DMP Mutual Support Thread - Part 12

Comments

-

Have got the dmp down to 9yeaes 3 months but is still suggesting Iva as first choice! Help!

Hi Amanda,

In England and Wales, there are 3 regulated options for dealing with debt, they are :

Bankruptcy,

IVA (Individual voluntary arrangement),

DRO (Debt relief order).

and one unregulated option :

The DMP (Debt management plan).

It depends on a number of factors which option would suit you best, if your debts were hugh, with no real prospect of ever paying them back, then bankruptcy would be your best bet, if you had a house you needed to protect, but still had a good income, then an IVA may be the better option.

If your debts are less than 20k and you have less than £50 a month left after all your bills are paid, a DRO may be the answer.

Most every other situation would qualify for a DMP, which is unregulated, which means there are few restrictions on how its run.

Sometimes more than one option gets recommended, you then need to discuss the finer details with a stepchange advisor, who can then work out the best option to go with.

DMP`s can last a long time, so if an option appears that will reduce that timescale, its always worth looking at it.

An IVA is a formal arrangement, its a form of insolvency, so not to be taken lightly, but can be a good way to go if you have a lot of debt, you also gain legal protection from your creditors, so they cannot contact you, it will most likely last 6 years.

Get as much information as you can on both options, the web is full of information, but a good place to look is on the debt camel website :

https://debtcamel.co.uk/

Its written by a CAB adviser, so you know the info is correct.

Please feel free to continue asking questions on this site, as we have a wealth of experience in the various options open to you.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

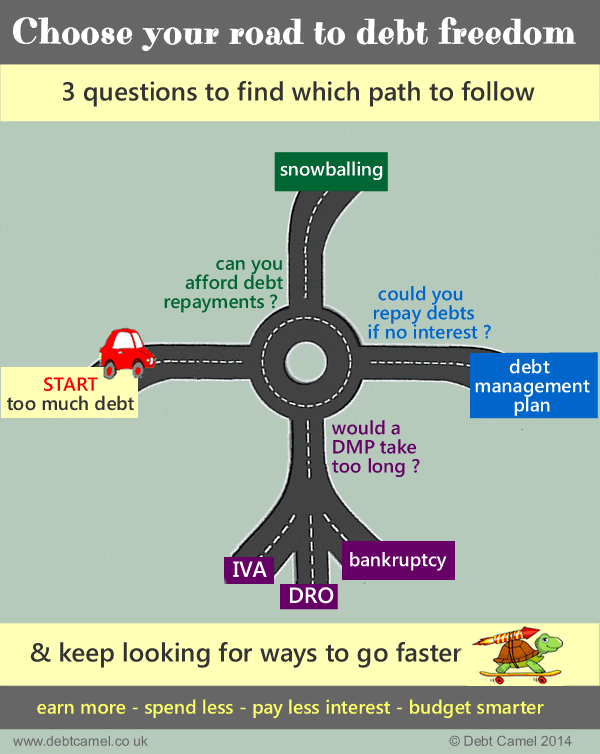

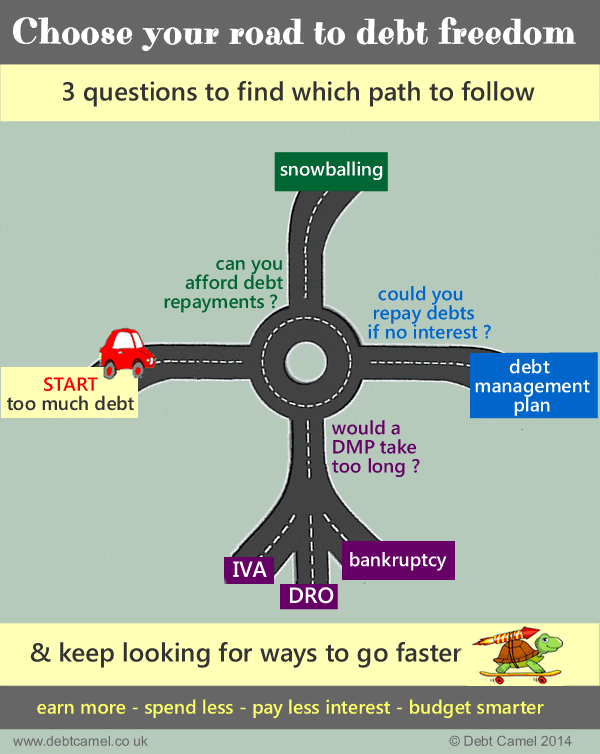

This is one of the best analogies i can find on the net :

I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Hope everyone is enjoying the Easter Bank Holiday

I've spent the morning updating and reviewing my debt countdown spreadsheet - nice to see the numbers dropping. Also applied for a Nationwide Flex Basic Account - all very straightforward and painless. The only niggle I have with having to change bank accounts is that my current bank/building society is not a member of CASS. So I'm going to have to do the switch manually and that's a little difficult to time - as my DDs are spread out across the month. The main ones to move first will be payments to SC and my mortgage company- then I'll have to see how I can time the others.

Had an odd thing happen this weekend. I received an email from Amazon confirming an order I placed and that the order would be delivered the very next day. Only problem with that is I didn't place an order. I thought initially that the email was some sort of scam/hoax - but on checking my account - low and behold there was an order sitting in my order history for a game controller at £39.99. Spent ages on Amazon's chat line to try and get it sorted and it looks like the order was placed late evening on Saturday and yet I haven't been on the Amazon website in months. No-one else in my household has access to my Amazon account - so its all pretty odd. The item arrived today and now I've got to return it for a refund which will take up to 48hrs after they receive the item. Just as well I've got the funds in my bank otherwise I would have been in a right pickle. Amazon are now investigating -but I'm to holding my breath.0 -

sourcrates wrote: »This is one of the best analogies i can find on the net :

That's absolutely brilliant - makes it so simple to see which is the best way forward for each person's individual situation.

Many thanks for sharing this Sourcrates :j:beer:DFW Nerd No. 1484 LBM 07/01/15 Debt was £95k :eek: Now debt free and happy :j0 -

Hi, little bit of a rant/question.

I received a letter from Halifax saying they were moving my loan to a DCA called Wescott. I then received a letter off Wescott saying they were now dealing with my loan and would be in touch with SC to sort out the payments. A couple of days later I got a letter from SC saying that Blair, Oliver and Scott had rejected my offer of payment (for the exact same amount as the loan) and then another letter saying BO&S were no longer dealing with my loan and I needed to let SC know who is now dealing with it within 6 weeks or they will strike that debt from my list and recalculate payments to everyone else.

Who do I call about where my debt now lies and why am I being passed from pillar to post!? Surely they can see this is making it more difficult for me to pay and causing unnecessary stress for me.

Every other aspect of my DMP has been easy but this feels like they're messing me about.LBM: October 2016: £20,130 / Current: May 2019: £12,576 37.53%DFD: [STRIKE]February 2024[/STRIKE] April 2022?0 -

DancingUnicorn wrote: »Hi, little bit of a rant/question.

I received a letter from Halifax saying they were moving my loan to a DCA called Wescott. I then received a letter off Wescott saying they were now dealing with my loan and would be in touch with SC to sort out the payments. A couple of days later I got a letter from SC saying that Blair, Oliver and Scott had rejected my offer of payment (for the exact same amount as the loan) and then another letter saying BO&S were no longer dealing with my loan and I needed to let SC know who is now dealing with it within 6 weeks or they will strike that debt from my list and recalculate payments to everyone else.

Who do I call about where my debt now lies and why am I being passed from pillar to post!? Surely they can see this is making it more difficult for me to pay and causing unnecessary stress for me.

Every other aspect of my DMP has been easy but this feels like they're messing me about.

This is par for the course with bad debts unfortunately.

Don't let it stress you out, let them play there little games, its not going to affect you one bit.

Are we talking about the same account here ?

If so then wescot are currently managing it, and you should ring stepchange and let them know.

This happens a lot sometimes, it's a pain I agree, but perfectly normal.

The thing to remember is that Halifax still retain ownership of your debt, the DCA's are only acting on there behalf.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Thank you for the very prompt reply! I was hoping it was with Wescot as my Natwest loan went there and they have been great to deal with. I guess I just need to bite the bullet and call them to check - being a bank holiday weekend has been terrible for my anxiety as nowhere is open for me to call and check!sourcrates wrote: »This is par for the course with bad debts unfortunately.

Don't let it stress you out, let them play there little games, its not going to affect you one bit.

Are we talking about the same account here ?

If so then wescot are currently managing it, and you should ring stepchange and let them know.

This happens a lot sometimes, it's a pain I agree, but perfectly normal.

The thing to remember is that Halifax still retain ownership of your debt, the DCA's are only acting on there behalf.

It is the same account (exact same amount in every letter) just felt like it was being passed from pillar to post.

Thank you again.LBM: October 2016: £20,130 / Current: May 2019: £12,576 37.53%DFD: [STRIKE]February 2024[/STRIKE] April 2022?0 -

Well it's been a while since I visited this thread but reading through all the posts just inspires me more. I am 4 1/2 years into my journey and can finally see light at the end of the tunnel with only 8 more monthly payments to make before I reach my DFD in December. I never thought the day would arrive! :beer:

I can honestly say it was the support and advice from members of this group that helped me to face my fears and deal with my debts and I haven't looked back since I took the plunge!

For those of you who are still worrying about what to do I can honestly say it was the best thing I have ever done. Be brave you can do this :T:T:TDMP started 1st July 2012

Total debt £24,000

Balance at 17/04/17 £3496

Total Paid to date £12000 :beer:

DFD Dec 2017 :money:

4 1/2 years in and all is well feeling good:j0 -

Halifax definitely seem to be playing games at the moment. Just logged onto my accounts to see they have added over £500 interest over 2 loans :mad:

The letters I received saying that they haven't received payments according to our payment plan is contradicting as both my loan accounts show the exact payments received on the 7th April. Interest was added on the 15th. These payments are the same amounts that SC had agreed according to my budget.

Will be phoning them first thing in the morning. I have written to them twice now and may get a little further if I speak directly to them. I will be requesting that they remove the interest that has been added and hopefully they will. Fingers crossed.

Any tips on what I should say to them.

MEmptying my lake with a teaspoon0 -

DancingUnicorn wrote: »Thank you for the very prompt reply! I was hoping it was with Wescot as my Natwest loan went there and they have been great to deal with. I guess I just need to bite the bullet and call them to check - being a bank holiday weekend has been terrible for my anxiety as nowhere is open for me to call and check!

It is the same account (exact same amount in every letter) just felt like it was being passed from pillar to post.

Thank you again.

Hey, I was about to say it is probably with Wescot, and how helpful I've found Westcot in the past. Never had a problem with them on the phone. I've also been able to make the odd extra payments to them online if I've felt I've got a little

Bit spare that month and think I'll help knock an extra bit of my debt.

Sometimes these things do happen with debt agencies, but it's good your ontop of and opening the letters. I was so scared to open those letter in the earlier days seeing my debt going to a different company and then worrying about if they will except my payments.

But I soon got over that and realised it was all part of being in debt.

Just let SC know what you have. I quite often just send them emails and scan letters and attach them to the emails. I always find them quick at responding and getting in touch with the credit agencies to make sure they all have the same information.

Have a good week.0

This discussion has been closed.

Categories

- All Categories

- 343.1K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.2K Work, Benefits & Business

- 607.8K Mortgages, Homes & Bills

- 173K Life & Family

- 247.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards