We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

SMT Sell now to utilise CGT or wait?

Comments

-

Any active fund is a gamble really, you could toss a coin....

2 -

Impossible to say what will give the best outcome, but another option on the table would be to Bed&ISA SMT, then switch to a tracker later. You won't be realising a loss at this time, and might have an opportunity to sell when sentiment is better.

2 -

Biggest mistake investors often make is to become emotionally attached to investments. Waiting for a share to return to past highs. We all get investment decisions wrong. Learning to accept them and take the hit on the chin, before moving on. Is a skill worth learning. Toughens you up. Just life.4

-

Thanks all. . Not troubled about the big hit , just wanted to be sure there wasnt an angle I hadnt considered/didnt know about which was less of a gamble than another .1

-

SMT is still up 118% over the past 3 years, so not much of a big hit if you have been invested in it for at least that length of time. However as masonic says a Bed and ISA might be a good idea if you don't want to sell at this time.ANGLICANPAT said:Thanks all. . Not troubled about the big hit , just wanted to be sure there wasnt an angle I hadnt considered/didnt know about which was less of a gamble than another .

3 -

I'm not overly concerned with selling SMT to optimise CGT right now.

I'm concerned that SMT SP could halve in the next 3 months thanks to the actions of Mr Putin, or if I sell now it could gain 50% while I hold cash if issues in Europe are resolved.

I should add that I'm more concerned about the wellbeing of several million Ukrainians than the performance of my investment portfolio!“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway1 -

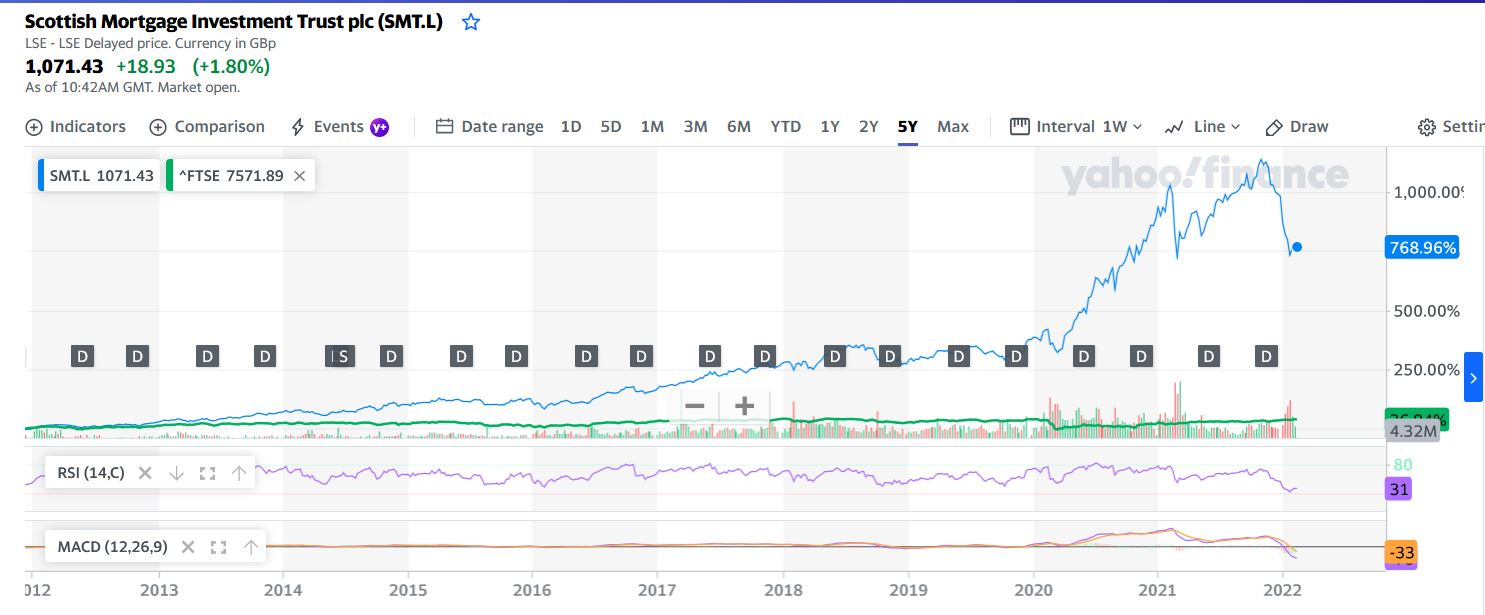

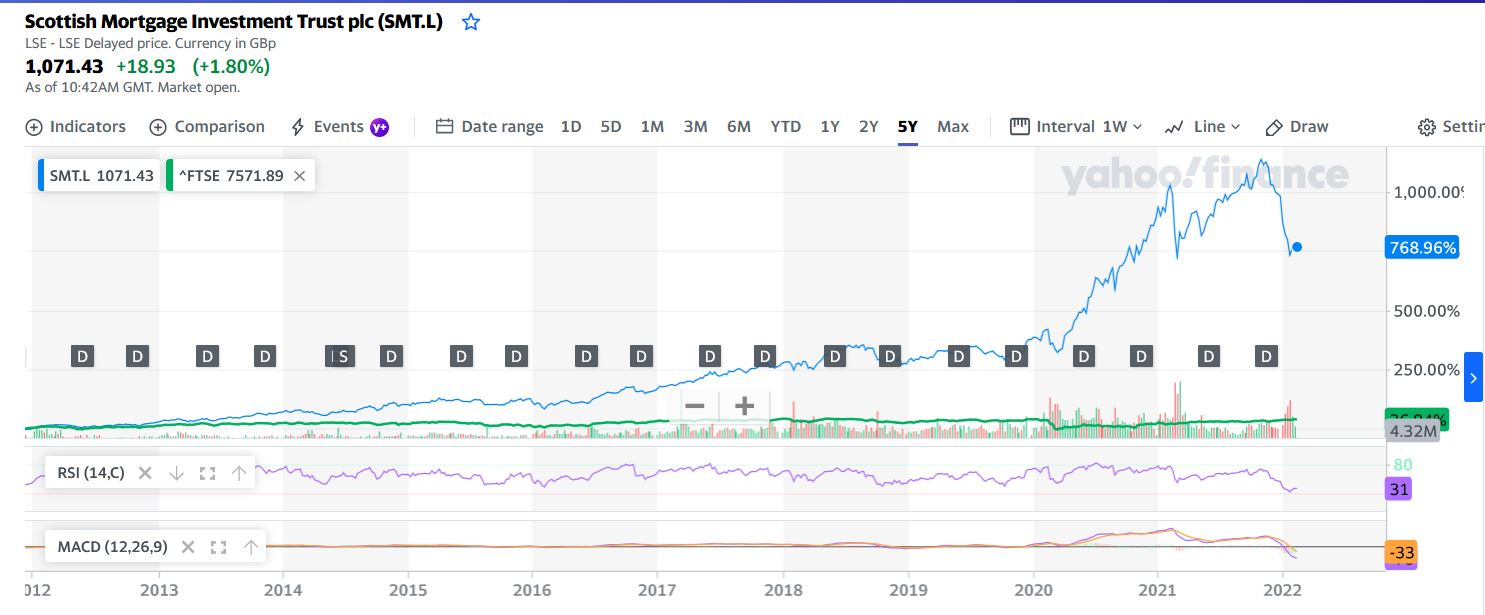

NoviceInvestor1 said:Any active fund is a gamble really, you could toss a coin....Very bold and misleading statement. If your statement was true then you would not find any active funds survive over a few decades. Why would sensible people want to buy active funds with higher fees but only performing worse then an index fund with less fees ?. Plot both of them during a reasonable amount of time and compare it and see whether you still come up with that conclusion. Here is just one example SMT (blue) vs FTSE 100 (green) over 5 years period.

Any investment in the stock market will involve some level of risk (call it gamble if you want). But for good funds, higher risk will normally come with higher reward. It is up to you to decide your risk attitude. Come back to this thread (say in one year time) and see how SMT will perform.

Any investment in the stock market will involve some level of risk (call it gamble if you want). But for good funds, higher risk will normally come with higher reward. It is up to you to decide your risk attitude. Come back to this thread (say in one year time) and see how SMT will perform.The fund like SMT contains a lot amount of high growth stocks which are normally not performing well in the bear market, high inflation with high interest rate, high degree of FUD (fear, uncertainty and doubt) in the market. But when they recover they also recover with multipliers. Just wait until all of this is over (and compare with the performance with the index fund, especially if you only buy this sort of fund during “the significant dip”, to be combined with drip-feeding DCA down) from that point and not blindly buying it at point even at the peak.

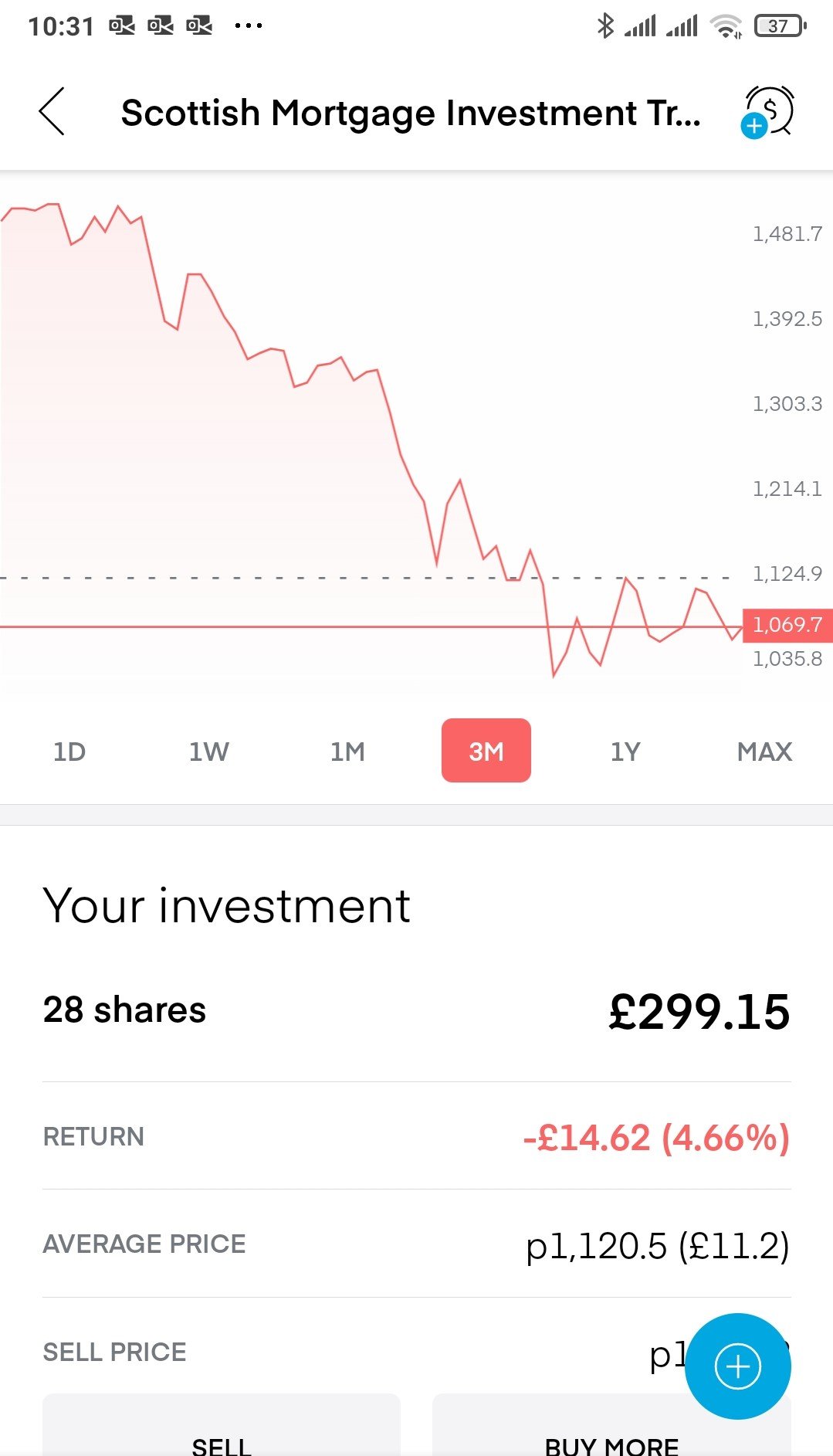

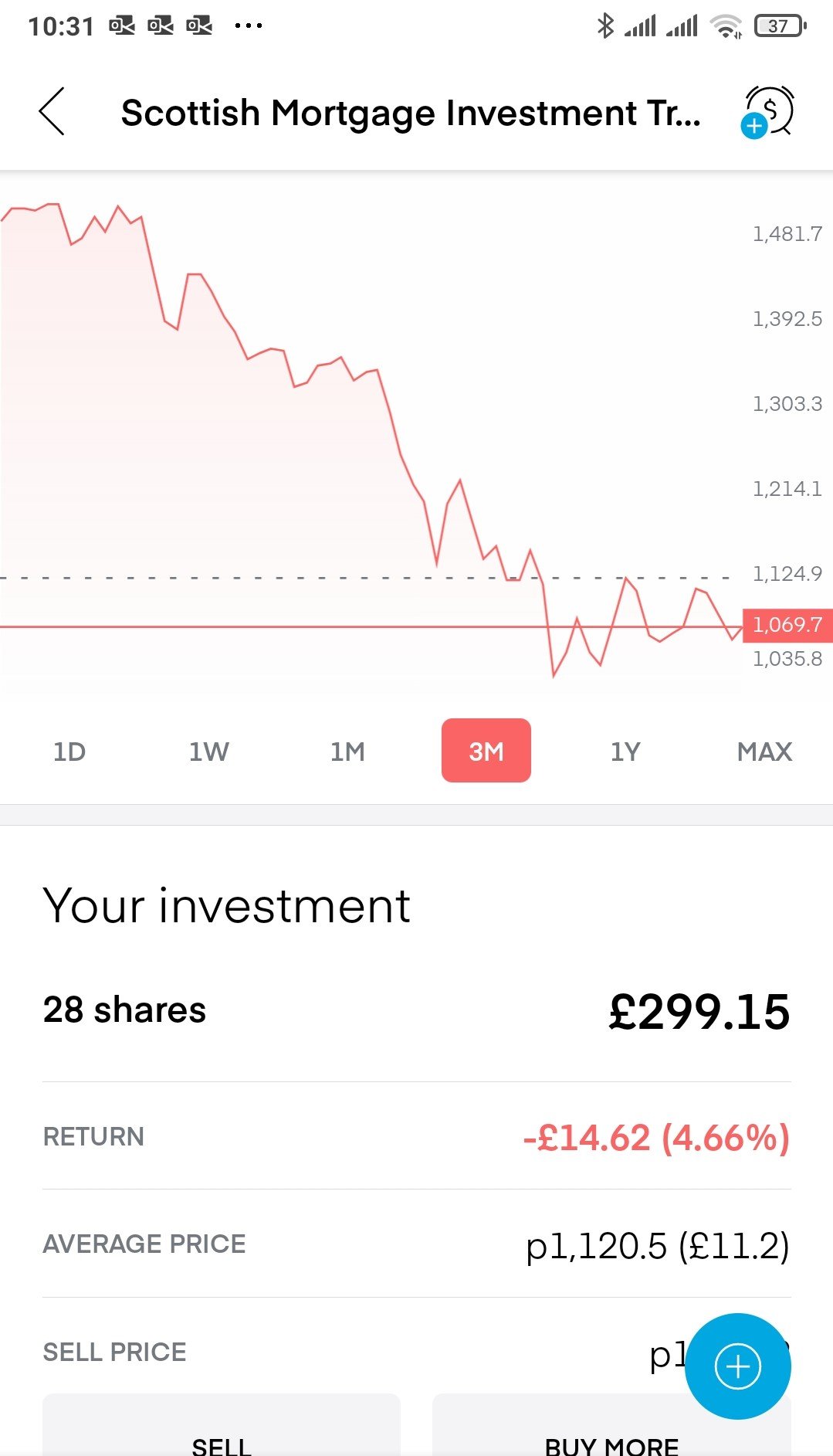

This is my result of my SMT by Combining "Timing the Market buy the dip and Drip feeding DCA down)" during the dip. I have set up a limit buy order for 2 shares to be triggered around @GBX1020 e.g the new low.

0 -

Steve182 said:I'm not overly concerned with selling SMT to optimise CGT right now.

I'm concerned that SMT SP could halve in the next 3 months thanks to the actions of Mr Putin, or if I sell now it could gain 50% while I hold cash if issues in Europe are resolved.

I should add that I'm more concerned about the well-being of several million Ukrainians than the performance of my investment portfolio!If Russia invades Ukraine, most stocks will tank anyway. The exception is probably only stock highly connected to industries like War Machines, Gold, Oil & Gas, Food & StaplesBut what are the other alternatives, Bonds, T-Bond, Gilts ? It is a certain money losing strategy considering inflation.The possibility that Russia will invade Ukraine is probably much lower nowU.S. stock futures jump as Russia says some troops are heading back to base

https://www.cnbc.com/2022/02/14/stock-market-futures-open-to-close-news.html

Dow futures jump more than 400 points as Russia pulls back some troops from Ukraine border.

0 -

adindas said:NoviceInvestor1 said:Any active fund is a gamble really, you could toss a coin....Very bold and misleading statement. If your statement was true then you would not find any active funds survive over a few decades. Why would sensible people want to buy active funds with higher fees but only performing worse then an index fund with less fees ?. Plot both of them during a reasonable amount of time and compare it and see whether you still come up with that conclusion. Here is just one example SMT (blue) vs FTSE 100 (green) over 5 years period.

Any investment in the stock market will involve some level of risk (call it gamble if you want). But for good funds, higher risk will normally come with higher reward. It is up to you to decide your risk attitude. Come back to this thread (say in one year time) and see how SMT will perform.

Any investment in the stock market will involve some level of risk (call it gamble if you want). But for good funds, higher risk will normally come with higher reward. It is up to you to decide your risk attitude. Come back to this thread (say in one year time) and see how SMT will perform.The fund like SMT contains a lot amount of high growth stocks which are normally not performing well in the bear market, high inflation with high interest rate, high degree of FUD (fear, uncertainty and doubt) in the market. But wait until all of this is over (and compare with the performance with the index fund, especially if you only buy this sort of fund during “the significant dip”, to be combined with drip-feeding DCA down) from that point and not blindly buying it at point even at the peak.

This is my result of my SMT by Combining "Timing the Market buy the dip and Drip feeding DCA down)" during the dip. I have set up a limit buy order for 2 shares to be triggered around @GBX1020 e.g the new low.

I don't think it's either bold or misleading whatsoever, it's 100% accurate - any active fund is a bet.

You are betting that the fund is going to outperform the market. The fund is betting that the stocks they buy are going to outperform the market and grow their earnings/valuation quicker than the consensus opinion of all market participants. Fund managers will often be asked about their big bets, people will talk about factor bets (i.e. growth, value, quality etc). Picking SMT is a gamble, in the way any other active fund is a gamble. Not only that but the odds of winning are factually and statistically very low. What aspect of that is misleading?

You ask the question; Why would sensible people want to buy active funds with higher fees but only performing worse then an index fund with less fees ?

Statistics show that most active funds underperform the index. The answer is those sensible people are betting they can beat the odds.

By the way are you really using the FTSE 100 as a comparative benchmark for SMT!? Very strange choice.

0 -

SMT is itself a FTSE 100 constituent.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 350.9K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.5K Spending & Discounts

- 243.9K Work, Benefits & Business

- 598.7K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards