Best Balance Transfers Discussion Area

Comments

-

I think you've answered your own question.moneysavingmarrow wrote: »That's ok saying that the fee spread over 16 months is only 2.235% APR, but how about factoring in, that as a basic rate tax payer, that fee could earn 3.733% in an egg savings account for 16 months? Or does that not matter as the fee is added onto the balance of dosh that you didn't have in the first place?

The Op was using a BT to reduce debt on another cc.Just thought that if costs are being worked out to 3 decimal places, perhaps the whole picture should be looked at in more depth.

Industry-wide BT fees certainly make it difficult to make any money, unless you have an offset mortgage or fixed-rate savings accounts taken out before interest rates dived.

If you're intent on making a few quid using credit cards, the 0% on purchases deals are probably the way to go People who don't know their rights, don't actually have those rights.0

People who don't know their rights, don't actually have those rights.0 -

I think you've answered your own question.

The Op was using a BT to reduce debt on another cc.

Industry-wide BT fees certainly make it difficult to make any money, unless you have an offset mortgage or fixed-rate savings accounts taken out before interest rates dived.

If you're intent on making a few quid using credit cards, the 0% on purchases deals are probably the way to go

Thanks Moggles.

As you may have guessed, my post was made with a little tongue in cheek approach!;)0 -

moneysavingmarrow wrote: »Thats ok saying that the fee spread over 16 months is only 2.235% APR, but how about factoring in, that as a basic rate tax payer, that fee could earn 3.733% in an egg savings account for 16 months?

But then the egg deal is only for 12 months at the moment anyways. Yes?

Or does that not matter as the fee is added onto the balance of dosh that you didn't have in the first place?

Just thought that if costs are being worked out to 3 decimal places, perhaps the whole picture should be looked at in more depth.

Or am I being pedantic?

Yup, the APR on the debt is guaranteed (although you could argue that you'll only get 15 months of a 16 month deal because you lose a couple of weeks from application to receiving funds and it's sensible to clear the balance a couple of weeks before the promotion ends, but with MBNA deals there's a trick for getting the full period).

The AER on the Egg has a 2% bonus but only for a year boosting it to 3.25 AER (although you can get up to 6% AER for a year on an Abbey or A&L current account if you meet their funding requirements).

The poster was looking to see if they could do better than the 3% fee on £1200 having just missed out on the Virgin 0% with 0% fee. They were trying to see if they could avoid the £36 fee. The basic answer was no but when I reread their post they indicated they could actually clear the card sooner so I pointed them to the 1.5% fee if it was the £36 that was bothering them, although that was only a 6 month deal.

but when I reread their post they indicated they could actually clear the card sooner so I pointed them to the 1.5% fee if it was the £36 that was bothering them, although that was only a 6 month deal.

The interest earned on the fee isn't really significant, but if you run the numbers on the interest on the full amount over a 16 month period then you can make a couple of pounds.

And there's nothing wrong with being pedantic

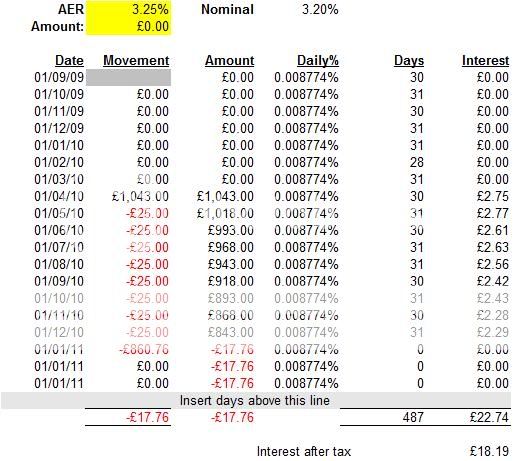

For fellow pedants, if he paid it over 16 months with the 2.98% fee (MBNA promotions run to a statement so it is possible to squeeze the full term out by asking them to change the statement to "yesterday" when you call to activate the card) it'd look like this:

If he took the shorter 6 month deal with 1.5% fee (Play are also with MBNA), it would look like this:

If you look at the difference between these and consider what the money would earn with Egg @ 3.25% AER (because it's identical terms for the first 6 months, the 10 months left will fit into an Egg Savings 12 months, and because the interest is paid annually you just use the basic AER)

So on this you pay back an extra £17.76 being the difference in the fee, but the interest after tax is £18.46 so you're actually £0.70 better off .

.

However, if you can get the money to sit at 6% for the 10 months then the numbers look like this (I've used A&L 6%, interest is paid monthly net of 20% tax so the net movement is adjusted by the interest earned):

So after tax, you earn £33.76 which deducting the £17.76 additional fee still leaves you £16.00 in profit.

Not enough to retire on, but if you follow the principles behind it and apply it on a bigger scale then obviously it starts to add up."A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

moneysavingmarrow wrote: »Thanks Moggles.

As you may have guessed, my post was made with a little tongue in cheek approach!;)

Tsk, tsk, you should know better than to ask a stoozer about obscure ways of squeezing extra money out of two different deals "A child of five could understand this. Fetch me a child of five." - Groucho Marx0

"A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

It's certainly worth a phone call to see what MBNA can offer. This lender has a reputation for regular, follow-on offers and, with your balance paid off in full, you'd be in a strong position to negotiate a further rate reduction. The bank will even waive BT fees sometimes, if you're prepared to negotiate over the phone. I've had offers as good or better than the introductory deals now and againchattychappy wrote: »Not used MBNA for year or so now and the balance is zero. They offered me 8.9% LOB + 3% fee, which I ignored. On expiry, they made another offer 6.9% LOB + 3% fee. I will need some finance, but not right now. Should I bag 6.9%? Are MBNA likely to come back with a better offer? Of course I'll ring them up first to see if they can do better.

If you don't get the offer you'd hoped for, I'd ask to be put through to the retentions dept. Obviously, for this to work, you have to sound prepared to close the account :cool:

To help you further, we would need to know which CCs - besides MBNA - you hold at the mo or have held recently. Also which, if any, you've applied to unsuccessfully.People who don't know their rights, don't actually have those rights.0 -

6.9% APR is described as the typical rate.I have heavy borrowing on my credit cards which I am anxious to reduce. Although I have never missed a payment I am unable to get any transfer deals and my interest rates have soared. In the first instance I followed Martin's advice and contacted the companies concerned asking them to reduce my rates. All said no and Abbey's response was to increase my rate to 29.9%! I have debts of £35,000 spread over five cards. At the moment I have about £6,000 to reduce this debt but I am unsure how to use it to the best advantage. The obvious solution is to pay off the highest interest card first, however, one of my cards is a Barclaycard and I am considering paying this off completely and trying to get the 6.9% deal that Martin says is available to existing clients. I called BC about this and they said there was no guarantee that I would get this rate. As it happens my current BC rate is the lowest of all five cards so my quandry is whether to risk paying this off but not getting a good balance transfer deal or alternatively to immediately put this money towards the balance on the highest rate card.

If memory serves, at least 66% of customers must be offered the "typical rate", otherwise it cannot be advertised as such. In other words, there are no guarantees, as I think you realise.

Also, this rate is not fixed, it's variable. This means Barclaycard reserves the right to raise the rate at any time.

Other than B'card, may I ask which four cards you have at the mo? Also, which providers you've applied to unsuccessfully.People who don't know their rights, don't actually have those rights.0 -

Hi,

Sorry if this is the wrong bit, but I currently have a 1000GBP credit limit on a credit card. The current balance is 833.73.

I'm currently unemployed (still looking) and barely making the minimum payments.

The card is http://www.debenhams.com/webapp/wcs/stores/servlet/CategoryDisplay?storeId=10001&catalogId=10001&langId=-1&userType=G&categoryId=66276

Would switching to virgin 0% card be the best option for me right now? What else can I do apart from the obvious (not spending anymore!, borrowing money from family/friends etc) to reduce the debt?

Thanks kindly 0

0 -

Unfortunately, you're not in a position to get the best balance transfer deals on credit cards.I have £1000 credit limit on a credit card. The current balance is £833.73. I'm currently unemployed (still looking) and barely making the minimum payments. Would switching to Virgin 0% card be the best option for me right now? What else can I do apart from the obvious (not spending any more, borrowing money from family/friends etc) to reduce the debt?

Lenders launch these 0% promotions, which are sometimes heavily advertised, to draw in new customers. Often they are flooded with applications and can afford to cherry-pick applicants. They are all likely to see your lack of a permanent job as too great a risk, so I would concentrate on finding a new job first.

Provided that you continue to meet the minimum monthly payments, your credit rating is not affected.

For tips to improve your chances of credit card acceptance when the time comes, have a look at the *Credit Rating: how it works and how to improve it guide*, especially Martin's *Manage and Improve your credit score* article

http://www.moneysavingexpert.com/banking/credit-rating-credit-score#improve.

Meanwhile, is it possible to move this balance to a new card in your partner's name, if there is one?People who don't know their rights, don't actually have those rights.0 -

Unfortunately, you're not in a position to get the best balance transfer deals on credit cards.

Lenders launch these 0% promotions, which are sometimes heavily advertised, to draw in new customers. Often they are flooded with applications and can afford to cherry-pick applicants. They are all likely to see your lack of a permanent job as too great a risk, so I would concentrate on finding a new job first.

Provided that you continue to meet the minimum monthly payments, your credit rating is not affected.

For tips to improve your chances of credit card acceptance when the time comes, have a look at the *Credit Rating: how it works and how to improve it guide*, especially Martin's *Manage and Improve your credit score* article

http://www.moneysavingexpert.com/banking/credit-rating-credit-score#improve.

Meanwhile, is it possible to move this balance to a new card in your partner's name, if there is one?

Thanks for the reply.

Well I'm currently a full time student, hence the lack of a job, but I'm looking for part time when I return to university.

My credit score is alright as far as I can tell, never been rejected for credit, all green on my experien report.

I'm making the minimum repayments on the card, but the ever increasing amount of interest, I'm just looking for ways to reduce the overall.

I guess you're right about the carrot these card companies offer. Am I putting my credit score at risk by even applying to transfer the balance? Should I wait until at least being part time employed at uni?

Thanks for the reply 0

0 -

Well, you won't get a 0% BT card with an income of less than £8000 pa and even then your choice of card would be extremely limited.I'm currently a full-time student, hence the lack of a job, but I'm looking for part-time, when I return to university. My credit score is alright as far as I can tell, never been rejected for credit, all green on my Experian report. I'm making the minimum repayments on the card, but the ever increasing amount of interest, I'm just looking for ways to reduce the overall. Should I wait until at least being part-time employed at uni?

You say you've never been rejected for credit. May I ask which credit cards - besides Debenhams - you have at the mo or have held recently?People who don't know their rights, don't actually have those rights.0

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards