What's wrong with people.

Comments

-

It's my opinion, controversial no doubt, people who are struggling simply choose to make bad financial decisions and don't seem to have the capacity to recognise as much or more importantly the desire to seek help and/or mend their ways. Everything that's wrong is someone else's fault.

Being frugal is not cool.

One thing that stuck with me after watching one of those nasty poverty !!!!!! TV programs years ago which paradoxically I object to and typically avoid...

This glamorous young thing, caked in makeup, nice hair do, thousands in debt, living with parents and struggling to make ends meet day to day speaks into the camera,

'Just because I'm on low pay why shouldn't I have nice things.'

I agree there is a certain sense of entitlement now with a large proportion of society. Its been fostered by the media through advertisements and to an extent the government wanting to perpetuate the consumer society. Individuals living beyond their means for any length of time isn't any good for any of us.

Take cars for example. It wasn't that long ago that people drove older cars without any real hesitation. Now new drivers are wanting brand new cars. The average of the cars on the road must have reduced significantly in the last 10-15 years.0 -

We have a social welfare system that discourages saving. If you do not have much you might as well spend it all. What are they going to do take the crap you bought back?

.

That's exactly the problem. My Dad has just retired having saved reasonably hard on an average salary most of his life. Some of his peers haven't saved a bean yet with their top ups and credits they are only marginally worse off than he is. Its easy to see how someone would think "why bother?"0 -

bowlhead99 wrote: »So, it's a nice story (and there are plenty of blogs which are very evangelistic about financial independence / retire early etc - Mr Money Mustache is quite fun). But, "why doesn't everyone do it like me it was eeeeaaasssy" seems a bit like bragging, tbh.

It is bragging in a way. I've been doing a lot of reading and listening to blogs recently... most of the people who shout loudest about FI fall into a similar category. They're certainly all intelligent and are able to earn good money in a short space of time. None of these people are earning minimum wage and struggling to feed the kids.0 -

Anonymous101 wrote: »That's exactly the problem. My Dad has just retired having saved reasonably hard on an average salary most of his life. Some of his peers haven't saved a bean yet with their top ups and credits they are only marginally worse off than he is. Its east to see how someone would think "why bother?"

because they will be marginally better off? Margins can make a difference.0 -

The economy needs people to spend money on things they don't really need. We'd all be in a mess if they didn't.0

-

because they will be marginally better off? Margins can make a difference.

Marginally better off in retirement by sacrificing throughout their whole working lives though.

Its sent me the other way and made me endeavour to save even harder for my retirement. If I were unable to though it would certainly have me thinking if it was worth it.0 -

-

The OP does seem to be Willy Waving0

-

longleggedhair wrote: »Despite earning big money, why are some people in big debt and have no savings.

I think it's definitely a psychological thing. I had parents who were professionals & earned very good money, but never had any money, because while they are both intelligent people they are financially illiterate. Money was just wasted on needless things and quite often financial problems would crop up.

The experience as a child changed my whole mindset and as an adult I've saved & invested with every pay rise. Just added up my latest total and im around £200,000 after 12 years....and it really was very easy! I don't earn big money (just above minimum wage) I did have a small inheritance and have done well with my investments.

The key is not to chase the posh cars/clothes/phones. I absolutely love my life, I live it to the full but that money gives me so much security and happiness you wouldn't believe. I know that if I want I can walk out of work tomorrow I can, it gives you choices. And that security is worth far more than material things.

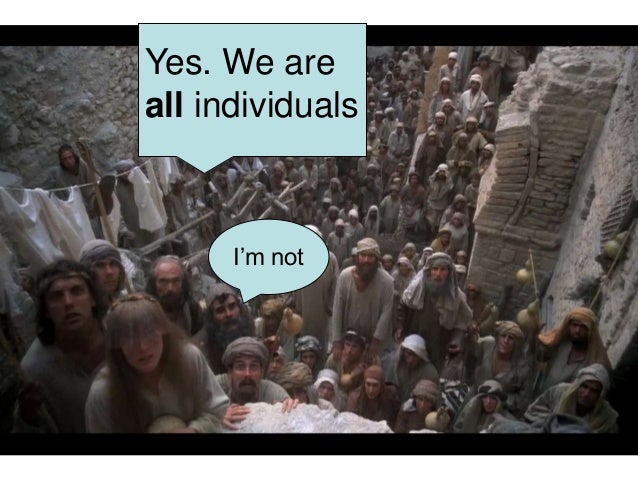

As others have said it's important to live life and enjoy it, we only come this way once, but what I don't understand is why most people haven't "seen the light" (time is precious, we don't have much so why spend most of our life at work to buy things that make us feel better about going to work, which then results in us having to be at work almost forever) I work with people who hate work, are desperate to leave but have no prospect of ever being able to become they are driving the posh car, the designer clothes etc

It seems so simple to me...but why have so few seen the light?

The answer lies in understanding the psychology of status competition, because a consumer society is just a society in which consumption is the primary means of competing for status.

Maximising status is about recognising the difference between commodities whose value is relative and those whose value is absolute. The former is a conspicuous consumable, the latter an inconspicuous consumable. For example, the value of a car is measured by whether it's bigger/newer than the neighbours, but the value of say a central heating boiler is in how well it heats the house. Nobody sits in the pub bragging about boiler power the way the would about the power of their car engine.

Pensions and spare time are both inconspicuous consumables: the guy with a Ferrari and no pension has higher status than the guy with a pension and no Ferrari. Similarly, the chief executive with money and no spare time has more status than a dosser with lots of time but no money.

For more reading on the subject see here:

Robert Frank, Luxury Fever

Geoffrey Miller, Spent

Thorstein Veblen, Conspicuous Consumption0 -

This discussion has been closed.

Categories

- All Categories

- 343.1K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.2K Work, Benefits & Business

- 607.9K Mortgages, Homes & Bills

- 173K Life & Family

- 247.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards