortgage rate is 4.79% - change to your own rate

In E4 add reduction and interest, enter: =C4+D4

In F4, determine the monthly payment, enter: =E4/12

If you’ve followed the above, it should look something like this:

So this is telling me (roughly), that if I want to reduce my mortgage by 10k in 2009, I’ll need to pay 12,610.55 as I will be charged 2,610.55 over the course of the year in interest. This equates to a monthly payment / overpayment of 1,050.88

Taking into account your regular payments, you can then work out the overpayment needed to top up to the "monthly payment".

Note: This isn’t going to be massively accurate, as it’s taking the average mortgage from just two values and estimating the interest, but it’s another little sheet to try out.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Would like to join your list of overpayers for 2009. Have been regularly overpaying on mortgage for last 3 years. Huge mortgage, but every bit helps. Aim to overpay by £6000 in 2009. Currently have a tracker mortgage, repayments have obviously fallen sharply so am able to overpay by £700 per month, but not sure how long this will continue.

Please advise if I need to supply any additional information.0 -

Would like to join your list of overpayers for 2009. Have been regularly overpaying on mortgage for last 3 years. Huge mortgage, but every bit helps. Aim to overpay by £6000 in 2009. Currently have a tracker mortgage, repayments have obviously fallen sharply so am able to overpay by £700 per month, but not sure how long this will continue.

Please advise if I need to supply any additional information.

I have added you to the first post - WELCOME to the 2009 MFW thread and GOOD LUCK with your OP'ing

ZavMFW 2010 Challenge (No 68) - £133.29/ £5000MFITT2 Challenge - (No 181) - Target Reduce mortgage to £130,000Mortgage @ 1.8.09 - £161160 :eek: @1.12.09 - £159052 :eek: @ 1.2.10 £157,3630 -

Can i join in ?

Current mortgage balance is £157k. I can only overpay by 10% per year with my current provider, so i guess my maximum target is £142k.:j 2009 MFW Challenge (No 219) - Overpayment to date £7500)Mortgage @ 01-01-09 - £158499 :eek: @ 1.7.09 - £150999:j0 -

I've added two new columns to my earlier graph.

G4 downwards: enter your standard monthly payment.

H4 downwards: enter =F4-G4

This will break the monthly payment down between your standard mortgage payment, ie the one that is dictated from the schedule you got from your lender and the overpayment required to "top up" your standard payment to the monthly payment required to attain the reduction goal.

Financial Bliss.Mortgage and debt free. Building up savings...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards