We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Loan and credit card advice...

Comments

-

No reason to worry yet, but I'd chase them up on the phone. The fact you've not been declined yet is a good sign and I would hope your application is sitting in a pile labelled "Couple of bits to check on these before we accept."

My restaurant tastes run to aged steaks, fine wines and a selection of single whiskies. Actually, who am I kidding? I'll accept a bag of chicken nuggets.0 -

Hopefully it's on the "right" pile!

Shall ring tomorrow and see what's occurring!

Popcorn chicken is lovely, had some yesterday Pugzy...aka Mike

Pugzy...aka Mike

DFW Nerd #13550 -

Finally had chance to ring them a few minutes ago (have been changing job this week and not at home!), sorta happy, sorta not, need advice please!

Good news; after being put on hold for countless times in the Apps Dept, they accepted me for the 0% Money Transfer until Oct 2012 (16 months).

Bad news; she said straight after saying everything had gone through and a card was being issued, my limit was £2000, to which I replied, "my application does states £3500 doesn't it as anything less isn't much use!"

I got put through to the Closure Dept by the useless bint (she was really unhelpful and never even explained my situation to the other girl in the Closure Dept beforehand) and explained my situation to them meaning I got a bit irrated. She explained that even though the higher £3500 limit hadn't been approved at this point, this was due to having no credit history with MBNA for proof of payments etc. She did suggest that maybe I just use the £2000 limit towards the Lloyds loan now, pay a couple months back to MBNA and then ask them to heighten the limit to whatever was left on the loan at point (would be circa ~£1400) and fully complete paying it off. That way, loan paid and just debt with MBNA at 0% rate until Oct 2012.

This has left me totally puzzled, I am open to cancelling the card at the moment too she said.

Tell me if I'll be paying more per month or not doing it this way?

Loan will come down from £3414 to £1414.

MBNA will have £2000 on it.

Loan will be getting paid £118.65 per month at 14.88% APR (currently what I pay per month).

MBNA will be getting paid X amount per month at 0% APR (can't remember the minimum payment %).

Do I continue or is this going to !!!! things up?

:):(:):( Pugzy...aka Mike

:):(:):( Pugzy...aka Mike

DFW Nerd #13550 -

I think you take it. Transfer what you can so you're paying 0% on at least some of the debt.

Maybe make a LITTLE more than min payment on the MBNA card, so that when you phone up in 2-3 months, they can see that you're intending to pay it back, not just tarting.

I certainly wouldn't close it it. If you do, you'll remain paying all your debt with interest and your chances of getting another card will diminish slightly, as the MBNA search will show up. A new lender may assume (wrongly) that you're looking for a 0% deal, been rejected by MBNA, so making more applications in desperation.

I think MBNA are not completely averse to reviewing credit limits, though it may take more than a couple of months.0 -

That's good advice, thank you!

So then, I now ring up MBNA, ask them to put the £2k in my bank, I then go into Lloyds and say "pay this towards my loan", will they just move it over for me? Will an actual £2k all go towards the loan or will some of this end up being interest too, meaning that the big total is still quite big as opposed to £2k less?

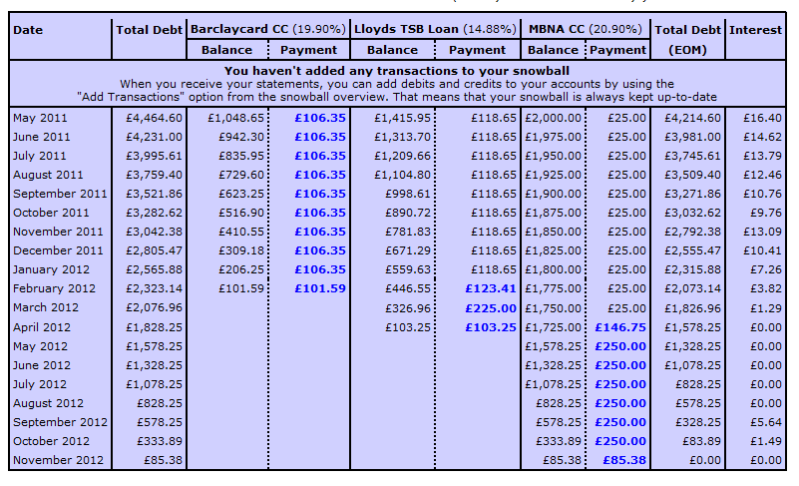

Snowball Debt Calculator reckons that if I throw £250 per month at all my debts, I'll be debt free by Nov 2012 it also suggests that clearing them in balance order will be more beneficial than interest order by over £100?!?! I hope to be earning some bonuses on a quarterly basis in between now and then too

it also suggests that clearing them in balance order will be more beneficial than interest order by over £100?!?! I hope to be earning some bonuses on a quarterly basis in between now and then too  Pugzy...aka Mike

Pugzy...aka Mike

DFW Nerd #13550 -

Yes - get the cash into your account, then send it to Lloyds. It'll come off the principal effectively, as you're already making monthly payments - kind of like a credit card overpayment.

Don't follow what you mean about paying off in balance order rateher than interest order?0 -

Ahh I see

On the calculator, I put in all my debts, APR's, promo lengths, minimum payments and how much I want to pay towards all my debts per month, then it gives you 2 choices as to whether you would rather pay off the amounts in Interest Order (doing what you said to do) or pay them off in Balance Order (focussing on the smaller debts and clearing that first). If I was to pay them all on Interest Order, I'll pay £260 in interest over 19months. If I pay in Balance Order, I'll pay £120 over 19months.

Those aren't taking into consideration that I'll BT my Barclaycard to another 0% deal in October so no interest will be there either in reality.

Either way, it's good! Pugzy...aka Mike

Pugzy...aka Mike

DFW Nerd #13550 -

This is the table for the Balance Order.Pugzy...aka Mike

DFW Nerd #13550 -

I see. So you need to gamble on getting another decent card later down the line. Can't help you with I'm afraid! But things don't seem to be looking too bad for you (congrats on the job by the way - saw your other thread). I'd say you're not going to be an obvious 'no chance in hell' applicant - and lending may have eased a little further by then.0

-

No mate...thank you, you couldn't have been anymore helpful and would have made some bad decisions had you not guided me with your advice!!!

:):)

:):)

Going to get on to MBNA and get that money over ASAP.

Thanks on the job front too, it's hard but the money, recognition and potential rewards are cracking and hopeully in a few months time, I'll be ending this thread with a DFD! Pugzy...aka Mike

Pugzy...aka Mike

DFW Nerd #13550

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards