Arrangement to Pay (AP)

Comments

-

*Appluads*

Excellent post Izools, very insightful and you put a lot of information into something that most people get confused or worried about.

A credit to this site, my friend.0 -

*Appluads*

Excellent post Izools, very insightful and you put a lot of information into something that most people get confused or worried about.

A credit to this site, my friend.

Why thank you my good sir!

I am trying to become more accurate and less subjective with the advice I give save the void that our departed Niddy left, in the hope that either he comes back to help everyone else shouting me down or the advice is replaced with mine

I can but try Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

0 -

This really makes me angry, when i went to uni i was given a bursary on the condition that the student support/student financial aid office restructured all of my debts to a minimum monthly payment. I didn't want to as up until i went to uni as a mature student i'd always managed to pay my bills. However i had no choice if i wanted the bursary so i let them do it. They didn't tell me at the time that it would affect my credit rating. I have recently obtained my credit report from experian and equifax. On experian my CC which had this arrangement on back while i was at uni, is shown like any other CC debt which is up to date and it is shown as being about 60% of my credit limit. So it looks fine. On equifax however it shows years of AP markers from when it was in the arrangement. It is worth noting that i was not in arrears nor had i defaulted when the arrangement was made and it was done by the university without them explaining to me what the consequences would be. Is there anything i can do about this? I didn't realise it had such an adverse effect on my credit rating. If i had known then what i know now i wouldn't have let them rearrange all of my payments because it has caused me years of grief since leaving uni.0

-

Thank you izools0

-

I have AP on 1 out of 6 accounts on my credit file. Have managed to get cap 1 progress, orange mob contract and 3 shop direct accounts.0

-

This really makes me angry, when i went to uni i was given a bursary on the condition that the student support/student financial aid office restructured all of my debts to a minimum monthly payment. I didn't want to as up until i went to uni as a mature student i'd always managed to pay my bills. However i had no choice if i wanted the bursary so i let them do it. They didn't tell me at the time that it would affect my credit rating. I have recently obtained my credit report from experian and equifax. On experian my CC which had this arrangement on back while i was at uni, is shown like any other CC debt which is up to date and it is shown as being about 60% of my credit limit. So it looks fine. On equifax however it shows years of AP markers from when it was in the arrangement. It is worth noting that i was not in arrears nor had i defaulted when the arrangement was made and it was done by the university without them explaining to me what the consequences would be. Is there anything i can do about this? I didn't realise it had such an adverse effect on my credit rating. If i had known then what i know now i wouldn't have let them rearrange all of my payments because it has caused me years of grief since leaving uni.

Sue them. Plain and simple. Defamation of character.Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

0 -

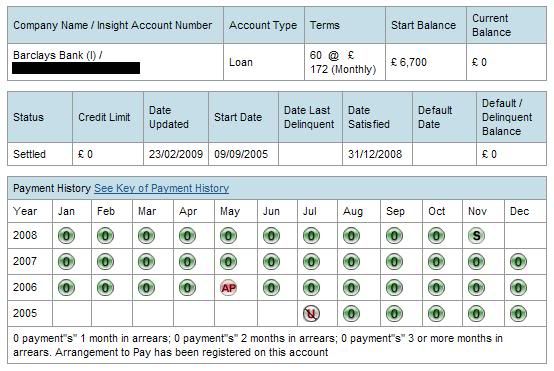

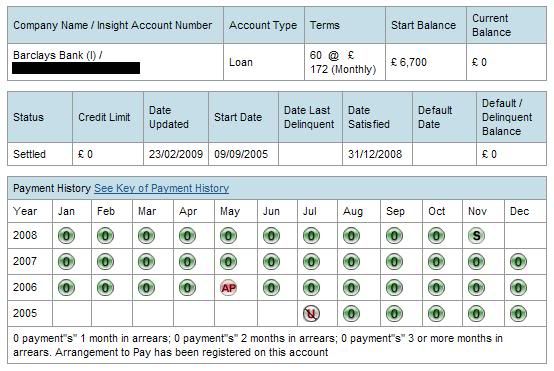

This has got me a bit worried now. On my credit report i have the following;

The account is settled now and i don't recall ever having missed payments or any other issues with it. Can anyone shed some light on it? The rest of my report has lots of green circles so don't want this to ruin my chances of getting credit in future.0 -

This has got me a bit worried now. On my credit report i have the following;

The account is settled now and i don't recall ever having missed payments or any other issues with it. Can anyone shed some light on it? The rest of my report has lots of green circles so don't want this to ruin my chances of getting credit in future.

I'd be very surprised if that had any impact whatsoever.

It was only one month, and it was a long time ago. Most credit scoring systems only look at the last 36 months of data, but even if there was one month in arrears or one month in an AP it's very unlikely to affect your chances.

You can dispute the data by raising a Notice of Dispute with Experian and Equifax if you wish Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

0 -

Thank you for this information :T.

I ended up on a debt management programme (never, ever again!) and defaulted on my mobile phone contract (which will vanish next May) and got two arragements to pay with HSBC Card Services and Capital One. This are now both settled and won't be off my credit reports for another 4 years, but that's how it goes.

HOWEVER, NatWest (who I bank with) gave me a credit card with their typical APR AND I've got car insurance, home insurance, a mobile contract, home shopping account and laptop contract.

So, whilst an Arragement to Pay isn't brilliant, work hard and hopefully things will look up 0

0 -

I reckon i'll have paid off my Credit card that has an arrangement to pay marker on it by Feb/March next year, will it be worth me keeping it open for a while so that the AP markers drop off the account.

On my Experian report it shows as up to date and no late payments. On my equifax report it has lots of AP markers. Am i right in thinking that if i close the account when i've paid it off, it will continue to show the last 4 years history of the account, if i keep it open, in Nov 2013 the AP markers will drop off, whereas if i settle the account it will continue to show the details of the period of feb2007 to feb2011 for four years after that date ie feb 2015.0

Categories

- All Categories

- 343.1K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.2K Work, Benefits & Business

- 607.9K Mortgages, Homes & Bills

- 173K Life & Family

- 247.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards