Mastercard rate on Public (Bank) Holidays

Options

OceanSound

Posts: 1,482 Forumite

in Credit cards

The mastercard rate on a Public (bank) holiday holds as the previous working day's rate. How do I know this? Easy. check Mastercard Currency calculator. e.g.

31 December 2018 (Mon) = 1000 MYR = 190.67 GBP <

working day

01 January 2019 (Tue) = 1000 MYR = 190.67 GBP <

01 Jan is a Public (bank) holiday, so the rate is the same as it was on 31 December 2018

02 January 2019 (Wed) = 1000 MYR = 192.23 GBP <

rate changed.

However, I just realised that this applies only to federal public holidays in the U.S. e.g. Good Friday, Easter Monday are not Federal public holidays. (They are only holidays in some states in U.S.) Therefore, Mastercard rate changed on Friday 19 April 2019 (which was a bank holiday in UK). i.e. it did not hold.

Can someone confirm this?

Also, I noticed something peculiar with the mastercard converter yesterday. Usually, you can only see rates for the previous day. However, yesterday (Saturday 20 April 2019) I was able to see the rate for that day (Saturday 20 April 2019). Never seen that before.

Today when I check (local time in Malaysia: 13:05, EST time=01:05) the mastercard currency calculator is only allowing me to select 20 April 2019, however, there is a message 'Present day's rate is available at 2pm EST'. I've personally never seen this message before. Have you?

Anyway, it seems I would need to check tomorrow (after 2am local time) to see today's rate. But then how do you explain how I was able to see Saturday 20 April 2019 rate on the same day? I definitely checked before 2am. (I know this because I turned off computer just before 1am)

All this may be a bit moot, considering that FRiday's rate holds throughout Saturday (yesterday) and Sunday (today), and changes only on Monday (tomorrow). Am I overthinking this?

31 December 2018 (Mon) = 1000 MYR = 190.67 GBP <

working day

01 January 2019 (Tue) = 1000 MYR = 190.67 GBP <

01 Jan is a Public (bank) holiday, so the rate is the same as it was on 31 December 2018

02 January 2019 (Wed) = 1000 MYR = 192.23 GBP <

rate changed.

However, I just realised that this applies only to federal public holidays in the U.S. e.g. Good Friday, Easter Monday are not Federal public holidays. (They are only holidays in some states in U.S.) Therefore, Mastercard rate changed on Friday 19 April 2019 (which was a bank holiday in UK). i.e. it did not hold.

Can someone confirm this?

Also, I noticed something peculiar with the mastercard converter yesterday. Usually, you can only see rates for the previous day. However, yesterday (Saturday 20 April 2019) I was able to see the rate for that day (Saturday 20 April 2019). Never seen that before.

Today when I check (local time in Malaysia: 13:05, EST time=01:05) the mastercard currency calculator is only allowing me to select 20 April 2019, however, there is a message 'Present day's rate is available at 2pm EST'. I've personally never seen this message before. Have you?

Anyway, it seems I would need to check tomorrow (after 2am local time) to see today's rate. But then how do you explain how I was able to see Saturday 20 April 2019 rate on the same day? I definitely checked before 2am. (I know this because I turned off computer just before 1am)

All this may be a bit moot, considering that FRiday's rate holds throughout Saturday (yesterday) and Sunday (today), and changes only on Monday (tomorrow). Am I overthinking this?

0

Comments

-

You are definitely overthinking, I'm not sure what you're worrying about to be honest. Go relax with a white coffee.

The MasterCard rates are good, stable and they don't load them on non-working days. Bear in mind you'll only get today's rate on purchases made 2-3 days ago, not on any made today.0 -

That old chesnut!You are definitely overthinking,...

Already had a coffee. Thanks...still I'm glad you didn't ask me to 'go have a lie down in a dark room'.Go relax with a white coffee.

Not if you use the curve card for purchases. With curve you receive the inter-bank rate at time of transaction for MOST transactions. This doesn't apply for some transactions (e.g. Airline bookings), where the airline may be in the habit of (without word or warning) processing the transaction as an 'offline transaction' a few days later.Bear in mind you'll only get today's rate on purchases made 2-3 days ago, not on any made today.0 -

Well sure, but you asked about the MasterCard rate not the interbank rate. If your card uses the interbank rate then the MasterCard rate isn't relevant, unless you're trying to compare between two cards. The difference between the interbank rate today and the MasterCard rate in a few days is likely to be very small, assuming no Brexit announcements in the meantime.OceanSound wrote: »Not if you use the curve card for purchases. With curve you receive the inter-bank rate at time of transaction for MOST transactions.0 -

Overthinking and overcomplicating things again.

Just use what you want to use and the rates will be what they will be0 -

As you state, MasterCard don't change rates at the weekend (or certain US public holidays) so, in some ways, there is no reason why MasterCard couldn't just provide weekend rates as soon as they know Friday's rate. Either way you don't really need to worry about why you saw Saturday's rate before the stated publishing time.

The issue you had with Curve and Malaysian Airlines was nothing to do with any strange decision to clear a transaction several days after getting it authorised - that is, in fact, the normal process and how Malaysian Airlines always processes its transaction (and most other retailers across the world for that matter).

The problem you had was because Curve tries to settle/bill transactions at the authorisation/pending stage. Malaysian Airlines sought authorisation for your spending as a single transaction and then (for some bizarre reason) split the 'later' clearing message into two separate transactions. That caused the whole process to 'fall over' because the two clearing messages couldn't be matched to the single authorisation message. Curve will have built a process to cater for this to stop you being double-charged but it does mean that you have to pay at the ex-rate in force at the time of clearing rather than authorisation.

On that occasion you appeared to lose out, but if the ex-rate had moved the other way, you would have appeared to gain.

That is the normal process for most transactions across the world on most credit cards. Curve is different because it is trying to bill you/take your money earlier on in the process so that it can benefit from it.0 -

I don't think he said MOST in his post. He said:Terry_Towelling wrote: »...That is the normal process for most transactions across the world on most credit cards.....

Not clear if he was talking about Curve or MOST other cards.The MasterCard rates are good, stable and they don't load them on non-working days. Bear in mind you'll only get today's rate on purchases made 2-3 days ago, not on any made today.0 -

Just visited Mastercard Currency Calculator page. Guess what, I can see today's rate already!.

The message I saw ealier 'Present day's rate is available at 2pm EST' is a load of tosh.

Why? because EST time now is 11:46am, well before 2pm. local time where I am is 23:46hrs (11:46pm)

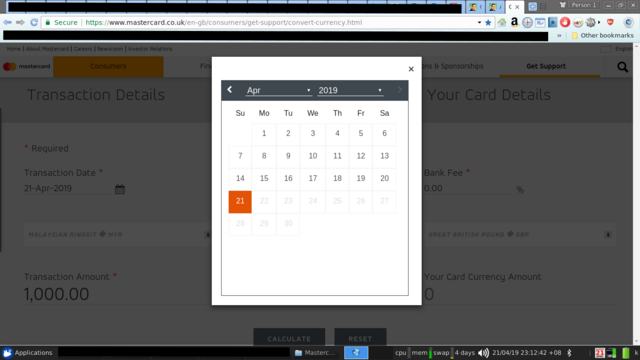

Here's the screen shot showing I can select today's date (if you don't take my word for it): 0

0 -

We do, it's just that you're the only one here needlessly obsessing about it.OceanSound wrote: »(if you don't take my word for it)0 -

You've lost me completely, OceanSound.

What dj1471 said was that (for a 'traditional' card using the dual-message system - which most do) a purchase on any given day may receive authorisation and become pending at the ex-rate on the purchase date but won't be cleared until 2 or 3 days later at the ex-rate in force on that later clearing date. That is correct in the world of dual-message processing.

What I've been trying to explain (obviously not very well) is that Curve is trying to operate a single-message clearing process where they use the information in the authorisation message (at the pending stage) to do the clearing rather than waiting for the clearing message.

Behind the scenes they are still receiving the later clearing message but, because they have set themselves up to do the conversion themselves and to presumably settle up-front in US$ with MasterCard, they can use the rate on the purchase date to clear transactions.

They obviously have some fancy arrangement with MasterCard to handle the later clearing message if they can show it matches with a prior authorisation message. In your Malaysian Airlines issue, the 'split' clearing message failed to match up with the authorisation message, so those two transactions were treated as being entirely new and unrelated to anything that had gone before.

As for the updating of the MasterCard ex-rate (which is irrelevant for Curve), it probably happens earlier during the weekend because it is the same rate as was in force on the preceding working day and updating it is therefore not dependent upon anything else. Stating a deadline for updates doesn't mean they can't update it earlier.0 -

How could I possibly have been referring to Curve? Nobody had mentioned Curve and you were asking about cards that use the MasterCard exchange rate, which Curve doesn't!!! My response relates to what you asked, not what was in your head.OceanSound wrote: »Not clear if he was talking about Curve or MOST other cards.

If you're going to be pedantic at least pay attention.0

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards