Sipp - To use or not to use an IFA

Options

Comments

-

....it’s impossible to outperform the market.

What has outperforming the market got to do with it? I really don’t get this fixation with “the market” all the time! In a an entrepreneurial economy, I would hope that “the market” is taking greater risks than I will take with my retirement investments. My only goal is for my investments to sustainably provide me with a comfortable standard of living through my retirement years. It matters not a jot if “the market” is beating me or I am beating it. In life there will always be people earning more or earning less than you!0 -

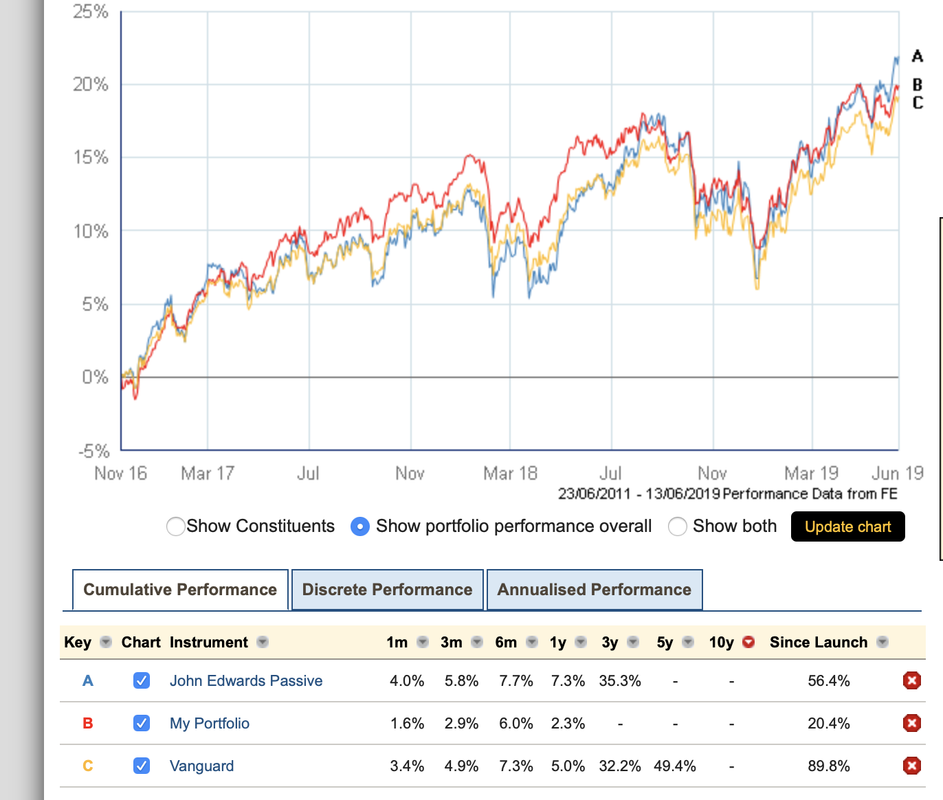

Platform 0.25%Those 3 portfolios are tracking really closely.

If you went with Vanguard on a cheap SIPP platform, with a e.g. £500k portfolio you should be paying <0.4% in fees/charges in total

With your IFA portfolio, what is total % in charges? (IFA+Platform+fund+dealing)?

If you plot out the effect of that difference in charges over e.g. 30 years (or whatever period suits you) what is the overall cost to you?

IFA (flat fee but works out at) 0.3%

OCF on this portfolio 0.69%

It is something I am worried about - I am currently putting my partners various SIPPs (only £35k) into a Vanguard 60:40 on Cavendish - well I would but their platform (Fidelty) is not working at the moment on creating new customers. (well it wasn't last week - they confirmed it in an email)

I will use the IFA to initially get me into retirement and if I don't see the value (and as mentioned above in some of the posts, its more than the portfolio) compared to my partners SIPP then I will change over the next few years0 -

According to a quick excel

Deleted_User wrote: »Platform 0.25%

Deleted_User wrote: »Platform 0.25%

IFA (flat fee but works out at) 0.3%

OCF on this portfolio 0.69%

My Assumptions

6% growth PA

£500K fund today

No further investment or withdrawal

vs a low cost SIPP of 0.4% total charges

Result : That difference in fees would cost you about £500k of cash by the end (which is less in today's money value of course)!0 -

I think you may be misunderstanding how a simple low cost portfolio using multi-asset funds works.I am not managing anything on a day to day basis, and I don't need lots of knowledge or time to spend worrying about how the funds are performing or keeping up to date with anything. I operate largely on a "fire and forget" basis.How much time would you expect to spend as an individual managing a self invested portfolio? Including researching funds, assets etc.

How much time in spent gaining the initial knowledge.

This isn’t my bag, I don’t want to take the risk and I don’t want to spend my time doing it but it would be interesting to see the numbers.

And what happens if you are otherwise engaged (I’ll, v.busy, dealing with death etc) and things happen in the market? Is this a risk?

It's pretty much effortless. And it costs far less than I would pay for an IFA. It's globally diversified, and the funds I have chosen are there to minimize downside risk at the cost of upside. Seems to be working so far.

It has taken me about 5 years of spending time on this forum, reading various books and trying various strategies (including working with an FA) to reach this point and I accept there are many people who don't want to do that, which is why it's fine to use an IFA. But now I am at that point and an IFA would add no value for me at a lot of extra cost.0 -

Deleted_User wrote: »

I like the smoothness of the IFA portfolio - this doesn't really show the fact that the IFA balanced portfolio can change maybe twice a year (this portfolio started to be used in Jan 2019 so history doesnt really make any sense - but its good for reference)

I like the smoothness of the IFA portfolio - this doesn't really show the fact that the IFA balanced portfolio can change maybe twice a year (this portfolio started to be used in Jan 2019 so history doesnt really make any sense - but its good for reference)

This is a really important point that people seem to miss when just looking at returns and charges, especially during retirement. A lower level of volatility is prefered when withdrawing and therefore if the IFA portfolio can produce a good return for a lower level of risk then that is worth considering. If the IFA can also out perform then thats great too.

Way too much time is spent worrying about charges compared to thinking about someone's goals. Things get more complicated when you get close to retirement.0 -

I think IFA or not IFA, is also down to personal preference .

Some people like to DIY either because they enjoy it/are interested in it.

Or that they do not like to give control of their money to a third party .

So its not just an argument about value for money or not .0 -

OldMusicGuy wrote: »I think you may be misunderstanding how a simple low cost portfolio using multi-asset funds works.

Yes and thank you (and lungboy - that was almost lunchbox !!)

Good to come on here and learn something on a polite thread.

I don’t think I’ll be changing my ways.

Partly because Im not inclined, but also because there is only so much time to go round various responsibilities (I’m in the elderly parent phase).0 -

I was reading yesterday on another forum about germans having a keen sense of value for money and not tolerating rip offs. This was in relation to breakdown cover. The germans have ADAC which is less than £43 a year. Similar AA cover is £135. I was alerted to this one year when the AA was more than my car insurance. I remember a german telling me they wouldn't tolerate UK football ticket prices. You can watch Bayern Munich for £13 a ticket. These IFA prices are outrageous. You can always tell there is a problem when they quote percentages. How do you pay IFAs these days. You're not going to write a cheque out for £4k for a 'pension review' are you? I bet they take it out of the pension so you don't really spot it. I would be happy to use an IFA if they charged reasonable prices for the service.0

-

I was reading yesterday on another forum about germans having a keen sense of value for money and not tolerating rip offs. This was in relation to breakdown cover. The germans have ADAC which is less than £43 a year. Similar AA cover is £135. I was alerted to this one year when the AA was more than my car insurance. I remember a german telling me they wouldn't tolerate UK football ticket prices. You can watch Bayern Munich for £13 a ticket. These IFA prices are outrageous. You can always tell there is a problem when they quote percentages. How do you pay IFAs these days. You're not going to write a cheque out for £4k for a 'pension review' are you? I bet they take it out of the pension so you don't really spot it. I would be happy to use an IFA if they charged reasonable prices for the service.

I agree with this - I think there is a real problem with IFA charges however I do not know who will have the bottle to do anything to fix it!

MSE?

Its been fixed already a few times, now the advice is probably high quality - less rip-offs. But the charges are too much.

Maybe it needs a disruptive fintech type company to come along and undercut IFAs significantly while still providing great advice. Like what is happening in other financial areas.0 -

I was reading yesterday on another forum about germans having a keen sense of value for money and not tolerating rip offs. This was in relation to breakdown cover. The germans have ADAC which is less than £43 a year. Similar AA cover is £135. I was alerted to this one year when the AA was more than my car insurance. I remember a german telling me they wouldn't tolerate UK football ticket prices. You can watch Bayern Munich for £13 a ticket. These IFA prices are outrageous. You can always tell there is a problem when they quote percentages. How do you pay IFAs these days. You're not going to write a cheque out for £4k for a 'pension review' are you? I bet they take it out of the pension so you don't really spot it. I would be happy to use an IFA if they charged reasonable prices for the service.

Yes and no.

If you don’t use your IFA then you could say the prices are high.

I do actually use mine and they do a lot of work that I don’t explicitly pay for, for example advising whether to move old pensions.

I did ask how to do that DIY on here and the answers I got did not fulfill the requirement, for example on here i was told to enquire about “guaranteed benefits”.

I was told no there weren’t any, there were however some non-guaranteed benefits that I didn’t find out about DIY even with forum help as I didn’t ask exactly the right questions.

Yes you are correct you don’t see the charges although I can drill down and see mine if I wanted to.

Whilst I agree the savings are meaningful, it still relys on there not being anything you haven’t thought of when choosing your platform/funds/strategy/tax treatment.0

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards