We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

liz lil thread

RAS

Posts: 36,183 Forumite

This is a long story, so I am putting up a severely edited version to which I hope to invite a couple of DFwers to comment as the advice here and outside has been contradictory.

This is a core issue. If this is a proper CCA, then it will be tackled one way, if it is not a proper CCA, OP needs to know chapter and verse, given that she has re-instated payments.

In response MCS demanded the reason why the CCA was invalid

Unable to get any reponse to the enquiry on-line here or on the original site, OP sent the photocopy to the local CAB

Given the other documentation that has since been unearthed from CAB, this last para just about sums up their level of service in this area.

On the basis of the letter from CAB, OP is paying £1 per month which has been accepted.

WHAT IS YOUR VIEW OF THIS paperwork?

is is a proper CCA?

If not exactly why not?

a) in words of one syllable

b) in legalese please

OP cannot afford to get this wrong, but if it is not a valid CCA, it will make her life a huge lot better. She has already paid back as much as was borrowed.

This is a core issue. If this is a proper CCA, then it will be tackled one way, if it is not a proper CCA, OP needs to know chapter and verse, given that she has re-instated payments.

She did this and and then the other web-site advised her MCS that the paperwork was not a proper CCA.I was getting help from another site who suggested I get a copy of the CCA from MCS.

In response MCS demanded the reason why the CCA was invalid

(MCS) thanks me for my letter of .. June (where I said I wasn't going to pay because their CCA wasn't up to scratch).

It then says "In order for us to refer matters to our client (HSBC), please forward a copy of the agreement highlighting the area you dispute, to the above address.

We shall suspend further recovery actions for 14 days to allow time for the above information to be received"

I have been back to the old site, but now I'm in a bit of a fix, I've had no help from anyone there at all!!!

Well, I simply don't know enough about CCA's to be able to do this!

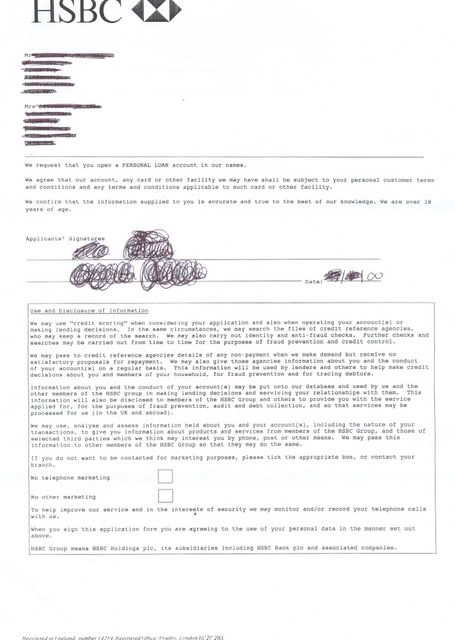

I have scanned them and I'd be REALLY grateful if someone could take a look for me

Unable to get any reponse to the enquiry on-line here or on the original site, OP sent the photocopy to the local CAB

CAB reply came this morning.

It says:

"Thank you for your letter of .....

Your credit agreement is regulated by the Consumer Credit Act. You do have a copy of the credit agreement.....

.....

Then they have enclosed some print outs telling me about CCA's. They also give the telephone number of the Ombudsman.

"Finally, if you feel we can assist in re-negotiating your debt please call into one of our offices as shown on the leaflet enclosed". (But then they forgot to enclose the leaflet!!!)

Given the other documentation that has since been unearthed from CAB, this last para just about sums up their level of service in this area.

On the basis of the letter from CAB, OP is paying £1 per month which has been accepted.

WHAT IS YOUR VIEW OF THIS paperwork?

is is a proper CCA?

If not exactly why not?

a) in words of one syllable

b) in legalese please

OP cannot afford to get this wrong, but if it is not a valid CCA, it will make her life a huge lot better. She has already paid back as much as was borrowed.

If you've have not made a mistake, you've made nothing

0

Comments

-

Hi

Could weller or shane have a look at this pleaseIf you've have not made a mistake, you've made nothing0 -

Don't know RAS but bumping it to see if anyone else knows."I wasn't wrong, I just wasn't right enough.":smileyhea97800072589250

-

Hi RAS,

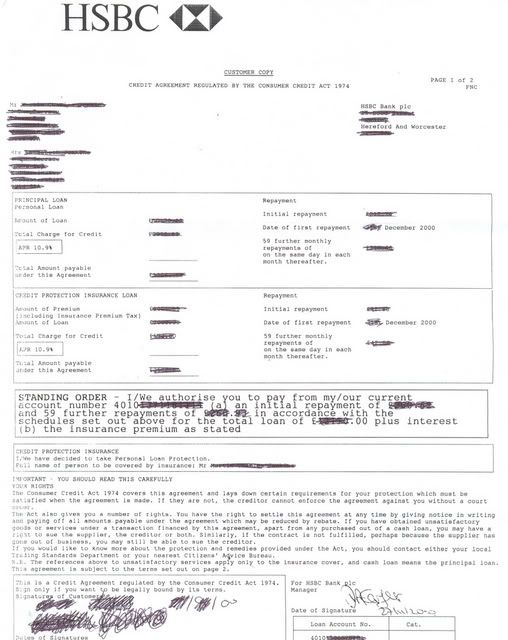

sorry for the delay in getting back to you. It would seem the agreement contains all the prescribed terms, them being Amount of Credit & Repayments.

I can't quite read all off it, does it mention cancellation rights anywhere?

Was is signed on or of company premises?

how was the agreement signed, was the debtor sent the agreement in the post, asked to sign and send it back? Who signed the agreement last and made it executed?

Also, with regard to the PPI was this optional or did the creditor require it as a condition of the loan?

Even if the agreement itself does contain all prescribed terms and conform to the regs, if it is a cancellable agreement then the creditor is duty bound to send the debtor copy documents within certain timeframes as well as details of how they can cancel should they choose to. on these grounds, by virtue of s 127(4) and s65 of the ACT it could be unenforcable.

kind regards,

shane0 -

I can't quite read all off it, does it mention cancellation rights anywhere?

Sort of. There is a section entitled "IMPORTANT - YOU SHOULD READ THIS CAREFULLY. YOUR RIGHTS" This goes on to say "You have the right to settle this agreement at any time by giving notice in writing and paying off all amounts under the agreement which may be reduced by rebate. If you have obtained unsatisfactory goods or services under a transaction financed by this agreement, apart from any purchased out of a cash loan, you may have the right to sue the supplier, the creditor, or both. Similarily, if the contract is not fulfilled, perhaps if the supplier has gone out of business, you may be able to sue the creditor"...... "NB The references above above to unsatisfactory services apply only to the insurance cover, and cash loan means the principal loan"

Was is signed on or of company premises?

At HSBC in small Worcestershire town.

how was the agreement signed, was the debtor sent the agreement in the post, asked to sign and send it back? Who signed the agreement last and made it executed?

We signed it in the bank and the chap (illegible scrawl) dated it and signed it at the same appointment. 27.11.2000

Also, with regard to the PPI was this optional or did the creditor require it as a condition of the loan?

I *think* this was required. Or certainly suggested that it was very wrong not to take it out. Mind you, this was back in 2000.

Even if the agreement itself does contain all prescribed terms and conform to the regs, if it is a cancellable agreement then the creditor is duty bound to send the debtor copy documents within certain timeframes as well as details of how they can cancel should they choose to. on these grounds, by virtue of s 127(4) and s65 of the ACT it could be unenforcable.

kind regards,

shane[/quote]0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards