Civil service pension

Options

Bezm

Posts: 1 Newbie

Between the ages of 18 and 24 I worked for the Civil Service and paid into a pension. I went on Maternity leave and did not return to work, receiving the minimum maternity pay.

After I resigned, I remember getting a letter asking me if I wanted to receive some payments which had been paid into my pension, and being financially in great need, I said yes. I received a small lump sum.

I believe this may have been my pension contribution and have a significant affect on my future pension provision. I did not receive any advice on what impact taking this money would have on my pension when I retire. I am currently a teacher and have paid into the teachers pension since the age of 30.

Could anyone advise me of what actions I could take, or who to contact to find out more?

After I resigned, I remember getting a letter asking me if I wanted to receive some payments which had been paid into my pension, and being financially in great need, I said yes. I received a small lump sum.

I believe this may have been my pension contribution and have a significant affect on my future pension provision. I did not receive any advice on what impact taking this money would have on my pension when I retire. I am currently a teacher and have paid into the teachers pension since the age of 30.

Could anyone advise me of what actions I could take, or who to contact to find out more?

0

Comments

-

Ah, you'd like a one way bet? If that turned out to be a good decision, because the lump sum was needed then, thats OK, now that time is passed,you also like to have the pension benefits as well?

But if it was, in retrospect, a bad decision, "someone else" is responsible, rather than your careless younger self.

The fact you didn't take any advice means you have no comeback. You could have invested that money in a pension. You chose not to. Have a stern word with your younger self.

Hopefully you teach more personal responsibility to your students than you are willing to take yourself.0 -

I'm sorry, but what's done is done. The letter you referred to would have set out all your options, which probably included a transfer to another pension fund. However, you opted for the cash because you were in 'great financial need'. If your need was really that great, would you have done anything else if someone had bashed you over the head and told you that taking the money then would have a detrimental affect on your pension in 40 years time?Could anyone advise me of what actions I could take, or who to contact to find out more?0 -

Bezm I did the same as you. Didn't really have a clue at the time. There are very knowledgeable people on here but I would start by getting a pension forecast to see exactly what you have paid since then and take it from there.0

-

I don't think that aged 18-24 you have any clue about pensions and what it could mean in the future, just looks like someone taking more money away from you. Letter may have told you to seek advice - they often do.0

-

Do you still have any of the correspondence?Between the ages of 18 and 24 I worked for the Civil Service and paid into a pension. I went on Maternity leave and did not return to work, receiving the minimum maternity pay.

After I resigned, I remember getting a letter asking me if I wanted to receive some payments which had been paid into my pension, and being financially in great need, I said yes. I received a small lump sum.

The reason I ask is that you normally have the option a short service lump sum refund if you have only been in the scheme for 2 years or less. As you worked there for 6 years, it could be that you were a member of multiple schemes and still have some of that entitlement?0 -

MoneySavingUser wrote: »Do you still have any of the correspondence?

The reason I ask is that you normally have the option a short service lump sum refund if you have only been in the scheme for 2 years or less. As you worked there for 6 years, it could be that you were a member of multiple schemes and still have some of that entitlement?

ISTR reading here that CSP pension entitlement didn't start until you were a certain age, perhaps 21. If so OP could easily have contributed for less than 2 years especially if they didn't start until over 21.

Its easy enough to contact CSP and find out if there is anything there but it seems very unlikely.0 -

Many years ago you needed 5 years of service to qualify for a deferred pension after leaving. If the OP didn't have this, perhaps because they didn't work there for 5 years, they were too young to join the scheme when first starting employment or because the maternity leave didn't count for pension membership (things change over time compared to how it works now), then there was no option to have a pension. They would need to check with MyCSP but their options may have been a short service payment or the opportunity to transfer the funds to another pension scheme and if they wanted advice it was their responsibility to get some.

OP you should call MyCSP if you want more information but you couldn't have gotten the money you did if you had qualified to keep your civil service pension after leaving, so you weren't conned out of a civil service pension.Don't listen to me, I'm no expert!0 -

AnotherJoe, thank you so much for your advice, it was received with the same vitriol in which you posted it.

FYI, at that time I my life, I was a new single mum wig post natal depression, jobless, almost homeless and certainly penniless none of which was my fault. I had no family to support me, and there was not the benefit of the internet as today, from whence myriad details can be gleaned at the touch of a button to ensure financial decisions can be taken in full knowledge that it is in ones best interest. So yes, when I was informed about this payment, giving me enough money for a deposit on a home for me and my baby, then I took it in good faith.

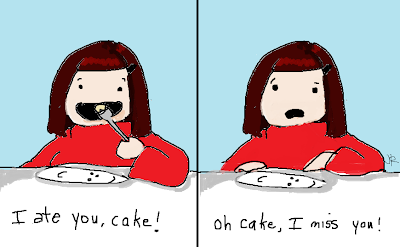

It most certainly isn't the case that I wanted my cake then and to eat it now. And yes, should I find myself in the same situation now, I may well make the same choice. However, I was not advised of any future implication for my pension, why should I be? After all, I would no doubt find a generous husband to keep me in diamonds thus negating the need for financial security in my own right!

I asked for advice, not a scathing diatribe on my foolishly ignorant decision making over thirty five years ago. If you're incapable of offering such advice, then swipe on!0 -

Well the silver lining is that the OP will potentially have twenty or thirty years of teachers pension for retirement, so far better provision than the vast majority of the population.0

-

Well the silver lining is that the OP will potentially have twenty or thirty years of teachers pension for retirement, so far better provision than the vast majority of the population.

Yes, I do indeed have a teachers pension to look forward to, having decided to improve my lot, get a degree and make sure I never have to rely in anyone financially again. I won't get a full one as I didn't start teaching until I was 31. As a result, I won't need to claim any benefits when I eventually retire, therefore not being a drain on resources. My pension, however, will not be the fortune people seem to think teachers pensions are, and as I no where won't get my state pension for another four years later than expected, I will still need to do some work to supplement it.

And who says the vast majority of the population don't have something similar? Where's your evidence?0

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608.1K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards