2013 Frugal Living Challenge

Comments

-

Wow, the new thread! Its amazing how excited I can become over a new thread - think I may be a bit of a MSE geek but proud of this nonetheless.

Will defo be joining again for 2013. I am having a bit of a dilema just now about applying for a job that may mean me moving house (if I get it). I have very small amount of savings but no mortgage (paid off earlier in 2012) and it would mean that I would have a permanent job again. Moving to this location is actually part of my 5 year plan but I am just not sure if I should accelerate that plan or wait until I have more avialable cash.January GC 2024 £135/£180

Frugal living Challenge 20240 -

I'd like to join in with this

I'm hoping that being more frugal will allow me to hit my savings target in 2013. This means I have now started to think of what I can change, what I am spending on wants instead of needs and I will start this off by trying to put together a budget which I found on your list in the 1st post so thank you Frugaldom.. 2018

I'm hoping that being more frugal will allow me to hit my savings target in 2013. This means I have now started to think of what I can change, what I am spending on wants instead of needs and I will start this off by trying to put together a budget which I found on your list in the 1st post so thank you Frugaldom.. 2018

Target £25,000 | £15,008 Saved0 -

Please can you add me to this years challenge.. I've been hiding away reading all last years posts & really need to get my butt in gear & do something about how we live! I'll be thinking of my budget & put up later/as soon as I can x Thanks for all the inspiration x"There's a little witch in all of us"🥰DEBT FREE 06/2018MrsSD 2023 Decluttering Campaign:🏅⭐️ ⭐️ ⭐️0

-

I really, really need to get back to this.

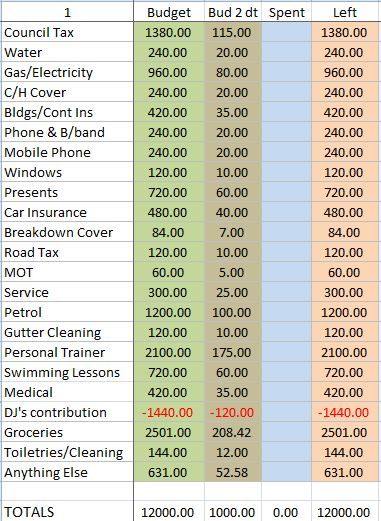

I just tried setting my budgets for next year, and I'm coming in at £2k more than I'd like to be, even after asking my son to increase his contribution to household running costs/grocery bills by 50% - so that's all going to have to come out of my savings :eek:

In fairness I could claw it (and more) back by cancelling my swimming lessons and personal trainer sessions, but with the health issues I'm having at the moment (and my long standing back problems) I think anything that forces me to exercise is money well spent :undecided Plus the swimming lessons are to get my techniques right (I can potter up and down for about 20 lengths in my own style), which means I shouldn't end up with back ache the next day as often happens now.

The budget's also not helped by the fact my grocery bill keeps climbing - and not just because of the costs rising in the supermarkets. It's looking increasingly likely I've developed lactose intolerance, but in the last couple of weeks I've also started to think I may be having issues with other foodstuffs (avoiding dairy but still having problems) - and that all means I'm having to pick and choose foods more carefully, and generally end up with much more expensive options (eg. my soya milk's almost twice the price of fresh skimmed milk, and the only cheeses I seem to be able to handle are goat's/feta which are a lot dearer than cheddar - especially compared to when mature cheddar comes up on offer). The grocery budget covers me for the whole year, my son for 2 days a week (about all he seems to be around, with the rest of the time spent at his girl-friend's) and my OH one day a week.

However it's looking possible I may be able to get a few extra hours work each week - and am hoping to tie them into a day I'm already at the gym for a PT session which means no extra petrol/car expenses. That would cover about £800 of my 'overspend' which is nice

I currently work Wed, Thur and Fri, with one PT session after work on Thur and my swimming lesson after work on Fri. My other PT session is on a Monday, so I'm hoping to do the extra hours that day so that I don't have to increase car running cost budgets - the boss is fairly flexible as to whether I do them Mon or Tues, so I may even be able to move them if I want a long weekend and not have to take holiday time

At least some of my exercise expenses (and all my commuting costs) are effectively covered by my employer. I used to pay £35/month for gym membership, but now I work there it's free as a perk of the job. So about £14/month of that covers the petrol I use to get to work, leaving the rest to offset other costs

I've had to set my 'medical' costs a lot higher than I wanted to, but that's because I remembered I'm due an eye check-up (and almost certainly new glasses) in October/November - which is over and above dental and prescription costs that were all I'd originally budgetted for.

I'm expecting to have to make some tweaks the first week of next month (after reading gas, electric and water meters and adjusting payments as necessary - almost certainly upwards ), but as it stands after a first stab my spreadsheet looks like this

), but as it stands after a first stab my spreadsheet looks like this

EDIT: I've already realised I'm going to have to increase my presents budget as I've not allowed anything for my brother, sister-in-law and nephews, nor OH's niece (let alone other members of his family!). I'm hoping to make some and cover others with vouchers from surveys (must get back to doing those on a regular basis), but it's still going to be a hefty upwards jump in case those plans don't work out Cheryl0

Cheryl0 -

It's looking increasingly likely I've developed lactose intolerance, but in the last couple of weeks I've also started to think I may be having issues with other foodstuffs (avoiding dairy but still having problems) - and that all means I'm having to pick and choose foods more carefully, and generally end up with much more expensive options (eg. my soya milk's almost twice the price of fresh skimmed milk,

Ohhh with you on that one Cheryl - I'm lactose intolerant and my milk costs come in at around a staggering £400+ / year :eek: when you think you can get fresh "normal" milk for 43p / litre and the lacto*free stuff is around £1.30 / litre :eek::eek: it quickly adds up.

I'm really struggling to keep my grocery bill under control - both from the lactose issues and having been ill recently I'm on a very restricted diet now ... and again it seems to consist of expensive foods *sigh*

I feel the way you do about your personal trainer with my massages - they help my back so much that there are other sacrifices I'd make first before getting rid of them.

Exercise is a good one as it's not built into my budget at all just now :eek: - I do a lot of walking with the dog but do find swimming helps the back too .... must look into that more as I get a staff discount at the pool!:oGrocery Challenge £211/£455 (01/01-31/03)

2016 Sell: £125/£250

£1,000 Emergency Fund Challenge #78 £3.96 / £1,000Vet Fund: £410.93 / £1,000

Debt free & determined to stay that way!0 -

2013 budget

Might be a bit of tweaking still but just about there I think!

Red + and Green - figures are differences from last year

I have got some savings figures included in here which shouldn't really be in my overall expenses total but I use the SoW to keep track of all my monthly payments / direct debits as well so they've had to be added for that purpose

Overall reduction of nearly £450 on last years figure but not sure if that's really a sensible move! Still .... it is a challenge so! Grocery Challenge £211/£455 (01/01-31/03)

but not sure if that's really a sensible move! Still .... it is a challenge so! Grocery Challenge £211/£455 (01/01-31/03)

2016 Sell: £125/£250

£1,000 Emergency Fund Challenge #78 £3.96 / £1,000Vet Fund: £410.93 / £1,000

Debt free & determined to stay that way!0 -

Here's my budget for 2013 - aims are to pay off £7900 cc debt and hopefully make some overpayments on my loan with just over £8000 to go. I haven't included mortgage or debt repayments, council tax or the cost of the MA I'm studying. We recently got rid of Sky and have no tv aerial so don't have to have a tv licence for watching catchup online so have saved on that.

Electricity £300

Oil £500

Life insurance £248.04

Home insurance £100

Mobile phone £120

Presents £200 (4 x birthday 4 x Christmas)

Car insurance £200

Petrol and bus fares £500

Car tax £95

Clothes & shoes £200

Haircuts £100

Social life £500

Groceries £1200

Cleaning supplies and toiletries £200

This leaves me with enough for a couple of hot stone massages all for £4500. I've been seriously considering selling my car as it's only 3years old is still under warranty with servicing included for another 2 years and would raise about £6500. I get the bus to work and walk home as I only work 3 days a week and only use the car to go to the supermarket and my voluntary work, both of which are on bus routes. I'll probably decide around April time when the weather is a bit nicer!

"I cannot make my days longer so I strive to make them better." Paul Theroux0 -

I am thinking of joining, I tried a few years ago and failed miserably!

I am going to do some reading. Not sure what I can manage, done a rough budget for the first time! and am in back in debt - due to my lack of budgetting and ability to save (this sentence is all a bit backwards but I really need the Loo so it is staying like that)

xxNevertheless she persisted.0 -

Wishing everyone a Merry Christmas and a Happy New Year.Frugal Living Challenge 2024 Mortgage free as of 1st August 20130

-

I'd like to join please. Aside from paying off masses towards debt including the mortgage, my budget is looking like £12k for the year. That's being very frugal with food, but the cats are a huge expense - about £300/month including insurance. DH won't agree to ditch Sky or get cheaper broadband, so there's not a lot else I can cut from fixed expenses, although I'll be ditching my mobile contract in May for PAYG. I'm not including anything on clothes/haircut/social life because those aren't really things I do. I'll be cooking from scratch, taking lunch into work and growing some veg. It's really a continuation of plans I've put into motion the past 3 months; I've finished tweaking them, now it's time to live them out."Save £12k in 2019" #120 - £100,699.57/£100,0000

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608K Mortgages, Homes & Bills

- 173K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards