Quarter of a million reasons to be Mortgage Free!

Comments

-

wantabetterlife wrote: »It looks beautiful...can oaks where you bought the curtains? I just love them!

The curtains were from N3xt I think. I tend not to get involved with the design elements Nov 2015:- Mortgage Balance £244,671

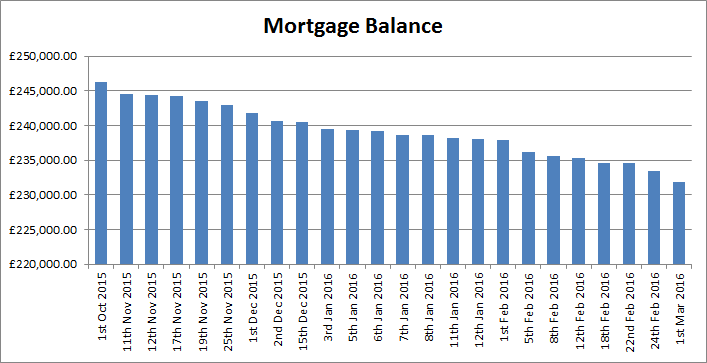

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've sold some shares today in a non performing bank and made another overpayment to the mortgage of £750. It means February really has been a fantastic month for overpaying.

Feb 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £3,011.19

(Shortfall) / Surplus . . . . . . . . . . . . £1,261.19

Cumulative Targets to date

Cumulative overpayment target . . . £7,000.00

Cumulative actual overpayments . . . £8,673.19

(Shortfall) / Surplus . . . . . . . . . . . . . £1,673.19

Other stats

Cumulative interest saved. . . . . . £7,200.00

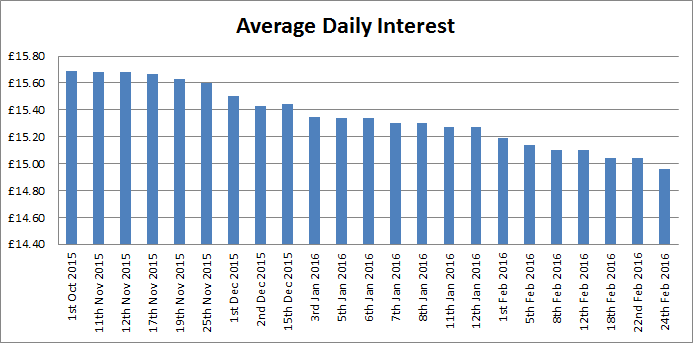

New estimated daily interest . . . . . £15.04

New mortgage balance . . . . . . . . . . £234,585

Financial Planning

I've been doing a lot of reading lately and I am getting more and more excited by the idea of financial independence. I'd realised quite a while ago that I want to retire early to spend more quality time with my wife as we would love to go travelling together and see the world. However to do this it is becoming apparent that I need to give more thought to long term financial planning.

I've been reading Edinburgher's diary and apart from enjoying his writing style I am also impressed by his attitude to financial independence and long term planning.

So........... things for me to consider are as follows:-

- As a result of this diary I have increased my pension contributions from £200 per month to £500 but I still don't think this is enough. I would like to get this closer to £1,000 per month by looking at adding employer contributions (I own 33% of my business). My pension pot is currently around £26k which is way off where I need it to be.

- I still haven't sorted my wife's pension out yet so this will be tackled in the next few weeks. We have sat down with 2 financial advisors so it is just a case of looking through the figures and picking one.

- I would like to do some research on ISA's for the start of the new tax year and start diverting some funds to these. Ideally I would like some kind of equity ISA to offer a greater cumulative growth.

- I also need to give some thought to how aggressive I am being with my mortgage overpayments. I am fully committed to overpaying the mortgage but I don't want it to be at the expense of losing out on building an asset portfolio.

- Lastly but not leastly I would also consider a BTL porfolio. I just need to understand the new tax rules for private landlords and also accept that this isn't one to set up overnight but if I don't plan for it, it will never happen.

- Continue with my "fun" investing of a small amount per month into equities but research what I am doing with a little more care.

- I also need to balance all of this with the wants and needs of daily life! New kitchens and drives to be paid for and holidays and fun days out with the kids.

Apologies for the long post but my head is spinning at the moment and I needed to get some thoughts down on "paper"Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've had a productive weekend and managed to get a few things sorted that have been on the "to do list" for a while.

1. I cleaned both our cars inside and out which means I saved £25 as I would usually take these once per month to be cleaned. The £25 saved has found it's way to the mortgage account this morning

2. I also did some research on current accounts as I figured I was missing out on some free money by only having 1. I have applied for 5 new current accounts which give the best rewards and I figure I will make around £30 per month once they have all been set up and direct debits moved around etc.......

3. I also started de-cluttering the house and have earmarked a number of unused items for 3bay. I have 4 things listed on there at present and will aim for 3-4 new listings each weekend.

4. I also managed to do a few DIY jobs that have been hovering over me for a while. A new shelf put up in DD's bedroom, fixed the en-suite light switch and fixed the flush on the toilet.

5. I also went to the tip and recycled lots of cardboard that was lying around the back of the annex from all the new furniture that has been assembled in there.

6. I opened up a stocks and savings ISA through Charle5 Stanl3y and have transferred some funds over to start buying some investment funds.

7. I also managed to get my hands on a number of books that I have been wanting to read (Rich Dad Poor Dad, The intelligent option investor, Buffett: The making of an American Capitalist, Trade your way to financial freedom and The little book that still beats the market.Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've received my Feb dividends today which would usually be used for my March overpayments but I figured the sooner it found it's way to the mortgage the better! Therefore £1,250 paid off the mortgage today

Feb 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £4,286.19

(Shortfall) / Surplus . . . . . . . . . . . . £2,536.19

Cumulative Targets to date

Cumulative overpayment target . . . £7,000.00

Cumulative actual overpayments . . . £9,948.19

(Shortfall) / Surplus . . . . . . . . . . . . . £2,948.19

Other stats

Cumulative interest saved. . . . . . £8,259.00

New estimated daily interest . . . . . £14.96

New mortgage balance . . . . . . . . . . £233,400

My daily interest has dipped below £15 for the first time ever! A small milestone to celebrate :beer: Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

A new month rolls in and my monthly direct debit has gone out for £1,045 plus my monthly standing order overpayment of £546.

Mar 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £546.00

(Shortfall) / Surplus . . . . . . . . . . . . (£1,204.00)

Cumulative Targets to date

Cumulative overpayment target . . . £8,750.00

Cumulative actual overpayments . . . £10,494.19

(Shortfall) / Surplus . . . . . . . . . . . . . £1,744.19

Other stats

Cumulative interest saved. . . . . . £8,705.00

New estimated daily interest . . . . . £14.87

New mortgage balance . . . . . . . . . . £231,926

This brings my total overpayments to just over £10,000 since I started this thread and I should dip below £230k next month :T Nov 2015:- Mortgage Balance £244,671

Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

The bay of E has earned me £123 from selling a few things that were just lying about so I've transferred this to the current account and overpaid it against the mortgage. I have a few other items that I can list as well so should generate a small amount of additional funds over the remainder of the month.

I have also set up 4 new current accounts to try and maximize the interest rates I earn on any floating balances through the month. With reward fees, cashback and additional interest I anticipate I should earn an extra £30 per month from April onwards, which will obviously find it's way to the mortgage

Mar 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £669.00

(Shortfall) / Surplus . . . . . . . . . . . . (£1,081.00)

Cumulative Targets to date

Cumulative overpayment target . . . £8,750.00

Cumulative actual overpayments . . . £10,617.19

(Shortfall) / Surplus . . . . . . . . . . . . . £1,867.19

Other stats

Cumulative interest saved. . . . . . £8,808.00

New estimated daily interest . . . . . £14.87

New mortgage balance . . . . . . . . . . £231,893Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

I've put £1k into Ratesetter today for a 1 year loan at 3.9% with a £100 bonus paid after 12 months so my return should be an effective 13.9% if the provision fund holds up and I encounter no bad debt. I have also referred my wife so we should get a £50 referral, £100 bonus and 3.9% interest which should return us an effective rate of 18.9%!

I am off to do some research to see if there are any other low hanging fruit bonuses available for similar deals!Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

My new years resolutions usually revolve around losing weight so it will be good to have some solid financial goals to work towards! That's not saying that I couldn't do with losing a stone

2016 Financial Goals

1. Overpay £23,000 on my mortgage. This works out to £2,000 more over the year than the monthly amount of £1,750 that I set myself but I want a bit of an extra challenge to see if I can find another £2,000 from other means. I won't include this amount in my monthly targets but it will be reviewed and measured throughout the year at various intervals.

2. Increase emergency fund to £6,000. Before the start of this year I had no emergency fund in place so to have a buffer would give us some comfort in the event of any unexpected changes.

3. Increase my pension pot to £33,000.

4. Increase my wife's pension pot to £5,000.

5. Increase my personal share holding to £1,500.

6. Pay for a new drive. I am expecting this to come in around £3,000 and is something we have wanted to do since we moved into the house as we are constantly driving across our neighbours grass when we reverse off the drive!

7. Pay off my 0% credit card in full. There is currently around £3,900 remaining on this credit card so I would like this to be gone by the end of the year.

I thought I would do my Q1 review of my financial goals for 2016 to ensure I am still on track, so here goes!

1. Overpay £23,000 on my mortgage. I have overpaid £6,985.19 in 2016 which is 34.93% of my target. I have £13,014 left to overpay in 2016 which equates to £1,446 over the next 9 months, which means I am on track

2. Increase emergency fund to £6,000. This one isn't going so well in the traditional sense of keeping a cash buffer. All spare money that has not gone towards the mortgage has been diverted towards medium to long term investments that deserves it's own post. I will expand more on this at another time

3. Increase my pension pot to £33,000. My pension pot is sitting at £26k due to a subdued market and I will have employer contributions of £625 per month going into the pension from this month onwards which will take me to ~ £31,625 so will need some recovery on my equity holdings to achieve this figure

4. Increase my wife's pension pot to £5,000. My wife's pension is currently in the process of being set up and she will also have £625 per month going in as an employer contribution. This will take her to ~ £5,625 by the year end if I ignore any potential growth so we are on track with this one

5. Increase my personal share holding to £1,500. I have £2,000 currently sitting in my personal share save scheme but this resulted in a rash decision to top up some shares that were deemed undervalued.

6. Pay for a new drive. I am expecting this to come in around £3,000 This is my big bug bear as my estimate was way off. We have had a number of quotes and the cheapest has come in at £8,000 for what we want doing. We are either going to have to tone down what we want doing or simply wait longer to save the extra money :mad:

7. Pay off my 0% credit card in full. There is currently around £3,900 remaining on this credit card so I would like this to be gone by the end of the year. This has been re-paid in full

I have also had a refund from some car insurance for £18 which has been paid against the mortgage today.Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320 -

you're going great guns

I'm a bit interested in person to person lending, not sure if I'm willing to risk my tiny funds just yet though.. good luckMortgage restart June 2018 £119950Re mortgage August 19 £110470, … Mortgage November 22 £85600 final 0% CC 3300Home renovations - £65000, mid 2018 - mid 20220 -

Things have been a bit quiet on the overpayment front this month as my efforts have been slightly diverted towards putting some money away for our new drive and starting to build a small investment portfolio.

However, I've made an overpayment of £125.00 today just to keep things ticking over and ensure I don't lose the momentum I have built up with regards to paying off my mortage

Mar 2016 Target

Monthly overpayment target . . . £1,750.00

Actual monthly overpayments . . . £812.00

(Shortfall) / Surplus . . . . . . . . . . . . (£938.00)

Cumulative Targets to date

Cumulative overpayment target . . . £8,750.00

Cumulative actual overpayments . . . £10,760.19

(Shortfall) / Surplus . . . . . . . . . . . . . £2,010.19

Other stats

Cumulative interest saved. . . . . . £8,927.00

New estimated daily interest . . . . . £14.87

New mortgage balance . . . . . . . . . . £231,943

Investment dilemma

I have been reading lots lately on the benefits of investing my money rather than overpaying my mortgage and effectively achieving a better rate, that is compounded over time, which makes more financial sense from a purely mathematical point of view.

However, I feel this poses dangers for me as it could mean a large pot of liquid funds lying about that I could get my hands on at any point and could be spent on a whim. For example, let's have a new kitchen now or have a loft extension etc......

I am trying really hard to change my behaviour towards financial decisions after spending a large part of my adult life thinking "I'll have that now and pay for it later". It's taking me a long time to start changing my thinking and although I am on the track I still don't fully trust myself 100%

Therefore although it flies in the face of conventional mathematics I will be splitting funds between mortgage overpayments and investing. I recognize that it will probably cost me in financial terms but it also gives me an element of protection that I don't wake up one day and blow the lot on some magic beans :rotfl:Nov 2015:- Mortgage Balance £244,671

Aug 2017:- Mortgage Balance £183,8320

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards